[ad_1]

- Shares of Citigroup are down greater than 12.5% since January

- Berkshire Hathaway’s new stake might present a flooring for share worth

- Lengthy-term traders may contemplate shopping for Citi at present ranges

- For instruments, information, and content material that will help you make higher investing choices, strive InvestingPro+

Shareholders of the worldwide monetary powerhouse Citigroup (NYSE:) have seen the worth of their funding lower by practically a 3rd over the previous 12 months and 12.6% up to now this yr. By comparability, each the and the are down about 16.5%.

Near a yr in the past, on June 2, 2021, Citigroup shares went over $80 to hit a multi-year excessive. However since then, it has been a painful slide for traders because the shares are hovering at $52.10. The inventory’s 52-week vary has been $45.40-$80.29, whereas the market capitalization at present stands at $102.3 billion.

The banking large has been making headlines following Berkshire Hathaway’s (NYSE:) (NYSE:) disclosure that it acquired 55 million shares in C.

Warren Buffett has lengthy been a loyal fan of monetary shares, which additionally present secure dividends. BRKb inventory has greater than 3.5% since January. Analysts concur that the present restructuring efforts led by Jane Fraser, Citigroup CEO, may need positively affected Berkshire Hathaway’s resolution to turn into a shareholder.

As an example, the worldwide financial institution is leaving greater than a dozen retail markets throughout Asia and Europe. Wall Avenue now expects Citigroup to turn into a leaner group, concentrating on segments, like wealth administration, with increased margins and a extra secure contribution to the underside line.

Latest Metrics

Citigroup launched on Apr. 14. Income decreased 2% year-over-year to $19.2 billion. Q1 internet revenue was $2.02 per diluted share, in contrast with $3.62 per diluted EPS, within the quarter within the earlier yr. The decline was a results of “increased value of credit score, increased bills and the decrease revenues.”

On the outcomes, CEO Jane Fraser said:

“We returned $4 billion to our shareholders throughout the first quarter and we now have about 6% fewer widespread shares excellent than we did a yr in the past. Whereas we’re making essential investments in our infrastructure, danger and controls and our companies, we stay dedicated to enhancing our returns over the medium time period.”

Previous to the discharge of the Q1 outcomes, C inventory was altering arms at over $50. As we write, it’s round $52.10.

On a closing be aware, among the many main US banking giants, Citigroup has the very best publicity to Russia. Administration is at present in talks to promote its Russian shopper division.

