[ad_1]

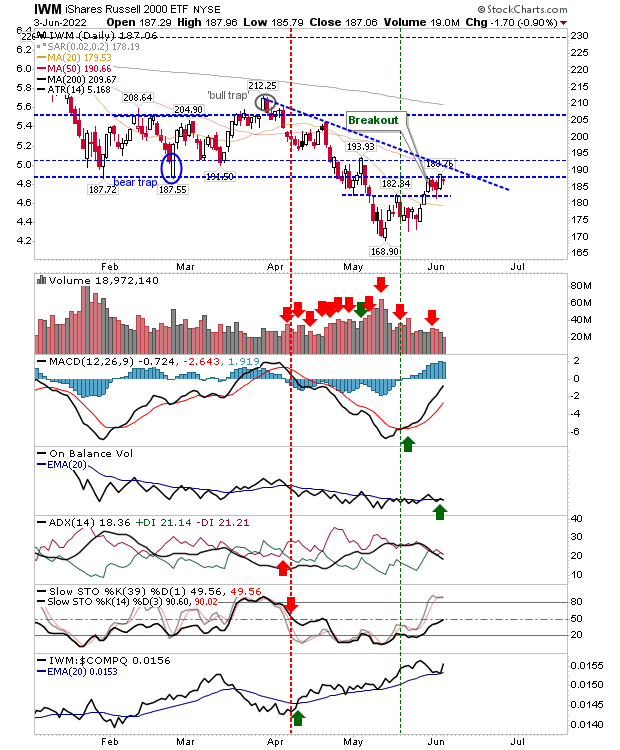

Markets have successfully cleared the primary hurdle of the newest swing excessive. Speculative indices—the and —have additionally began to outperform the extra conservative, .

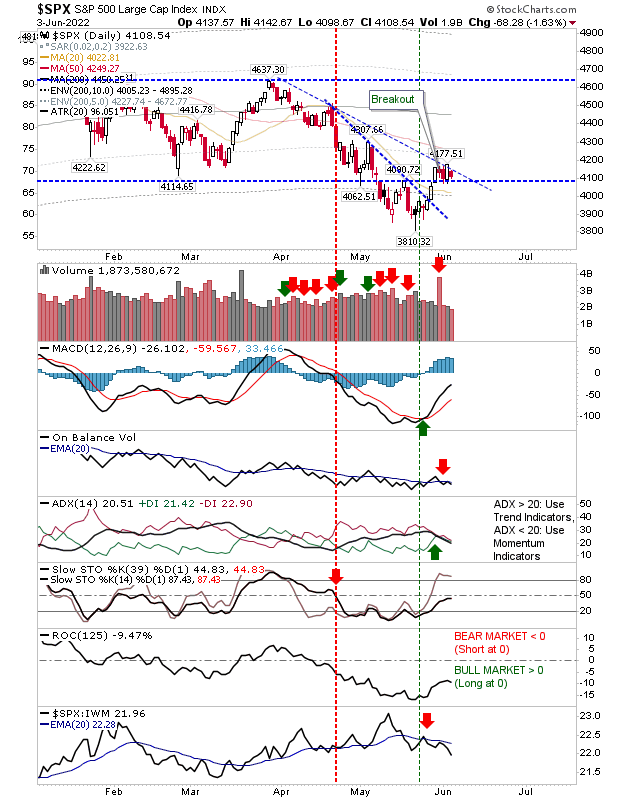

The S&P is about to edge previous declining resistance outlined by the March-April highs (4,637), one thing the NASDAQ has already achieved, however the Russell 2000 has but to do. When it does it is going to quickly come up towards the 50-day MA, then the subsequent actual problem is the 4,300 degree, which was resistance on the finish of April/starting of Might.

SPX Every day Chart

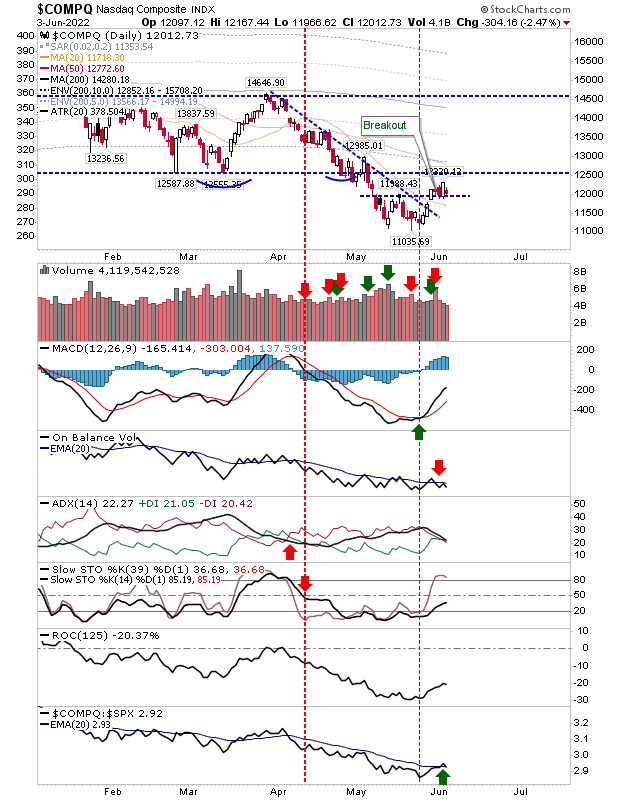

The NASDAQ has some contemporary air to play with because it seems to mount a problem on 13,000 resistance (additionally from the tip of April) and its 50-day MA. We nonetheless have the MACD set off ‘purchase’, however On-Stability-Quantity, ADX and Stochastics stay on the bearish aspect of the fence. Nonetheless, the relative efficiency acquire over the S&P ought to entice extra consumers.

COMPQ Every day Chart

The Russell 2000 (through ) has been outperforming peer indices since April, and we’re seeing that energy translate to different technicals. As soon as value makes it previous declining resistance, which can also be close to the 50-day MA, it is going to open up an enormous hole to the subsequent actual resistance on the 200-day MA.

IWM Every day Chart

Markets proceed to work by way of a rally off a backside, kicked off when breadth metrics had been closely oversold. We should be a bear rally, however bear rallies can final some time and buyers should not be involved about bear rallies at this stage (given the losses already incurred to get so far). I nonetheless assume we’ve a good market backside, nevertheless it appears like a minority view…

[ad_2]