[ad_1]

- Intel is enterprise large restructuring underneath Chief Govt Officer Pat Gelsinger to reclaim its previous glory

- Analysts, nevertheless, are sticking with their detrimental view of the inventory as they consider Intel is preventing an uphill battle

- Intel’s shrinking margins pose a big danger to the inventory’s long-term development

-

Searching for extra top-rated inventory concepts so as to add to your portfolio? Members of InvestingPro+ get unique entry to our analysis instruments, knowledge, and pre-selected screeners. Study Extra »

It has been a troublesome decade for traders within the US’s largest chipmaker, Intel (NASDAQ:). Throughout that point, the Santa Clara, California-based firm didn’t deliver essentially the most fashionable chips to the market, shedding important floor to opponents akin to Taiwan Semiconductor Manufacturing (NYSE:) and Samsung Electronics (OTC:) (KS:).

Intel’s share worth, by way of its technical chart clearly illustrates this poor efficiency. INTC produced simply roughly 20% positive factors in the course of the previous 5 years, whereas the benchmark surged greater than 190%. INTC closed Tuesday at $43.53.

Nevertheless, the corporate now appears to be taking its first steps towards change. Just lately, Chief Govt Officer Pat Gelsinger took the helm and promised large restructuring.

Outcomes have already began to look. The corporate is at present spending $20 billion on a chipmaking hub on the outskirts of Columbus, Ohio, which the Santa Clara, California-based chip producer expects to develop to change into the world’s largest semiconductor-manufacturing website.

The manufacturing facility will depend on essentially the most superior applied sciences, leading to an elevated American share of the worldwide chip provide chain, bringing extra manufacturing again to the US, counterbalancing Asia’s present manufacturing dominance.

Gelsinger additionally plans an growth in Europe, making offers and ramping up analysis spending. Earlier this yr, Intel agreed to purchase Tower Semiconductor (NASDAQ:) for $5.4 billion, a part of a push to make chips on a contract foundation for different corporations.

An Uphill Battle

Analysts, nevertheless, are sticking with their detrimental view of the inventory. They consider Intel is preventing an uphill battle, particularly when lots of the firm’s largest clients are actually designing their very own chips.

Apple (NASDAQ:) has already deserted Intel elements in its Mac line of computer systems, relying as an alternative on know-how from Arm Ltd. Amazon (NASDAQ:) and Microsoft (NASDAQ:) are taking comparable steps with their server processors.

