[ad_1]

- Microsoft’s acquisition of Activision Blizzard has shareholder approval

- $95 per share supply is determined by regulatory approval

- Consensus view is that the deal will shut

- Market-implied outlook favors deal-closing, however substantial likelihood of failure and a subsequent decline in share worth

- If you happen to’re enthusiastic about upgrading your seek for new investing concepts, try InvestingPro+

Shares of Activision Blizzard (NASDAQ:) fell 28% in 2021 and continued to fall within the early days of 2022. The whole image modified on Jan. 18 when Microsoft (NASDAQ:) introduced a plan to accumulate ATVI in an all-cash buy, at a share worth of $95. The digital gaming and multimedia firm’s inventory shot up from a closing worth of $65.39 on Jan. 14 to shut at $82.31 on Jan. 18, a acquire of just about 26%.

Since then, the shares have drifted decrease, reflecting issues about if the Federal Commerce Fee (FTC) and different regulators will approve the deal. The antitrust issues usually are not stunning, provided that the deal would make MSFT the third largest gaming firm on this planet.

The phrases of the acquisition have been by ATVI shareholders on the finish of April. Pending regulatory approval, the deal is anticipated to shut earlier than July 2023.

Supply: Investing.com

Whereas it is not uncommon for shares of an acquisition goal to commerce at a reduction relative to the supply worth, the present unfold ($95 vs. $78.20) indicating that the market is assigning a considerable likelihood to the deal failing to shut.

The long run outcomes for shareholders are considerably binary, with one vary of outcomes if the deal is accredited and one other vary of much less optimistic outcomes if the deal is blocked by the regulators.

On , I maintained my impartial score on the inventory. At the moment, ATVI was buying and selling at $69.69 and the share worth had fallen considerably—24.4% for the YTD and 33% over the previous 12 months. After my publish, the shares continued to say no and closed at practically $62 in early January. The fell wanting expectations for This autumn of 2021 (reported on Feb. 3) and for Q1 of 2022 (reported on Apr. 25). The deliberate acquisition, particularly now that it has shareholder approval, modifications issues considerably, so I’m revisiting my score.

After I analyze a inventory, I have a look at fundamentals and two types of consensus outlooks. The primary is the well-known Wall Road analyst consensus score and 12-month worth goal. The second is the market-implied outlook, a probabilistic worth forecast that displays the consensus view implied by the costs of name and put choices. Again in November, the inventory appeared pretty low-cost in comparison with friends, however the earnings development was lagging. The Wall Road consensus outlook was bullish, with a consensus 12-month worth goal of about $98. The market-implied outlook to June 2022 was reasonably bearish. Given the weak earnings development and the disagreement between the Wall Road consensus and the market-implied outlook, I compromised with a impartial / maintain score.

For readers who’re unfamiliar with the market-implied outlook, a short rationalization is required. The worth of an possibility on a inventory displays the market’s consensus estimate of the likelihood that the inventory worth will rise above (name possibility) or fall under (put possibility) a particular degree (the choice strike worth) between now and when the choice expires. By analyzing the costs of put and name choices at a variety of strike costs, all with the identical expiration date, it’s attainable to calculate a probabilistic worth forecast that reconciles the entire choices costs. That is the market-implied outlook. For a deeper rationalization than is supplied right here and within the earlier hyperlink, see this wonderful monograph printed by the CFA Institute.

Given the deliberate acquisition, the basics are primarily vital for the vary of outcomes which will happen if the deal doesn’t shut. The Wall Road consensus and the market-implied outlook present the premise for assessing the prevailing view on whether or not the deal shall be accomplished. I’ve calculated the market-implied outlook for ATVI to early 2023 and I examine this with the present Wall Road consensus outlook in revisiting my score for ATVI.

