[ad_1]

Straightforward cash insurance policies by the Fed and extreme fiscal spending have positioned the financial system and, thus, markets ready of weak spot. Inflation is raging and the Fed is attempting to reign it in because the financial system is displaying indicators of slowing. The online result’s that markets are more likely to be extra unstable and the danger of extended market declines elevated. Passive funding methods that labored effectively over the previous bull market run are more likely to underperform going ahead.

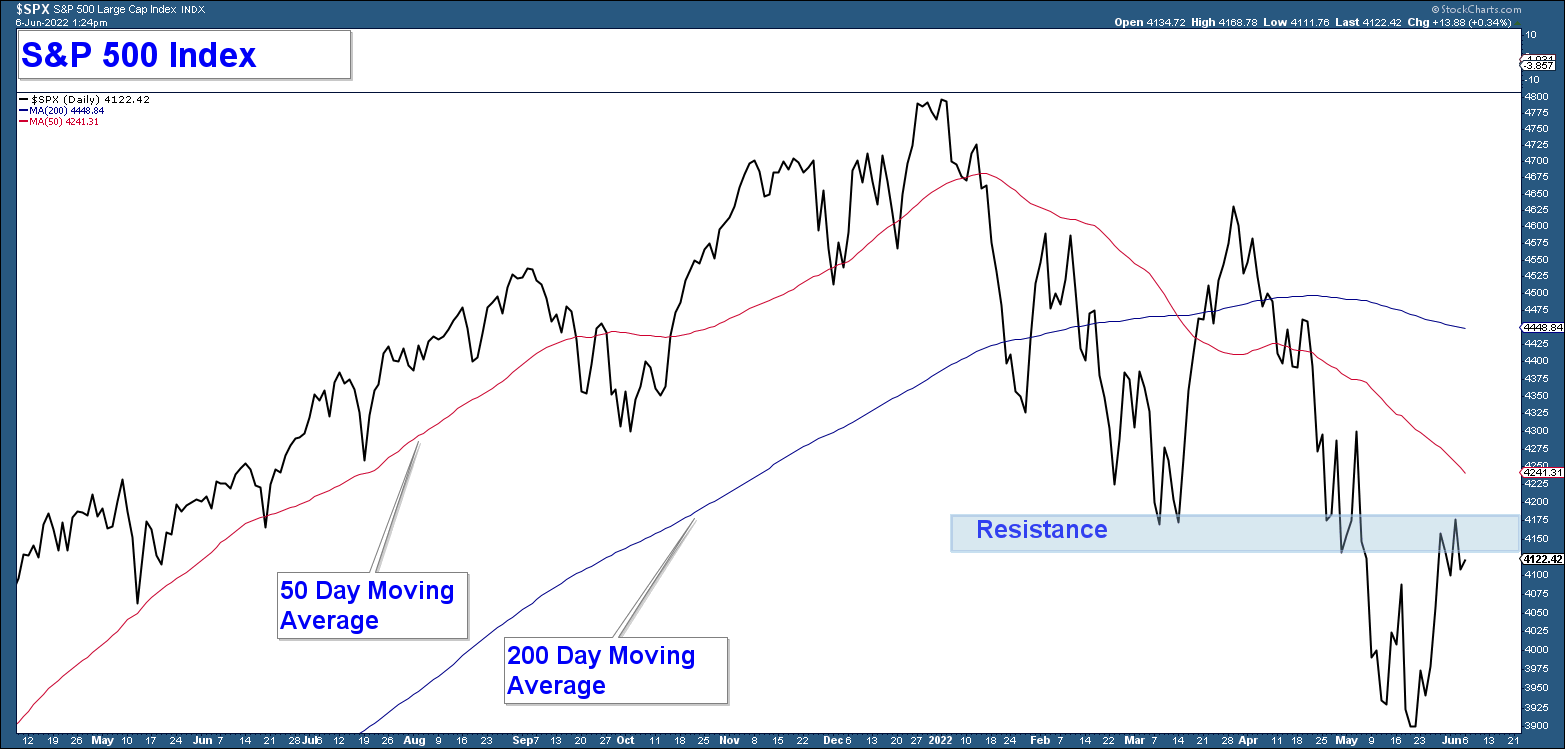

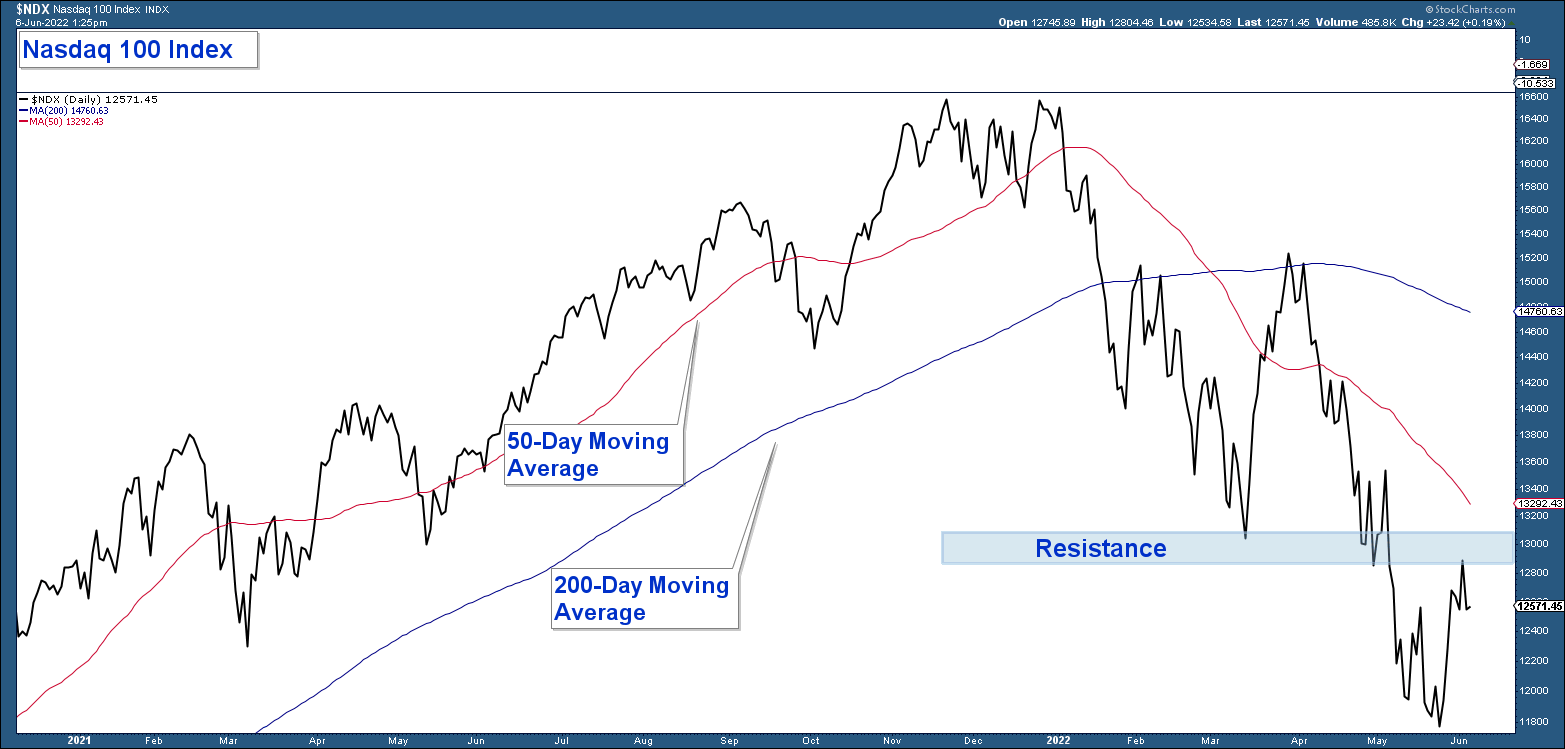

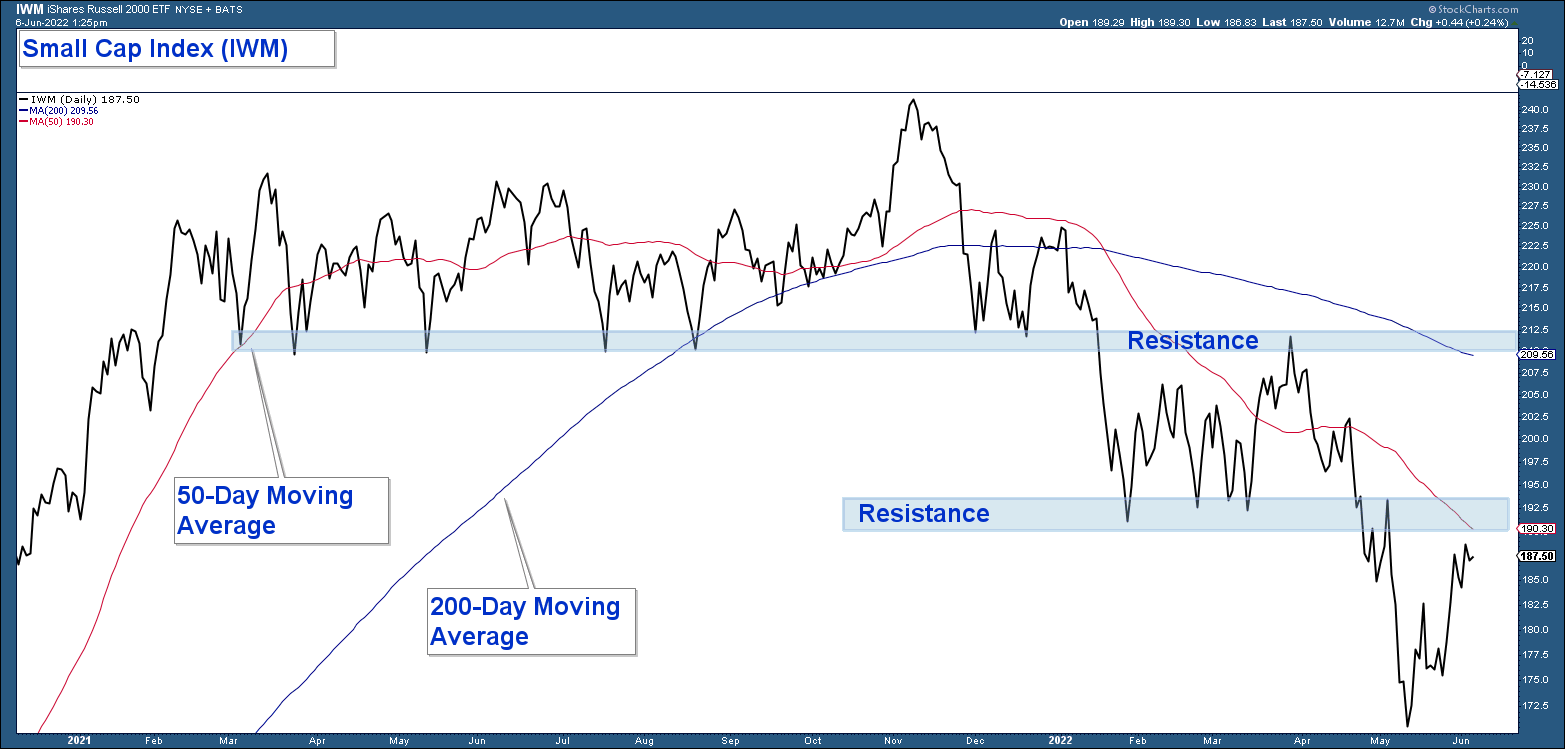

Under are every day charts for the , and iShares ETF (NYSE:). The sample of all three are comparable in that they’re experiencing a short-term advance inside a longer-term downtrend.

The query is, after all, does this bounce sign the top of the downtrend? For these traders hoping the market has bottomed as a result of they’re terrified of additional losses. Don’t get your hopes up.

Listed below are my takeaways from the charts:

- All three are in downtrends, value is beneath each their 50- and 200-day transferring averages, and people averages are trending down.

- The bounce that started final month has taken all three indexes proper as much as resistance.

At this level, I don’t see any technical knowledge that implies this advance is something aside from an oversold bounce. Nonetheless, if these indexes can advance strongly above resistance and risk-on property begin to outperform, I must reevaluate that thesis.

In abstract, the market nonetheless seems to be bearish.

[ad_2]