[ad_1]

Will the Fed pause its charge hikes as markets right? That’s the query that everybody is attempting to reply. After all, after greater than a decade of financial interventions, traders have developed a “Pavlovian” response to market declines and the “Fed Put.”

Classical conditioning (also called Pavlovian or respondent conditioning) refers to a studying process by which a potent stimulus (e.g. meals) is paired with a beforehand impartial stimulus (e.g. a bell). What Pavlov found is that when the impartial stimulus was launched, the canines would start to salivate in anticipation of the potent stimulus, though it was not presently current. This studying course of outcomes from the psychological “pairing” of the stimuli.

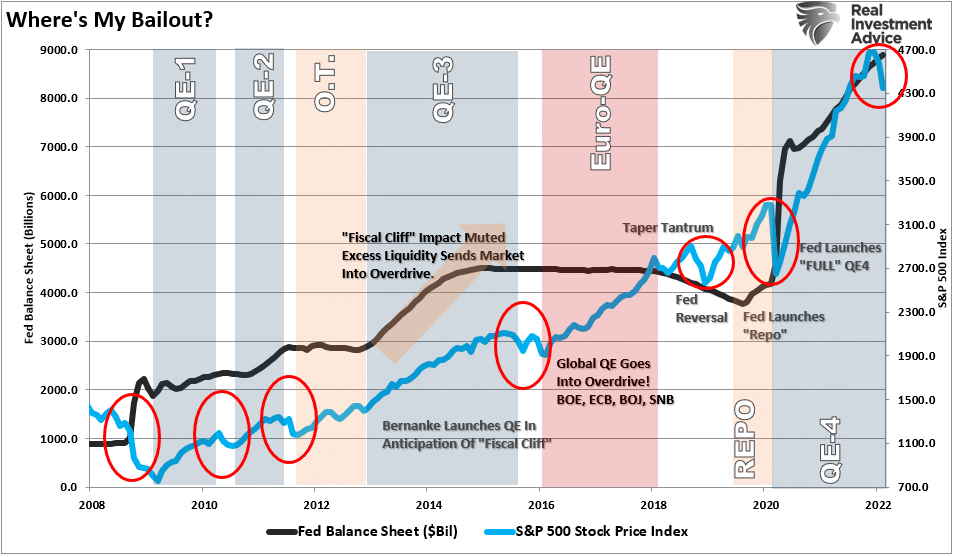

Importantly, for conditioning to work, the “impartial stimulus,” when launched, should be adopted by the “potent stimulus,” for the “pairing” to be accomplished. For traders, as every spherical of “Quantitative Easing” was launched, the “impartial stimulus,” the inventory market rose, the “potent stimulus.”

Every time a extra substantial market correction occurred, Central Banks acted to offer the “impartial stimulus.”

So, with the market having one of many roughest begins ever to a brand new 12 months, traders are asking the query:

“What does this imply for the financial system and the way unhealthy does it must be for the Fed to pause?”

Fed Nonetheless Sees A Bull Market

Buyers have been below an amazing quantity of stress this 12 months. As Ethan Harris not too long ago indicated in a word from BofA:

“Folks near the market are understandably sad in regards to the drop within the S&P 500 because the finish of final 12 months.”

