[ad_1]

Summer time is upon us, and historically that’s when households pack their baggage and get away for a well-deserved trip. Since that is the primary summer season journey season in three years that feels just like the earlier than occasions, airways and airports are bracing for what must be a very busy three months.

At the very least a few airways, the truth is, upgraded their second-quarter income projections final week, citing higher-than-expected demand. On Thursday, Southwest Airways (NYSE:) mentioned it anticipated revenues from April to June to extend 12% to fifteen% from the identical quarter in 2019, up from earlier projections of 8% to 12%. That comes regardless of greater gas costs, which must be “greater than offset” by elevated revenues.

Based mostly on present traits, Southwest “expects strong income and working margins” within the second quarter and for all of 2022, the Dallas-based provider mentioned in an investor replace.

JetBlue Airways (NASDAQ:) equally introduced final Thursday that bookings proceed to “exceed expectations” and that the provider could also be on observe to accumulate report revenues this summer season. JetBlue expects “June income per obtainable seat mile to be up greater than 20%” in comparison with the identical month in 2019.

As chances are you’ll know, JetBlue continues to be attempting to outbid Frontier Airways in an effort to amass rival low-cost provider Spirit Airways (NYSE:), despite the fact that Spirit has already agreed to merge with Frontier. This could inform you that airways are scrambling to gobble up as a lot market share as potential forward of an anticipated leisure journey increase.

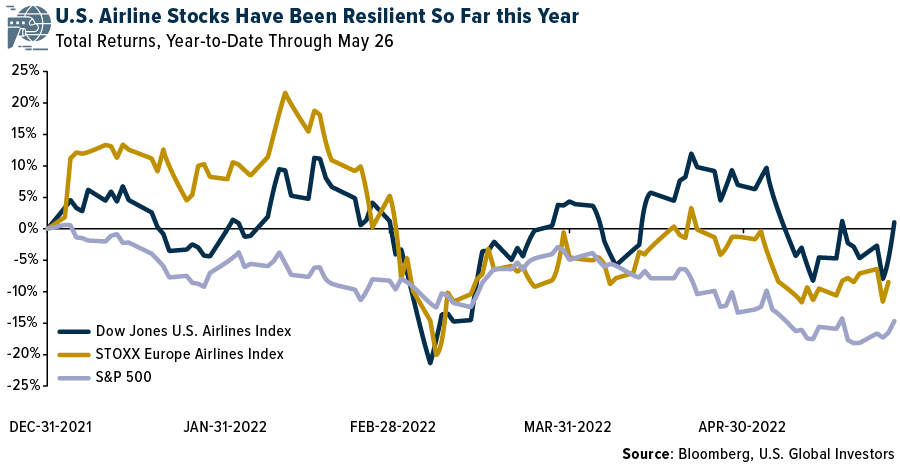

I’m more than happy with how nicely airline shares have carried out up to now this 12 months relative to the market. The was up greater than 3% year-to-date via Friday of final week. Though the was down 8% over the identical interval, that was nonetheless forward of the , which has bought off largely on issues.

That mentioned, under are three airline shares I’m conserving my eye on as we head into the busy summer season leisure journey season:

Southwest Airways (LUV)

I’ll simply say up entrance: Southwest has lengthy been certainly one of my favourite home carriers. As the unique low-cost, no-frills airliner, it’s had many years’ price of expertise working on the intersection of consolation and affordability.

There’s way more to like about Southwest than what I’ve already talked about. The corporate has the primary place in 23 of the highest 50 markets within the U.S., and the main focus proper now’s on restoring the community to pre-pandemic ranges—one thing that could possibly be achieved by 2023, if not sooner.

Southwest can be centered on sustaining its low-cost benefit. This consists of arising with extra environment friendly flight plans, optimizing upkeep planning, and modernizing its income administration system. In December 2021, the corporate signed a brand new bank card co-brand settlement with Chase till 2030, which is already very profitable. All mixed, these initiatives are anticipated so as to add between $1.0 billion and $1.5 billion to earnings earlier than curiosity and taxes (EBIT) by 2023.