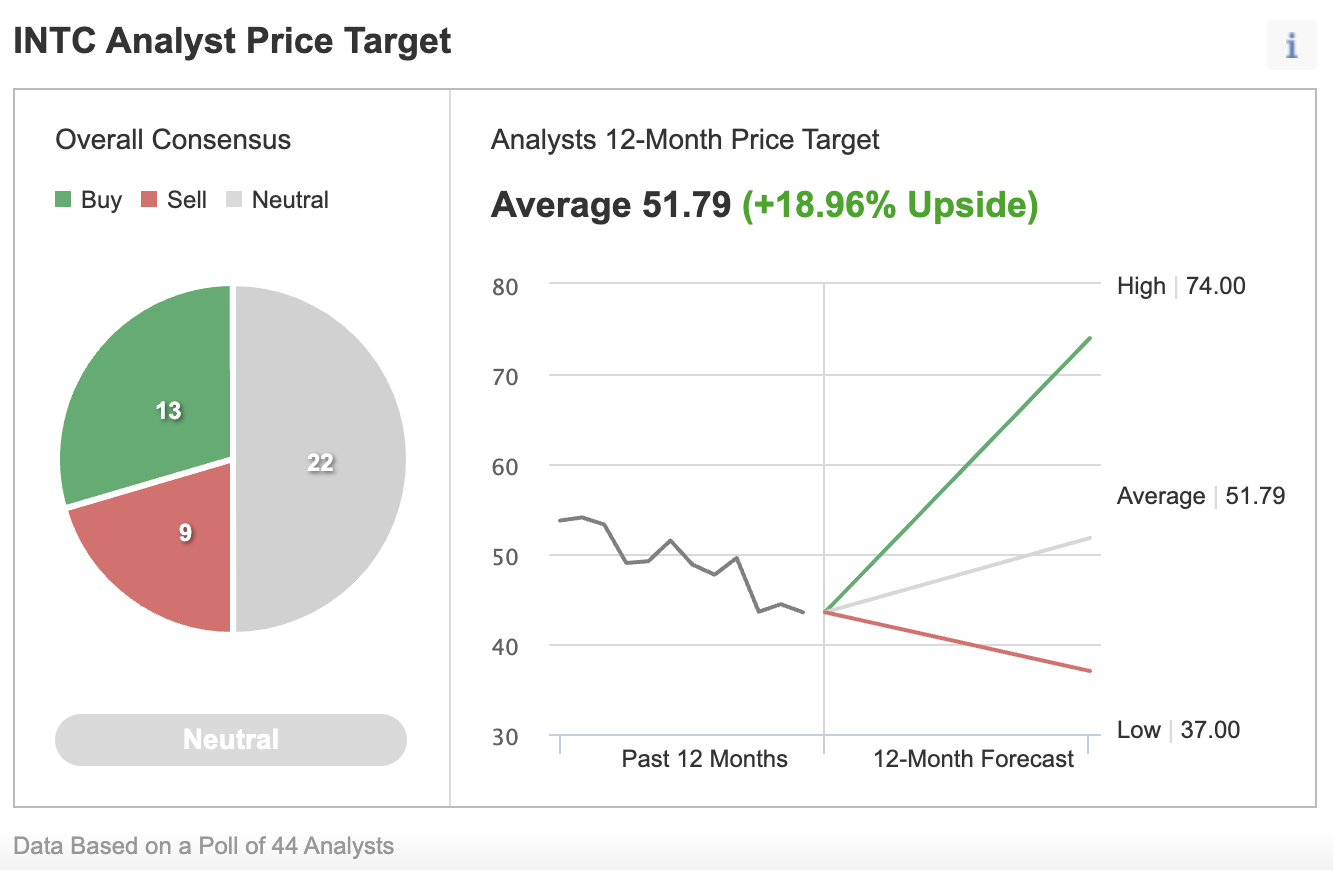

Among the many 44 analysts surveyed by Investing.com, the general consensus is Impartial, with 22 giving the inventory a impartial score, 13 a purchase, and 9 offering a promote score.

Supply: Investing.com

In a notice titled “Conflict of Chips,” Morgan Stanley’s analysts excluded Intel from their checklist of shares providing a shopping for alternative within the current market downturn.

Their notice stated:

“At the vanguard, we anticipate TSMC and Samsung to proceed to dominate superior semiconductor manufacturing within the subsequent decade, capitalizing on the massive and quickly rising foundry alternative.”

Intel’s function, in line with them, is “much less sure.”

TSMC and Samsung are the one different two corporations working foundries to manufacture modern semiconductors and depend the likes of Apple, Qualcomm (NASDAQ:), and NVIDIA (NASDAQ:) amongst their largest clients.

One other setback that would maintain Intel inventory depressed is the corporate’s shrinking margins. Intel’s gross margins—the proportion of income remaining after deducting the price of manufacturing—a key signal of well being for a producing firm, is predicted to be about 52% this yr.

That determine can be fairly engaging for different industries, akin to automotive, however it’s 10 share factors under Intel’s historic ranges. It’s additionally under these of some friends. Texas Devices (NASDAQ:) is near 70%, and Superior Micro Units (NASDAQ:)—not identified for its fats margins up to now—expects to make 51% this yr.

One other check to indicate whether or not the corporate is popping a nook underneath Gelsinger’s management is the way it protects its earnings from any cyclical downturn that many analysts predict inside the subsequent 12 months.

In April, Intel gave a disappointing second-quarter gross sales and revenue forecast, indicating weaker demand for its chips. This weak outlook comes amid escalating concern that general demand for shopper PCs—Intel’s largest income—is slowing following a growth fueled by pandemic-related working and learning from house.

Backside Line

Intel is on an extended street to restoration, consuming a good portion of its sources and hurting margins. Wall Avenue stays reluctant that the chipmaker will achieve reclaiming its previous glory.

We advocate a wait-and-see method for these trying to purchase Intel inventory.

***

Seeking to stand up to hurry in your subsequent thought? With InvestingPro+, you’ll find:

- Any firm’s financials for the final 10 years

- Monetary well being scores for profitability, development, and extra

- A good worth calculated from dozens of economic fashions

- Fast comparability to the corporate’s friends

- Elementary and efficiency charts

And much more. Get all the important thing knowledge quick so you can also make an knowledgeable determination, with InvestingPro+. Study Extra »

[ad_2]