What To Count on From Citigroup Inventory

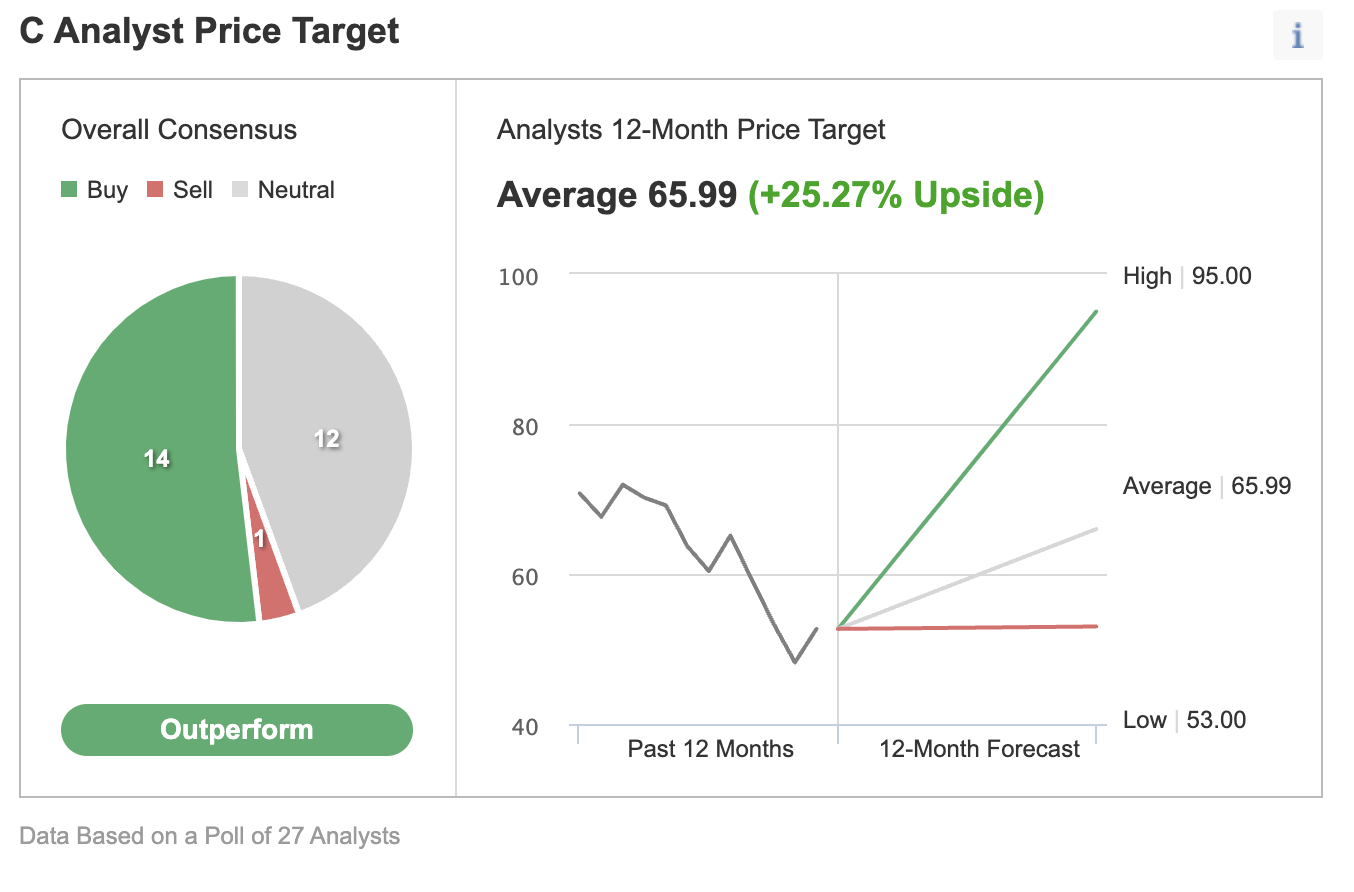

Amongst 27 analysts polled by way of Investing.com, C inventory has an “outperform” score, with a mean 12-month worth goal of $65.99. Such a transfer would counsel a rise of round 25% from the present worth. The goal vary stands between $53 and $95.

Supply: Investing.com

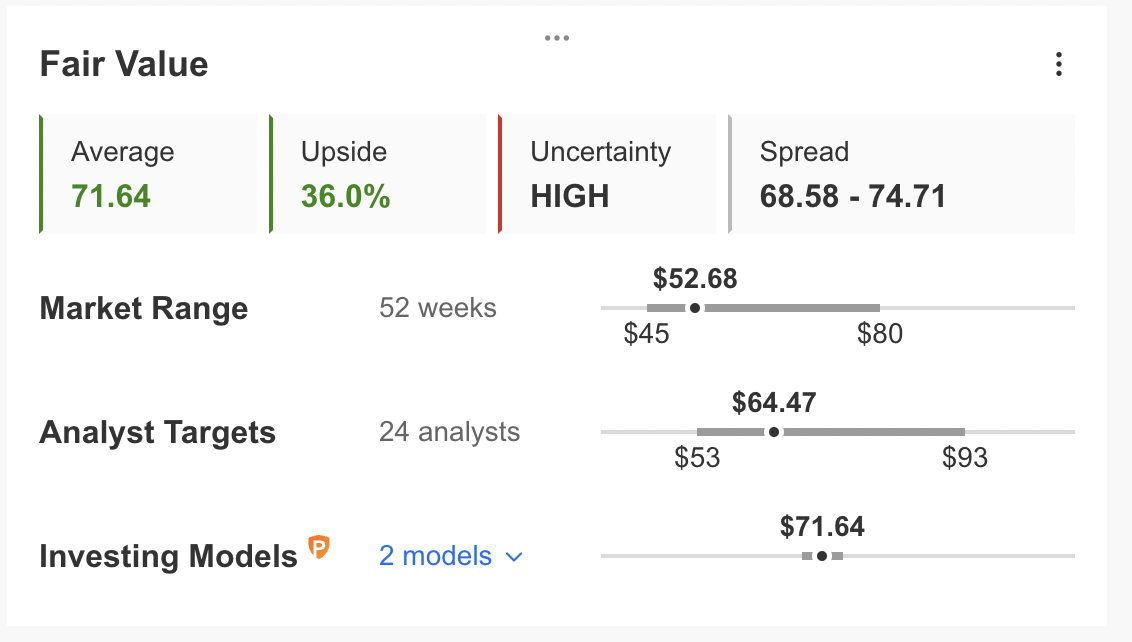

Equally, in accordance with a variety of valuation fashions, akin to P/E or P/S multiples or terminal values, the common truthful worth for Citigroup inventory at InvestingPro stands at $71.64.