Rising jet gas costs are a priority, however the excellent news is that Southwest is roughly 64% hedged for the remainder of this 12 months at round $60 per barrel. This places the corporate in a greater place than a lot of its bigger friends, together with American Airways (NASDAQ:), United Airways (NASDAQ:), and Delta Air Strains (NYSE:), that are at present unhedged.

Alaska Airways (ALK)

The extra I find out about Alaska Air Group (NYSE:), the extra I discover it engaging. Proper now, the corporate seems to have the very best steadiness sheet within the business with a 49% debt-to-capitalization ratio. For the reason that begin of the pandemic, Alaska was the primary airline to succeed in no money burn, the primary to turn out to be money move optimistic, and the primary to turn out to be worthwhile.

Because the quantity 5 U.S. provider by fleet measurement and passenger numbers, Alaska is transferring towards a low-cost construction that ought to match Southwest’s by the tip of this 12 months or subsequent. The airline has frequently outperformed the home business on working margin over the previous 20 years.

Not like different airliners, Alaska is working towards having a single-type fleet, resulting in thousands and thousands in price financial savings in plane swaps, upkeep, and decreased pilot coaching. For mainline operations, Alaska will use the Boeing (NYSE:) 737, whereas the Embraer (NYSE:) can be used for regional operations. These initiatives are anticipated to greater than offset greater labor prices and airport prices.

Just like Southwest, Alaska hedges its gas prices. Half of its gas necessities are hedged till the tip of this 12 months at the price of $71 per barrel.

In 2016, Alaska merged with Virgin America with the objective of changing into the premier West Coast provider. At the moment its market share in key hubs continues to rise, together with in Seattle, Portland, Anchorage, San Francisco, and Los Angeles. About 50% of its loyalty individuals are within the Pacific Northwest.

Ryanair Holdings

Now for one thing slightly completely different, let’s leap throughout the Atlantic to Eire, the place ultra-low-cost provider Ryanair (NASDAQ:) is headquartered. The most important airline in Europe, with flights to just about 40 vacation spot nations, Ryanair is well-positioned to seize a rise in leisure journey demand as Europe drops its COVID-related measures and restrictions.

To offer you an thought of simply how busy Europe could possibly be this summer season, the European airspace supervisor EUROCONTROL just lately mentioned it expects site visitors within the upcoming months to face at 90% of pre-pandemic ranges. This could possibly be an enormous boon for Ryanair, which reported a mean of two,815 flights per day in April.

Ryanair has been a pacesetter in attracting climate-conscious prospects, one thing that’s more and more vital within the European market. In June of final 12 months, the corporate took supply of the Boeing 737-8200 “Gamechanger” plane, which purports to cut back gas consumption by 16% per seat. As of March 2022, Ryanair has taken supply of 61 of those plane and reportedly plans to extend this by an extra 70 inside the 12 months.

***

All opinions expressed and knowledge offered are topic to alter with out discover. A few of these opinions is probably not acceptable to each investor. By clicking the hyperlink(s) above, you can be directed to a third-party web site(s). U.S. International Buyers doesn’t endorse all info equipped by this/these web site(s) and isn’t accountable for its/their content material.

The Dow Jones U.S. Airways Index measures the efficiency of the portion of the airline business which is listed within the U.S. fairness market. Element firms primarily present passenger air transport. Airports and airplane producers are usually not included. The STOXX Europe Complete Market Airways Index tracks the efficiency of shares of listed airways in Europe. The S&P 500 Inventory Index is a well known capitalization-weighted index of 500 widespread inventory costs in U.S. firms.

Holdings might change each day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article have been held by a number of accounts managed by U.S. International Buyers as of (03/31/2022): Southwest Airways Co., JetBlue Airways Corp., American Airways Group Inc., Delta Air Strains Inc, Alaska Air Group Inc., The Boeing Co., Embraer, Ryanair Holdings PLC, United Airways Holdings, Spirit Airways Inc.

[ad_2]