[ad_1]

One other sizzling CPI fails to suppress gold

With on faucet with an upcoming .5% price hike, received hammered and bounced again with a vengeance on ‘’ Friday.

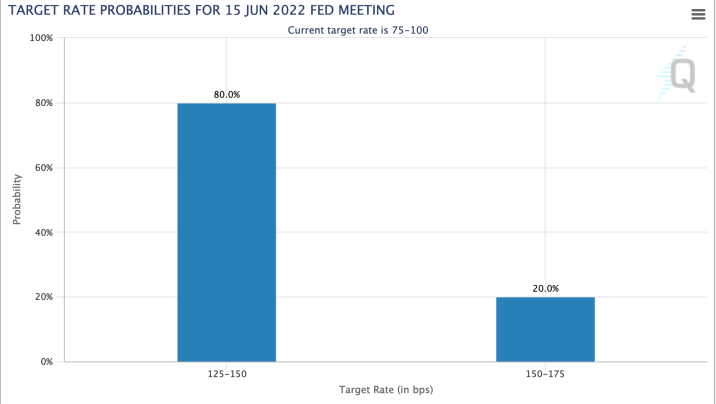

The Fed will increase the Funds Price a minimum of .5% this week. So says not me, however the sensible guys whose job it’s to appropriately FOMC coverage. Certainly, a full 20% of CME merchants count on .75%, up from our .

In the meantime, the gold worth (futures) was unceremoniously shoved beneath the every day chart’s 200 SMA earlier than pulling its bounce again routine on CPI Friday. Try that reversal quantity. That is notable stuff and with FOMC within the wings, it’s doubly so.

To NFTRH, not like many gold/commodity observers, gold is much totally different from the opposite inflated stuff. It has much more counter-cyclical features to it than , industrial supplies, power commodities ,and even to a level, silver.

Gold Futures Each day Chart

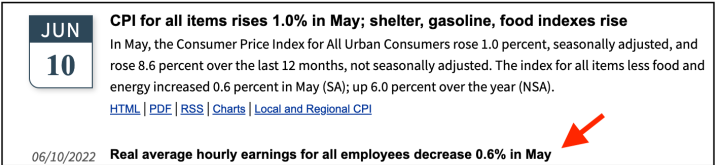

As the newest CPI inflation studying is available in (click on the graphic beneath for the total report from BLS) with economy-compromising information (amongst different issues, are falling and is taking a giant hit) the backdrop is stagflationary, not the long-since aborted however beforehand perceived ‘good’ inflation that drove shares up and out of the 2020 pandemic crash.

From day one (of NFTRH historical past, practically 14 years in the past and counting) we’ve got famous that gold is exclusive and as they leverage the macro both positively or negatively, gold shares— particularly miners— are much more distinctive.

The lengthy phases of gold miner under-performance to the steel are born of the truth that there have been lengthy phases the place central bank-sponsored inflation have labored towards pro-cyclical ends.

Now, amid the oncoming Stagflation (ref. this publish from Might 2021) and the Fed, tardy to its tightening routine, however now mode, prepared to lift charges once more, comes a potential (vital phrase; gurus making predictions needs to be tuned out because the carnival barkers they’re) turning level.

Possibly gold’s spectacular in-day transfer is simply that, a notable transfer throughout in the future. FOMC is up subsequent and that’s usually a tricky one for the financial steel that will shine a light-weight on the financial shenanigans that the Fed, and by extension, scores of economic advisers and the monetary cash administration trade, dwell by.

Here’s a reminder of the weekly chart scenario in gold. The steel has been hammered together with most different gadgets in the course of the Fed’s tardy however violent hawkish flip. However the ‘deal with’ breakout has held, as has key help.

Gold Futures Weekly Chart

Deal with you ask? Nicely sure. Since mid-2020 when projecting the necessity for gold to take a corrective breather we had been labeling the following correction because the deal with to a bullish large image Cup.

The gold worth broke out of the deal with in February of this 12 months, put in a tough check of the breakout and now—amid essentially the most hawkish projections but for the Fed—it’s appearing distinctive in comparison with cyclical and inflated markets. As famous earlier on Friday within the NFTRH Commerce Log:

However on a day like at the moment, insofar as the individuality persists I take it significantly. Patiently, however significantly.

Particularly because the month-to-month chart is and has been bullish since nicely earlier than we projected the mid-2020 correction/consolidation. There may be one factor and one factor solely that I don’t like about this chart. That factor was the failure to make a better excessive in March to the 2020 excessive.

It’s not a significant concern, however it needs to be identified anyway as a result of it could add an alternate view of a double high ought to gold unexpectedly fail. Forewarned is forearmed and all…

Gold Futures Month-to-month Chart

Backside Line

This doesn’t imply to expire and purchase gold shares proper this minute (I did add a pair premier royalty corporations to my one core miner and core smaller royalty already held), however it’s one thing to observe for as we enter FOMC week.

With the economically corrosive features of the present stagflationary atmosphere, and with gold already out-performing and a few commodities it’s time to search for change. That change won’t be towards the kind of inflation that lifted so many cyclical boats out of the 2020 quagmire.

Gold and particularly gold shares (ongoing evaluation in weekly NFTRH reviews) are counter-cyclical. We’ve been noting eternally and a day that the macro elementary image for gold shares is incomplete, however with a lot taking place now on the macro and with the seasonal because of backside in July, nicely, in the event you’re not paying consideration now you’re simply not paying consideration.

[ad_2]