[ad_1]

All McClellan OB/OS Oscillators Impartial

The foremost fairness indexes closed blended yesterday with unfavourable internals on the whereas the noticed unfavourable breadth however constructive up/down quantity. General buying and selling volumes declined on each exchanges from the prior session.

Three indexes posted new closing highs, leaving the near-term developments unchanged for every of the eight we observe with all in near-term uptrends, save one. The info noticed just a few shifts and continues to ship a usually impartial message, in our opinion. As such, we stay near-term “impartial/constructive” in our macro-equity outlook.

On the charts, the indexes closed blended yesterday with usually unfavourable internals as buying and selling volumes declined on each exchanges.

- The SPX, COMPQX, and NDX posted new closing highs as the remainder of the indexes declined.

- Nevertheless, not one of the motion altered the present state of the charts that are all in near-term uptrends besides the DJI, which is impartial.

- The unfavourable internals have been inadequate to change the cumulative advance/decline traces for the All Alternate, NYSE and NASDAQ that stay brief time period constructive.

- No stochastic alerts have been generated.

The info noticed just a few shifts.

- The McClellan 1-Day OB/OS Oscillators at the moment are all in impartial territory (All Alternate: +34.86 NYSE: +19.18 NASDAQ: +46.75).

- The Rydex Ratio (contrarian indicator) measuring the motion of the leveraged ETF merchants backed off to impartial from bearish at 0.91 as they decreased their leveraged lengthy publicity.

- The Open Insider Purchase/Promote Ratio was unchanged at a impartial 38.5.

- This week’s contrarian AAII bear/bull ratio noticed a rise in bears and bulls, remaining impartial (32.77/35.43) with Traders Intelligence Bear/Bull Ratio at a bearish 18.5/50.0 (opposite indicator) as just a few advisors left the bull camp.

- Valuation finds the ahead 12-month consensus earnings estimate from Bloomberg dipping to $207.10 for the SPX. As such, the SPX ahead a number of is 219 with the “rule of 20” discovering truthful worth at roughly 18.7.

- The SPX ahead earnings yield is 4.57%.

- The dipped to 1.29%. We view resistance as 1.4% with assist at 1.23%. We reiterate the latest shift of the 10-year yield into a better buying and selling vary may trigger some points for the markets.

In conclusion, nothing occurred yesterday on the charts or knowledge to trigger a change in our present “impartial/constructive” macro-outlook for equities.

: 4,440/NA : 35,000/35,495 COMPQX: 14,823/NA : 15,139/NA

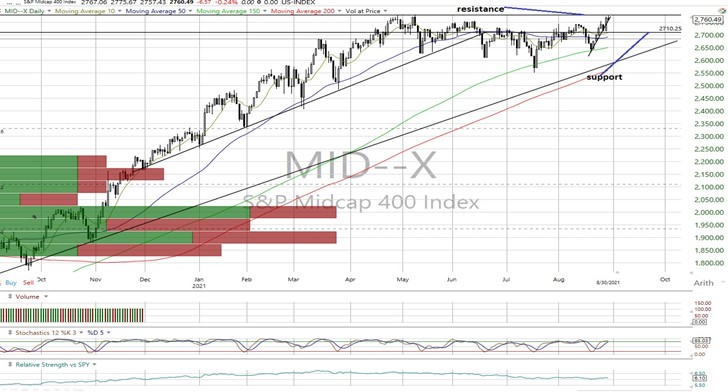

: 14,692/14,952 : 2,710/2,780 : 2,200/2,300 VALUA: 9,553/9,835

S&P 500

Dow Jones Industrials

NASDAQ Composite

NASDAQ 100

Dow Jones Transports

S&P Midcap 4000

Fusion Media or anybody concerned with Fusion Media is not going to settle for any legal responsibility for loss or injury on account of reliance on the data together with knowledge, quotes, charts and purchase/promote alerts contained inside this web site. Please be totally knowledgeable concerning the dangers and prices related to buying and selling the monetary markets, it is among the riskiest funding types attainable.

[ad_2]