Wall Road Consensus Outlook for ATVI

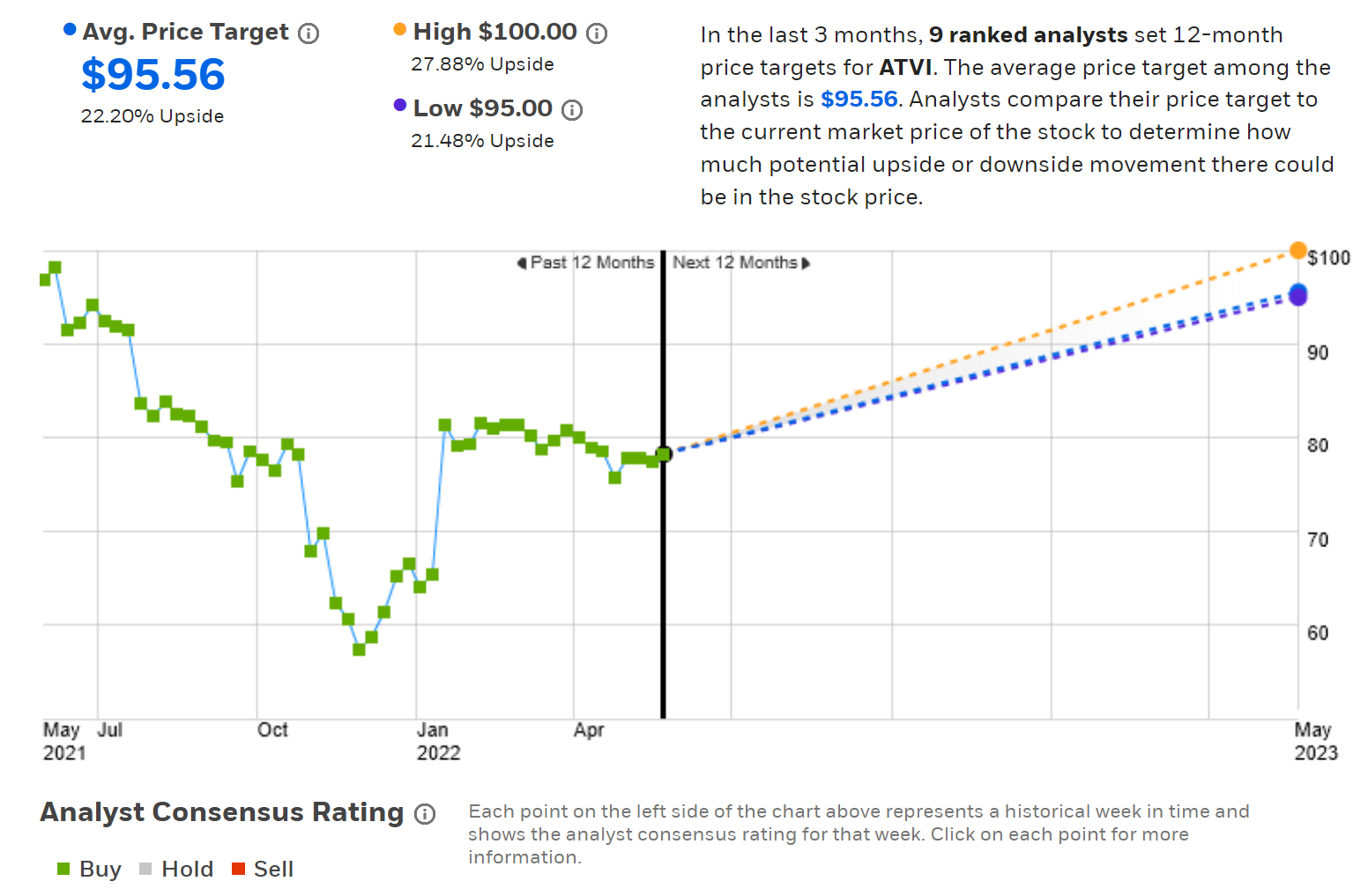

E-Commerce calculates the Wall Road consensus outlook for ATVI by aggregating the views of 9 ranked analysts who’ve printed worth targets and rankings over the previous 3 months. The consensus score is bullish and the consensus 12-month worth goal is $95.56, which is 22.2% above the present share worth. The unfold among the many particular person worth targets is extraordinarily low, demonstrating that the entire analysts anticipate the acquisition to shut.