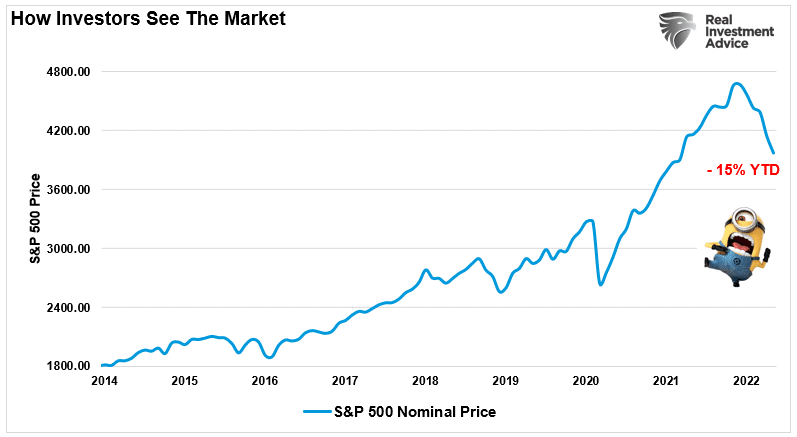

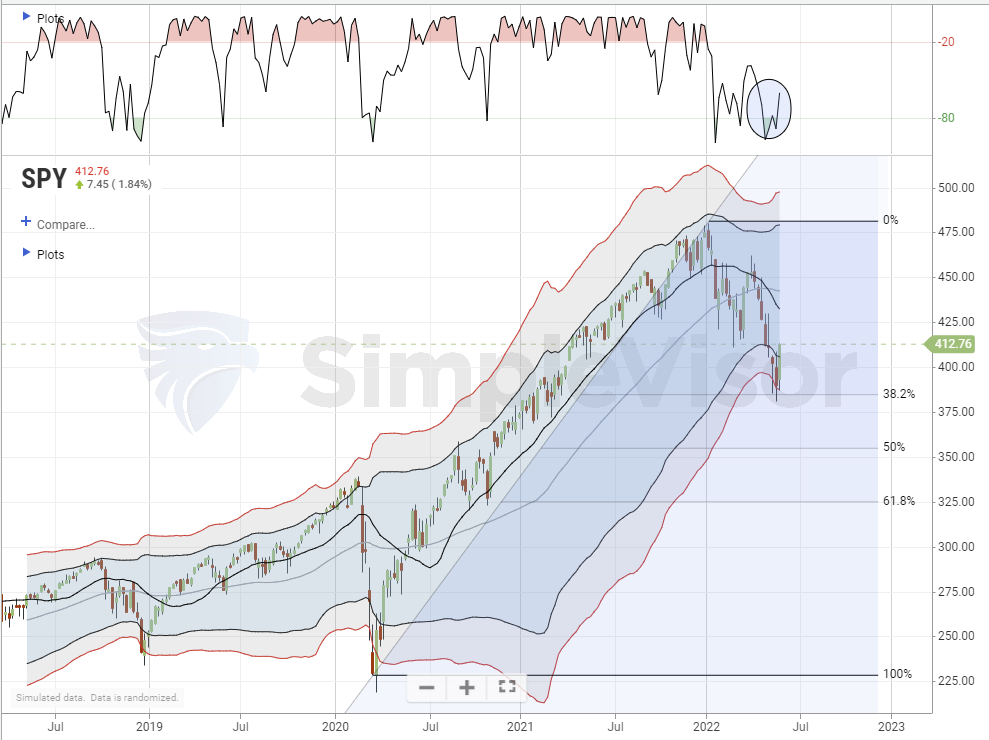

The chart under is an “investor’s view of the .”

In different phrases, as I mentioned in February, everyone seems to be questioning the place the is. To wit:

“The “Fed put” is the extent the place the Fed will take motion to help asset markets by reversing charge hikes and restarting quantitative easing (QE) packages.

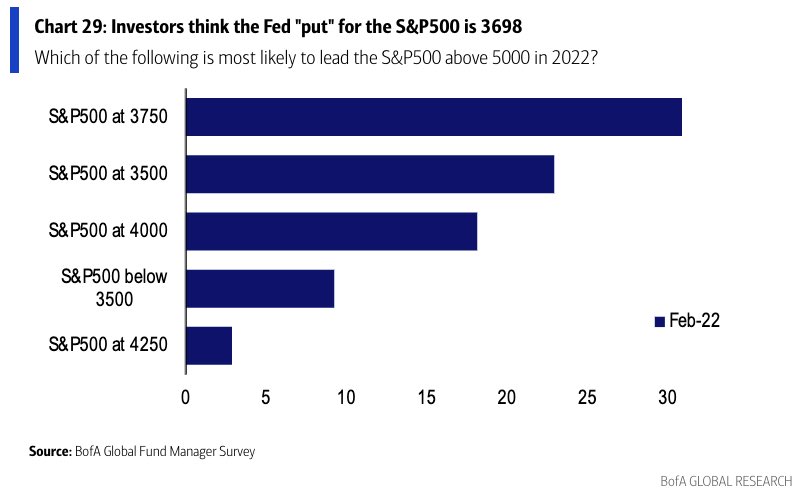

In February, the BofA fund managers survey pegged 3750 as the extent they thought the “Fed put” resided.

