[ad_1]

This text was written solely for Investing.com

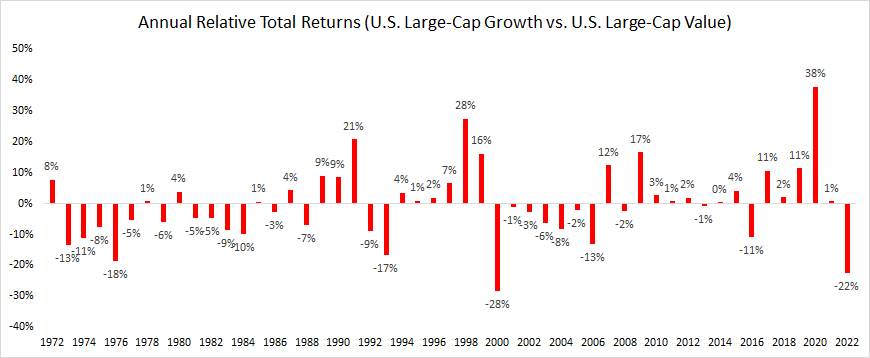

- Worth is thrashing progress by 22% in ‘22

- Development funds, heavy within the Data Know-how sector and light-weight in resource-sensitive shares, stay in a downtrend off their early-year peak

- Merchants ought to eye one key value level to substantiate a bullish transfer in U.S. large-cap worth

Worth buyers are lastly basking within the sunshine. After so a few years of sharp underperformance, low price-to-earnings and excessive book-to-market, Buffett favorites are main this inventory market restoration.

A telling chart, beneath, is the annual efficiency hole between the U.S. large-cap progress index versus the U.S. large-cap worth index. In accordance with information from Portfolio Visualizer, after 5 consecutive years of progress dominating worth, beaten-up worth corporations outpace progress shares by a whopping 22% in 2022.

Worth Over Development This 12 months

Supply: portfoliovisualizer.com

What’s Up with Small-Caps?

I wish to dig a bit of deeper to see what small caps are doing. Certainly, small-cap worth shares are crushing small-cap progress. By June 8, the Vanguard Small-Cap Worth Index Fund ETF Shares (NYSE:) is down simply 6.5% this yr whereas the Vanguard Small-Cap Development Index Fund ETF Shares (NYSE:) is down a whopping 23%.

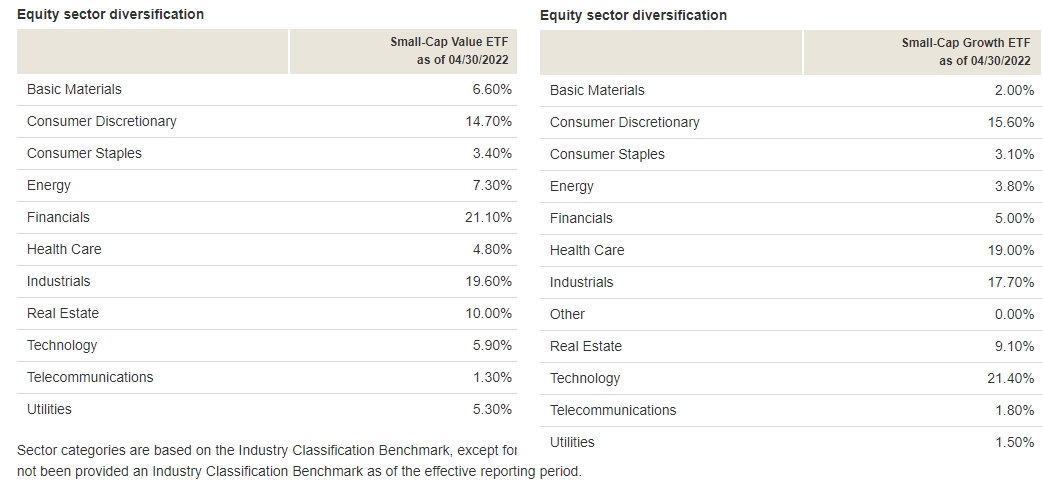

Sector Variations Play a Huge Function

What’s driving the expansion/worth disconnect in 2022? Take a look at the sector weights. The small-cap worth ETF is simply 6% invested within the Data Know-how sector. Distinction that to small-cap progress’s 21% weight. Furthermore, Vitality and Supplies have been sturdy areas over the past a number of months—VBR has 14% in these scorching sectors whereas VBK’s publicity is just about nothing. After all, Financials play a vital position in all worth shares, and that sector has been slightly weak year-to-date.