Supply: InvestingPro

In different phrases, basic valuation suggests shares may enhance round 36%.

As a part of the short-term sentiment evaluation, it will be necessary to have a look at the implied volatility ranges for C choices as nicely. Implied volatility usually exhibits merchants the market’s opinion of potential strikes in a safety like Citigroup, however it doesn’t forecast the path of the transfer in C shares.

Citigroup’s present implied volatility is about 5% decrease that the 20-day transferring common. In different phrases, implied volatility is trending decrease, whereas choices markets counsel quieter intervals forward for C inventory.

Our expectation is for Citigroup to construct a base between $49 and $52 within the coming weeks. Afterwards, C shares may doubtlessly begin a brand new leg up

Money-Secured Places On C Inventory

Intraday Worth: $52.10

Buyers who usually are not involved with each day strikes in Citigroup worth and who imagine in its long-term potential may contemplate investing in C inventory now. They may anticipate the shares to make a transfer towards $65.99, as recommended by analyst forecasts.

Those that are skilled with choices may additionally contemplate promoting a cash-secured put choice in C inventory—a technique we repeatedly cowl. Because it entails derivatives, this setup won’t be applicable for all traders.

Such a bullish commerce may particularly enchantment to those that wish to obtain premiums (from put promoting) or to presumably personal C shares for lower than their present market worth of $52.10.

A put choice contract on C inventory is the choice to promote 100 shares. Money-secured means the investor has sufficient cash in his or her brokerage account to buy the safety if the inventory worth falls and the choice is assigned. This money reserve should stay within the account till the choice place is closed, expires or is assigned, which implies possession has been transferred.

Let’s assume an investor needs to purchase C inventory, however doesn’t wish to pay the total worth of $52.10 per share. As an alternative, the investor would like to purchase the shares at a reduction throughout the subsequent a number of months.

One chance could be to attend for C inventory to fall additional, which it would or may not do. The opposite chance is to promote one contract of a cash-secured C put choice.

So the dealer would usually write an at-the-money (ATM) or an out-of-the-money (OTM) put choice and concurrently put aside sufficient money to purchase 100 shares of the inventory.

Let’s assume the dealer is placing on this commerce till the choice expiry date of June 17. Because the inventory is $52.10 at time of writing, an OTM put choice would have a strike of $50.

So the vendor must purchase 100 shares of C on the strike of $50 if the choice purchaser had been to train the choice to assign it to the vendor.

The C June 17 50-strike put choice is at present provided at a worth (or premium) of $1.45.

An choice purchaser must pay $1.45 X 100, or $145, in premium to the choice vendor. This premium quantity belongs to the choice vendor it doesn’t matter what occurs sooner or later. The put choice will cease buying and selling on Friday, June 17.

Assuming a dealer would enter this cash-secured put choice commerce at $52.10 now, at expiration on June 17, the utmost return for the vendor could be $145, excluding buying and selling commissions and prices.

The vendor’s most acquire is that this premium quantity if C inventory closes above the strike worth of $50. Ought to that occur, the choice expires nugatory.

If the put choice is within the cash (which means the market worth of C inventory is decrease than the strike worth of $50) any time earlier than or at expiration on June 17, this put choice may be assigned. The vendor would then be obligated to purchase 100 shares of C inventory on the put choice’s strike worth of $50 (i.e. at a complete of $5,000).

The break-even level for our instance is the strike worth ($50) much less the choice premium obtained ($1.45), or $48.55. That is the worth at which the vendor would begin to incur a loss.

Money-secured put promoting is a reasonably extra conservative technique than shopping for shares of an organization outright on the present market worth. This could be a solution to capitalize on the choppiness in C inventory within the coming weeks.

Buyers who find yourself proudly owning C shares on account of promoting places may additional contemplate organising lined calls to extend the potential returns on their shares. Thus, promoting cash-secured places might be thought to be step one in inventory possession.

******

Thinking about discovering your subsequent nice thought? InvestingPro+ offers you the prospect to display screen by means of 135K+ shares to seek out the quickest rising or most undervalued shares on this planet, with skilled information, instruments, and insights. Study Extra »

[ad_2]