Supply: E-Commerce

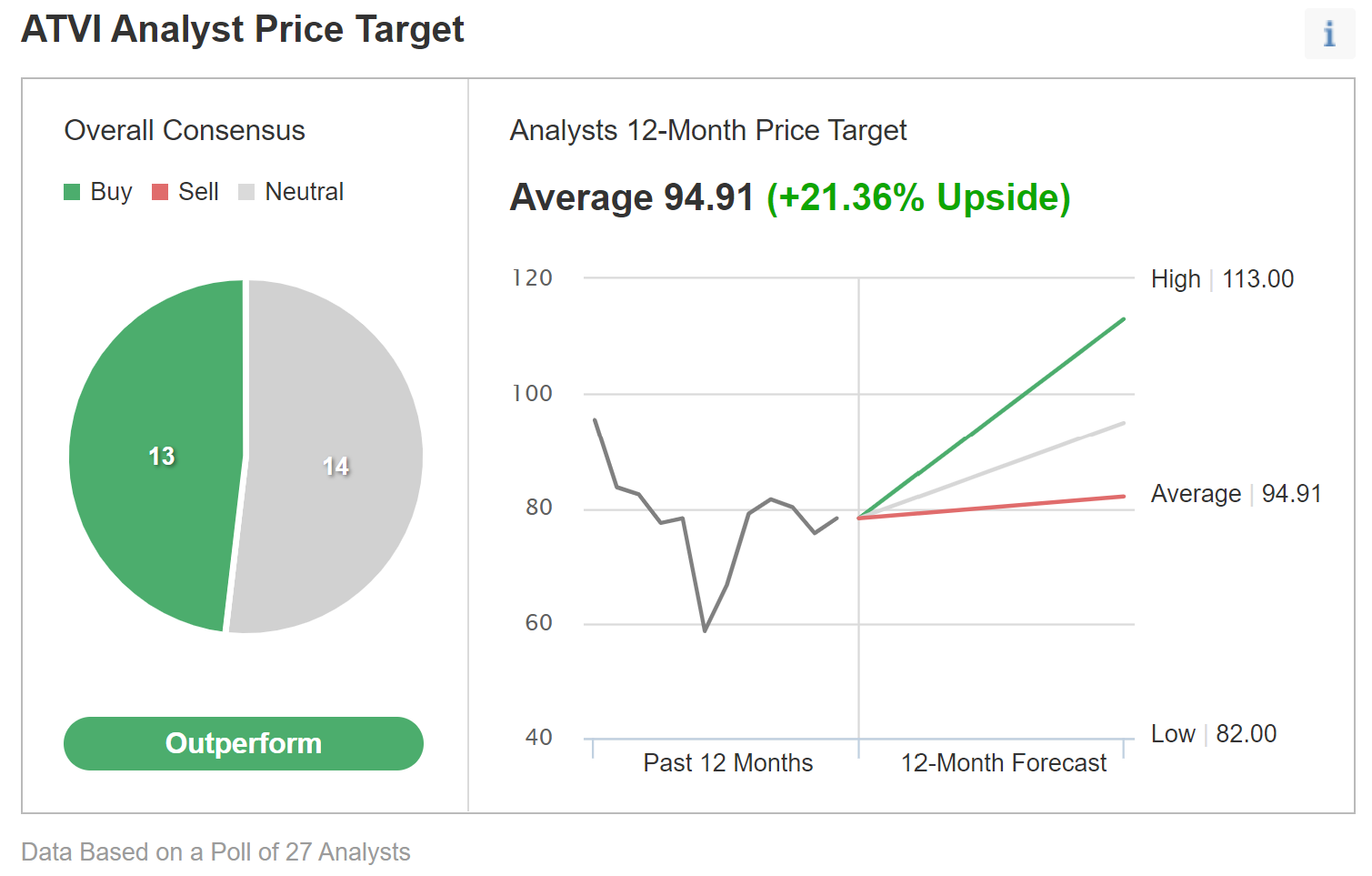

Investing.com’s model of the Wall Road consensus outlook is calculated utilizing worth targets and rankings from 27 analysts. The consensus score is bullish and the consensus common 12-month worth goal is $94.91, about 21.4% above the present share worth.

Supply: Investing.com

The prevailing view is {that a} share of ATVI is value what MSFT has proposed to pay for it. There’s, after all, some chance that the deal won’t occur or that will probably be delayed for some prolonged time period.

Market-Implied Outlook for ATVI

I’ve calculated the market-implied outlook for ATVI for the 7.7-month interval from now till Jan. 20, 2023, utilizing the costs of name and put choices that expire on this date. I selected this particular expiration date to offer a view by means of the tip of 2022 and since the choices expiring in January are closely traded. I thought-about additionally working an outlook utilizing choices that expire in June of 2023, which would offer an outlook nearer to when the acquisition is anticipated to shut, however the choices buying and selling at this later date was very skinny.