Small-Cap Worth and Small-Cap Development Sector Weights

Supply: Vanguard

The Technical Take

So, what does the long run maintain for worth buyers? Is that this only a blip on the radar or ought to we anticipate extra alpha from the industrial-heavy and tech-light market area of interest?

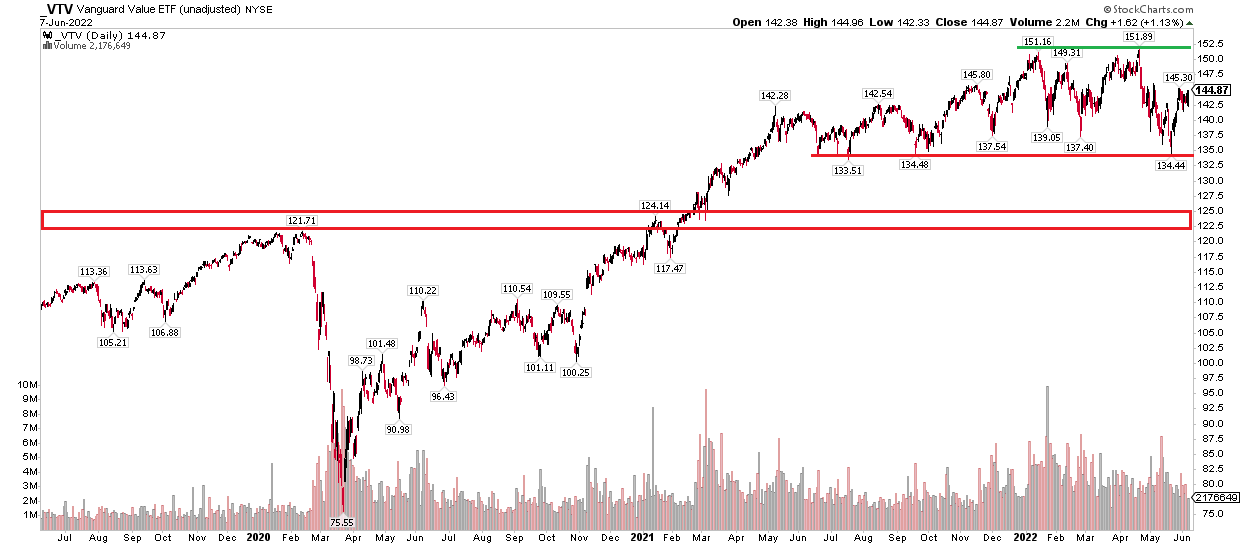

The technical chart exhibits a vastly totally different image than the down-trending nature of many large-cap progress ETFs. Vanguard’s Worth Index Fund ETF Shares (NYSE:) is solely in a uneven buying and selling vary. VTV has been caught within the $134 to $152 space for the higher a part of the final 12 months.

Vanguard Worth ETF: A Uneven Mess

Supply: Stockcharts.com

The whole lot is relative in monetary markets. A scorching mess is healthier than a downtrend. Bulls need to see VTV climb above $152 earlier than getting too excited. The bears are able to pounce on a breakdown via the $134 spot. Subsequent help comes into play on the $121-$124 vary—the pre-pandemic peak and the early 2021 spike.

So far as an upside goal, the $18 vary talked about earlier portends a measured transfer value goal to $170 on a bullish breakout.

The Backside Line

Momentum is on the facet of the worth buyers proper now. I believe that pattern persists via the remainder of the yr.

I need to see VTV climb above $152—I assert that may occur if Financials begin to take part in worth’s relative power to progress shares. Rising charges and skirting a recession could possibly be the elemental catalysts that can ship VTV to new all-time highs within the second half.

[ad_2]