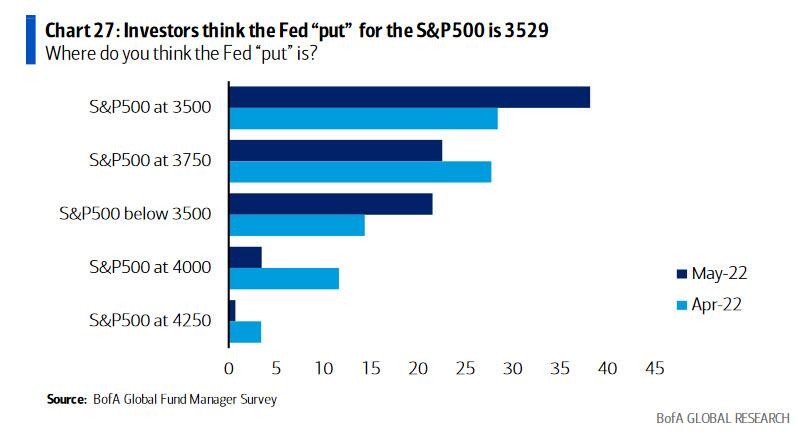

Nevertheless, by April and Might, BofA revised its “Fed Put” ranges right down to 3500.

Out targets are barely totally different as they’re a operate of Fibonacci retracement ranges from the March 2020 closing lows. From the height shut of the market, the targets are:

- 38.2% rally retracement = 3829 = 20% market decline (Fed possible fearful)

- 50% rally retracement = 3523 = 27% market decline (Margin calls triggered. Fed possible acts.)

- 61.8% rally retracement = 3217 = 33% market decline (Fed put triggered)

Apparently, a 33% decline solely erases market good points from early 2020.

There are two the reason why the “Fed Put” may be decrease than 3500.

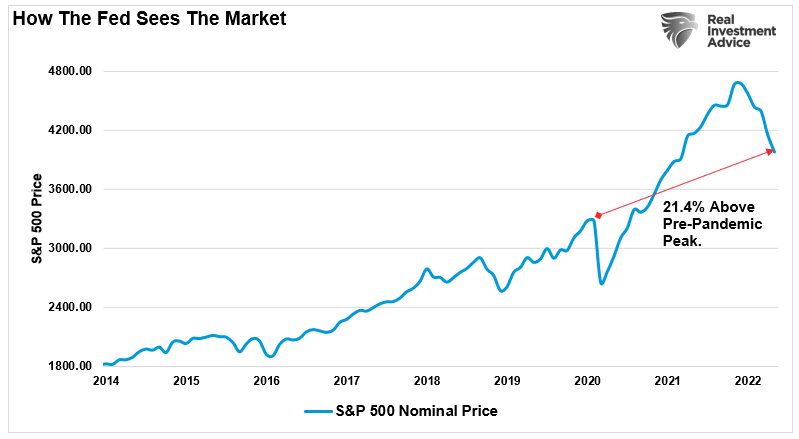

The primary motive is the Fed sees issues in another way than Wall Avenue or retail traders. Whereas the market has declined this 12 months, the market stays increased than in 2020.

The Fed doesn’t thoughts a “disinflation” in asset costs to cut back extra market speculations. Moreover, the market decline additionally contributes to its tightening financial coverage to mitigate inflationary pressures.

