[ad_1]

Elevated demand for video games sees GameStop (NYSE:) beat its quarterly income estimates, inflicting a spike within the meme inventory’s value.

Gamestop its first-quarter earnings for 2021, surpassing normal market expectations for the online game retailer. The corporate recorded $1.38 billion in income, up marginally from $1.27 billion a 12 months in the past. Nonetheless, it additionally recorded a web lack of $157.9 million, greater than the $66 million misplaced in Q1 2021.

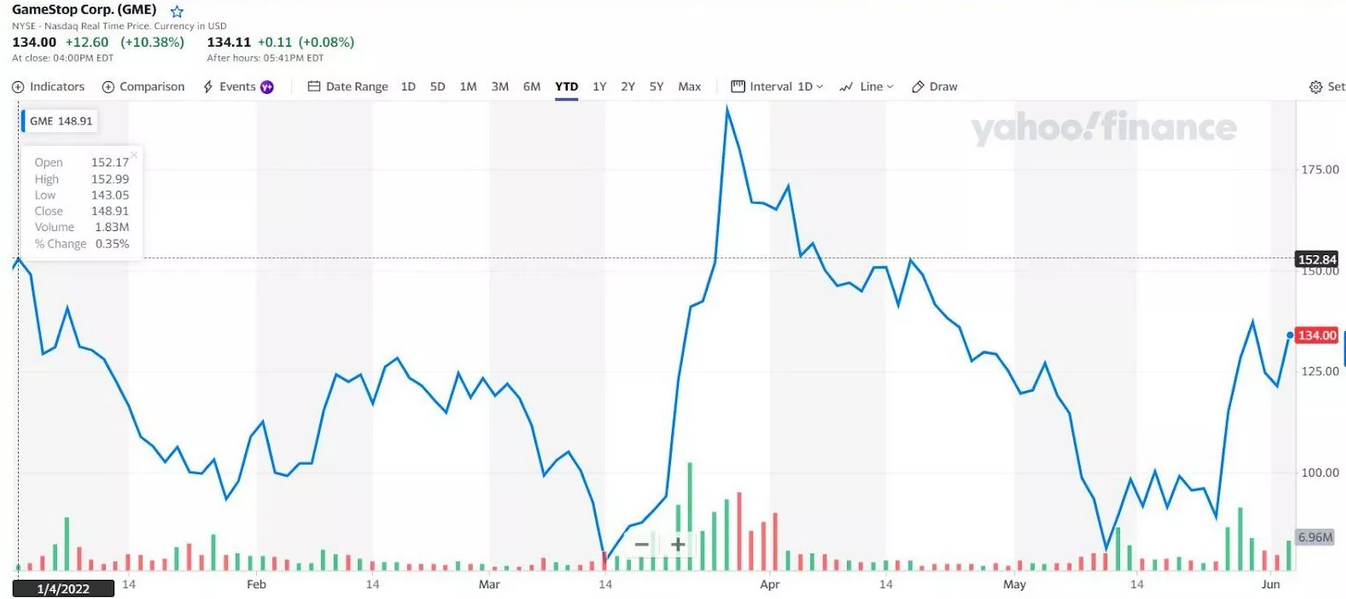

Regardless of not turning a revenue, its substantial income for the quarter has led to a surge in Gamestop’s share value. Largely attributable to retail traders’ curiosity, the inventory elevated over 11% all through the day on Thursday. Nonetheless, for the 12 months thus far, the share value continues to be down by 10%.

Supply: Yahoo Finance

Gamestop’s Q1 Earnings Beat Analysts’ Expectations

For the first quarter of 2022, Gamestop reported an 8% growth in sales to $1.38 billion. However, its loss per share widened to $2.08 from $1.01 a year earlier, beating the general expectation. Several analysts had expected a more significant loss for the company, with $2.49 per share on $1.32 billion in sales, as the consensus.

Furthermore, a breakdown of its revenue shows that Gamestop sold $673.8 million in hardware, such as game consoles and peripherals. This accounted for 48.9% of its total sales and was down 4.2% from $703.5 million recorded a year ago.

However, Software net sales brought in $483.7 million, up 22% from $397.9 million the previous quarter. Finally, collectibles brought in $220.9 million, up from $175.4 million in Q1 2021. The company’s collectibles strength this quarter is a result of its aggressive push toward non-fungible tokens (NFTs).

Consequently, Gamestop beating the general market expectation has led to several analysts raising their price targets. Stephanie Wissink, a Jefferies analyst, raised her GME target to $110 per share from $90 after being “encouraged” by the company’s progress.

Last year, Gamestop was heavily involved in a social media trading frenzy in the early part of 2021. It was the subject of an intense battle between retail investors and wall street hedge funds looking to short the company. This caused GameStop’s share price to soar over 600% last year.

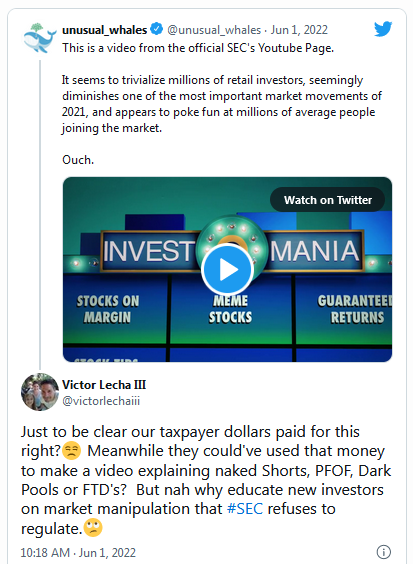

Also, its status as a meme stock saw it subjected to a parody video by the SEC in a new commercial called “Investomania: Meme Stocks”. However, the regulatory body has continued to be on the receiving end of backlash from investors. Many of whom have taken to Twitter to voice their displeasure.

Tweet

NFTs to Play a Function in Gamestop’s Future

Gamestop’s Q1 earnings clearly present that NFTs would play a essential function within the firm’s future. Because the 2021 frenzy, the corporate has revamped its management and made a concerted effort to shift its focus from bodily merchandise to digital ones.

The corporate unveiled plans to launch an NFT market alongside a pockets in Could 2021. In a while, it posted job listings for Internet 3 and NFT builders. In the meantime, it was rumored that GameStop would companion with Loopring, an Layer 2 resolution, to develop its NFT market. Nonetheless, it finally selected Immutable X, citing the platform’s zero gasoline costs for buying and selling and minting NFTs in a carbon-neutral setting.

Nonetheless, Gamestop lastly launched its digital pockets in Could whereas hinting at its NFT market scheduled to launch later this 12 months. The pockets will allow customers to retailer, ship, obtain and use cryptocurrencies and NFTs whereas additionally accessing {the marketplace}.

Consequently, Gamestop CEO Matt Furlong reiterated to analysts and traders that the corporate would proceed to embrace change. He additional stated that his agency would proceed to place prospects first whereas specializing in long-term shareholder worth and firm transformation.

He stated,

“Our development and the launch of latest tech merchandise, similar to our digital asset pockets and the upcoming NFT market, reveal that we’re, actually, beginning to rework.”

[ad_2]