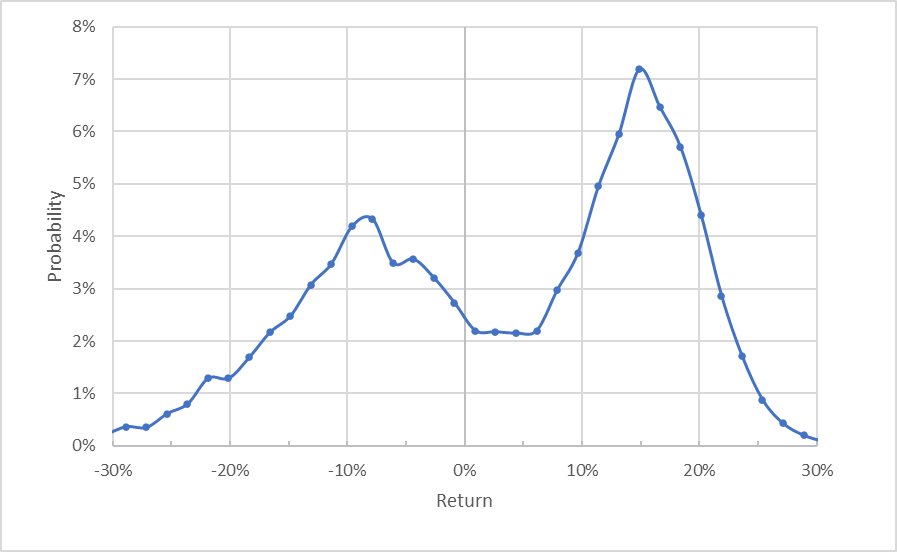

The usual presentation of the market-implied outlook is a likelihood distribution of worth return, with likelihood on the vertical axis and return on the horizontal.

Supply: Writer’s calculations utilizing choices quotes from E-Commerce

The market-implied outlook for ATVI is in contrast to any that I’ve calculated beforehand as a result of there are two substantial distinct peaks in likelihood. The primary, and better likelihood, cluster has a most in likelihood similar to a worth return of 15%. The second vary of outcomes has a peak similar to a worth return of -7.5%. For distinction, examine this to the earlier market-implied outlook with a single peak and which is in keeping with typical outcomes.

What this outlook is exhibiting is that the market anticipates two distinct attainable outcomes—one wherein the acquisition is on observe to shut and the share worth rises, and one wherein the acquisition has failed or been considerably delayed and the share worth declines. The height-probability final result related to the deal being on observe has the share worth at $90 relatively than the $95 supplied by Microsoft as a result of the deal won’t be accomplished by the point the choices expire.

Having two distinct peaks within the market-implied outlook could be very intuitive, given the binary outcomes–one with the acquisition being on observe and one wherein this isn’t the case. The anticipated volatility of this distribution is 24% (annualized), which is low. The market-implied outlook is indicating that probably the most possible final result is for ATVI’s acquisition to go ahead, wherein case buyers can anticipate a acquire of round 15% between now and early 2023, with the remaining unfold persisting as a reduction that displays the remaining potential for the deal to fail.

Principle signifies that the market-implied outlooks are anticipated to be negatively biased as a result of buyers, in combination, are typically risk-averse and thus must be prepared to pay greater than honest worth for draw back safety. There is no such thing as a technique to measure that this impact is current, however such a bias would imply that the market-implied outlook must be interpreted as much more tilted to favor the deal closing than it seems.

Abstract

Whereas ATVI shareholders accredited Microsoft’s supply, there are important regulatory hurdles. On this scenario, the attractiveness of proudly owning ATVI shares primarily is determined by the estimated likelihood that the acquisition will shut.

To look at this query, I’ve checked out two types of consensus outlooks. The primary, the Wall Road analyst consensus, signifies that the deal will shut and that, because of this, the shares shall be value $95. The market-implied outlook, which displays the consensus view amongst consumers and sellers of choices, is that there’s a substantial likelihood that the deal won’t be accomplished, though the likelihood of a profitable completion is bigger.

The bi-modal market-implied outlook could be very intuitive in exhibiting these outcomes. Provided that each the Wall Road consensus and the choices market consensus favor the success of the deal, my score on the inventory is purchase / bullish.

***

The present market makes it more durable than ever to make the suitable selections. Take into consideration the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive applied sciences

- Rate of interest hikes

To deal with them, you want good knowledge, efficient instruments to type by means of the info, and insights into what all of it means. It’s worthwhile to take emotion out of investing and concentrate on the basics.

For that, there’s InvestingPro+, with all of the skilled knowledge and instruments you must make higher investing selections. Study Extra »

[ad_2]