[ad_1]

This text was written completely for Investing.com

- Cybersecurity is a sizzling subject amongst companies throughout the sector spectrum. It’s additionally a preferred thematic investing play.

- The HACK ETF gives traders publicity to the house at an inexpensive value, however its valuation suggests the {industry} remains to be richly priced.

- The technical chart suggests dangers are to the draw back, however there’s a favorable entry level traders can use to dip their toes into.

Cybersecurity shares are always talked about as a key thematic play. The foremost ETF monitoring the house is the ETFMG Prime Cyber Safety ETF (NYSE:).

In accordance with ETFMG, the HACK fund allocates to a portfolio of firms offering cyber safety options. That features companies within the {hardware}, software program, and companies niches. The fund options an expense ratio of 0.60% and rebalances its holdings every quarter.

Dividend traders gained’t hunt down HACK because it yields simply 0.27% as of Might 28, 2022.

Worldwide Spin on Cybersecurity–However It Does Not Come Cheaply

HACK is 81% comprised of US shares and has 68 holdings. Which suggests you additionally get some overseas publicity.

To date this yr, the fund is down greater than 20%, about on par with different globally diversified expertise funds. Furthermore, the present common price-to-earnings ratio of the fund is excessive at 28.3, in accordance with The Wall Road Journal.

On valuation, I believe the {industry} nonetheless has room to see a number of contractions given how the air has been set free of the tech commerce since November final yr, notably amongst small- and mid-caps.

12 months-to-Date ETF Efficiency Warmth Map: HACK ETF Down Extra Than 20%

Supply: Finviz

HACK Holdings And CrowdStrike Earnings

Prime holdings in HACK embody many acquainted names for inventory merchants: BAE Programs (LON:), Akamai (NASDAQ:), Splunk (NASDAQ:), Fortinet (NASDAQ:), Palo Alto Networks (NASDAQ:), and CrowdStrike (NASDAQ:), which at greater than 5% is the fund’s largest holding.

This can be a large week for the Cybersecurity {industry}. CrowdStrike is confirmed to report its fiscal Q1 2023 earnings this Thursday after the market shut, in accordance with Wall Road Horizon. A convention name follows the discharge. CRWD is anticipated to report EPS of 0.232 on income of 463.88 million. Within the it posted each EPS and income beat.

Traders also needs to concentrate on doable industry-moving data to be shared on the Berenberg Thematic Software program Convention 2022 which takes place in London on Wednesday, June 15.

The Technical Take

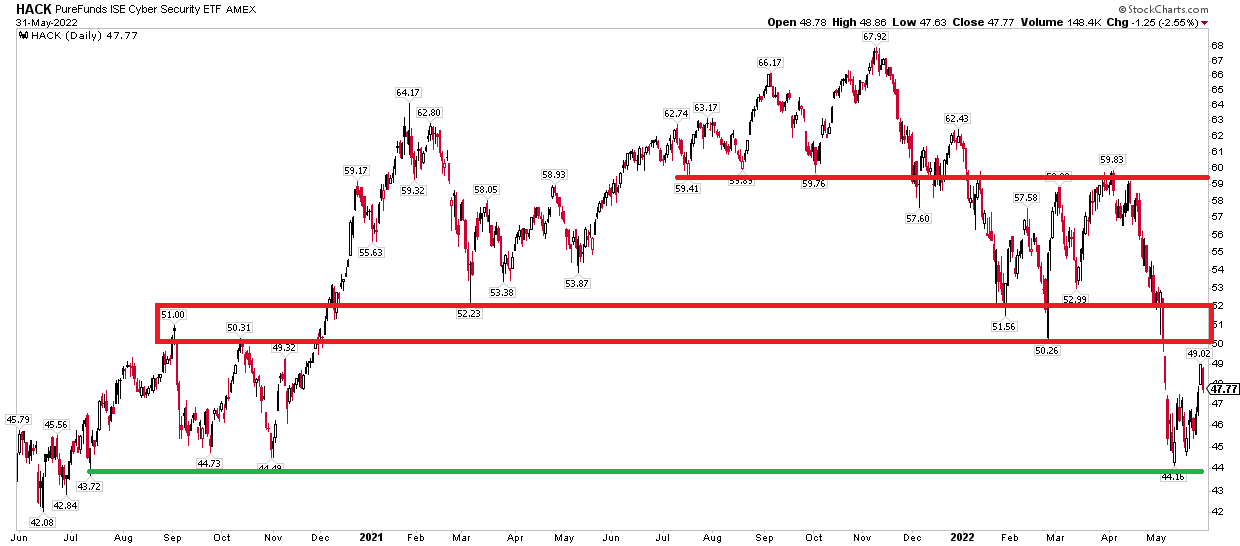

Turning to the charts, there’s clear resistance within the $50-$52 vary on the HACK ETF. It’s a sellers’ market, for my part, and rallies must be used as a possibility to take earnings on tactical longs or set up quick positions.

Ought to HACK shut above $52, ideally on a weekly foundation, that might change the narrative. There may be one other layer of resistance close to $60—the vary lows from the again half of 2021 and the April 2022 peak. As for help, $44 has attracted consumers on a number of events since late 2020.

HACK ETF Under Key Resistance within the $50-$52 Vary

Supply: Stockcharts.com

Backside Line

Cyber safety is a well-liked funding theme. The elemental want for safety and safety in immediately’s technological world is little question important. I urge traders to be cautious about leaping into HACK at these ranges. Sellers are in management, however consumers can take a swing on HACK ought to it dip to help close to $44.

[ad_2]