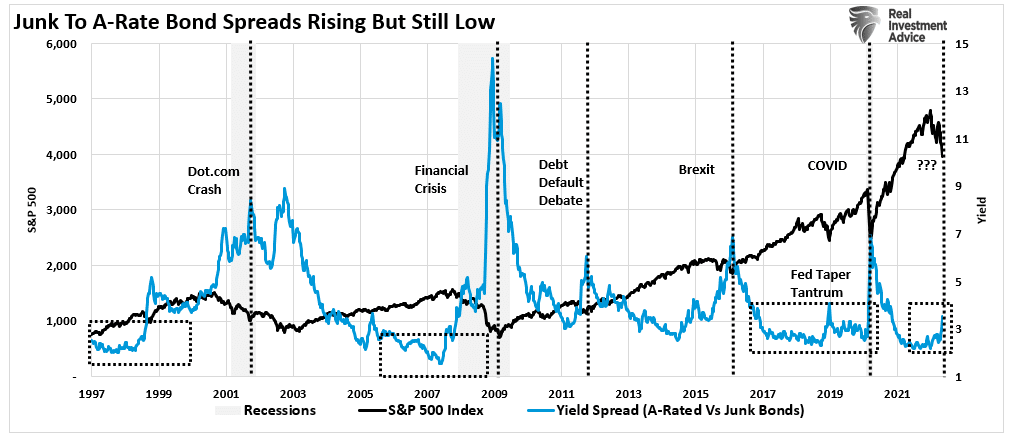

Whereas fairness costs are necessary, it’s the credit score market the Fed focuses on.

No Credit score Stress Means No Fed Pause

In terms of the monetary markets, the Fed’s major focus is “monetary stability.” After the monetary disaster, the soundness of credit score markets turned a major focus of the Federal Reserve. As famous beforehand:

“With the monetary ecosystem now extra closely levered than ever, the “instability of stability” is now essentially the most important threat. The “stability/instability paradox” assumes that every one gamers are rational and such rationality implies avoidance of full destruction. In different phrases, all gamers will act rationally, and nobody will push “the large crimson button.”

Whereas retail traders marvel when the Fed will intervene, there may be little proof of extreme market stress. At present, credit score spreads will not be spiking, suggesting the bond market is functioning usually. With working scorching, the unfold between junk and A-rated bonds provides the Fed room to hike charges for now.

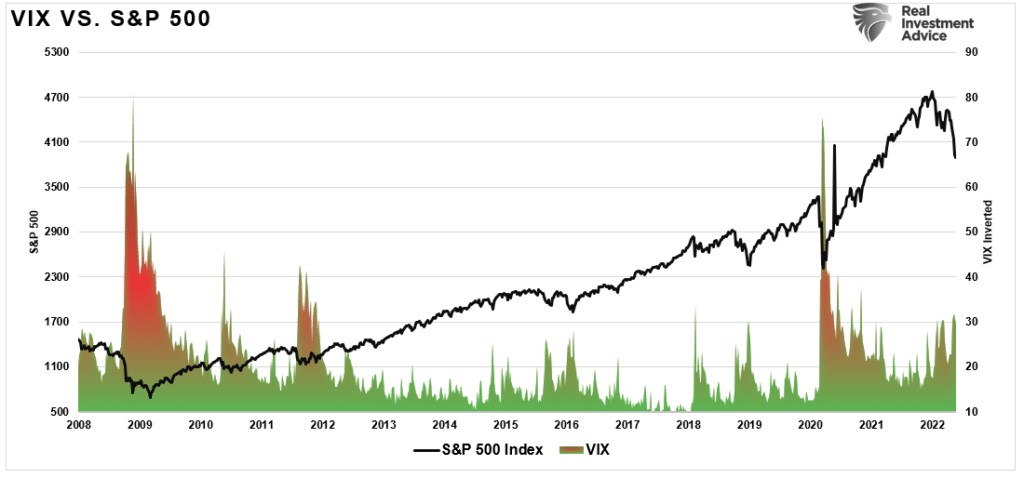

Whereas credit score spreads have risen and markets declined, such has remained orderly, as proven by the subdued rise in . Nevertheless, the Fed is delicate to credit score markets and beforehand acted rapidly on the first trace of turmoil.

Absent a disorderly meltdown, the Fed will stay centered on shares being nonetheless above their pre-crisis peak. As BofA notes:

“Since in a typical consumption mannequin, households react to sustained adjustments in costs over a interval of three years or so, the Fed is satisfied the wealth impact continues to be constructive.”

From that view, and with little stress within the credit score market, the Fed can stay centered on combating inflation.

Nevertheless, make no mistake, because the Fed continues to hike charges, there may be an rising threat that “orderly” markets quickly change into “disorderly.“

Will the Fed “pause” their charge hikes?

That reply is “sure.”

The one questions are “when will it occur,” and “how briskly will the Fed should reverse course?”

[ad_2]