[ad_1]

- Tesla inventory is down greater than 40% this yr amid a broad-based sell-off in excessive progress firms

- Analysts warn the carmaker’s difficulties in China have grow to be unattainable to disregard

- Elon Musk’s provide to purchase Twitter can be weighing closely on the inventory

Shares of the world’s largest electrical carmaker, Tesla (NASDAQ:), have been dropping sharply for greater than a month now, closing on Tuesday at $628.16, down nearly 7% for the day.

The inventory has been harm by a mix of things, together with a grim macroeconomic outlook, a surge in COVID circumstances in China, and Elon Musk’s pledge to purchase Twitter (NYSE:) in a $44-billion deal.

Not like final yr’s corrections, when Tesla managed to rebound rapidly, this time appears completely different. Amid the broad-based sell-off in high-growth firms, losses on Tesla shares—the inventory is down greater than 47% to date year-to-date—are a lot steeper than different market heavyweights, corresponding to Apple (NASDAQ:), which is down greater than 20% this yr.

Tesla has, to date, efficiently navigated present international provide disruptions and hovering raw-material prices extra successfully than the competitors. It has produced 11 consecutive whereas constantly beating analysts’ manufacturing estimates.

Nonetheless, there are indicators that the most recent coronavirus outbreak in China, which prolonged already ongoing lockdowns that led to a number of manufacturing disruptions at its manufacturing unit in Shanghai, will harm manufacturing within the second quarter.

In a current word, Morgan Stanley analyst Adam Jonas warned that the China provide constraints might probably drive a “substantial” miss on deliveries in Q2. In accordance with Bloomberg knowledge, analysts’ common estimate for Tesla’s second-quarter deliveries stands at round 303,000 items, down 12% from the tip of March.

Uncertainty Surrounding Twitter Deal

Along with China’s lockdowns and the worsening macroeconomic atmosphere, Elon Musk’s involvement in securing favorable phrases on Twitter is not serving to both. The billionaire Tesla chief government not too long ago tweeted that the deal is “on maintain” till he will get extra details about the portion of the social media platform’s customers which are spam accounts.

This occurred as each Tesla, which Musk depends on for funding the deal, and Twitter shares tanked. Twitter’s board, in the meantime, says it intends to implement the settlement, which requires him to pay $54.20 a share. This uncertainty weighs closely on Tesla traders who fear that Musk should promote extra of his holdings within the EV firm to fund the deal. Including further strain: the settlement additionally features a $1 billion “reverse termination charge” that will be triggered if Musk walks away from the deal.

Given the myriad headwinds, Tesla’s newest troubles have created a pointy divide among the many analyst group relating to the corporate’s inventory.

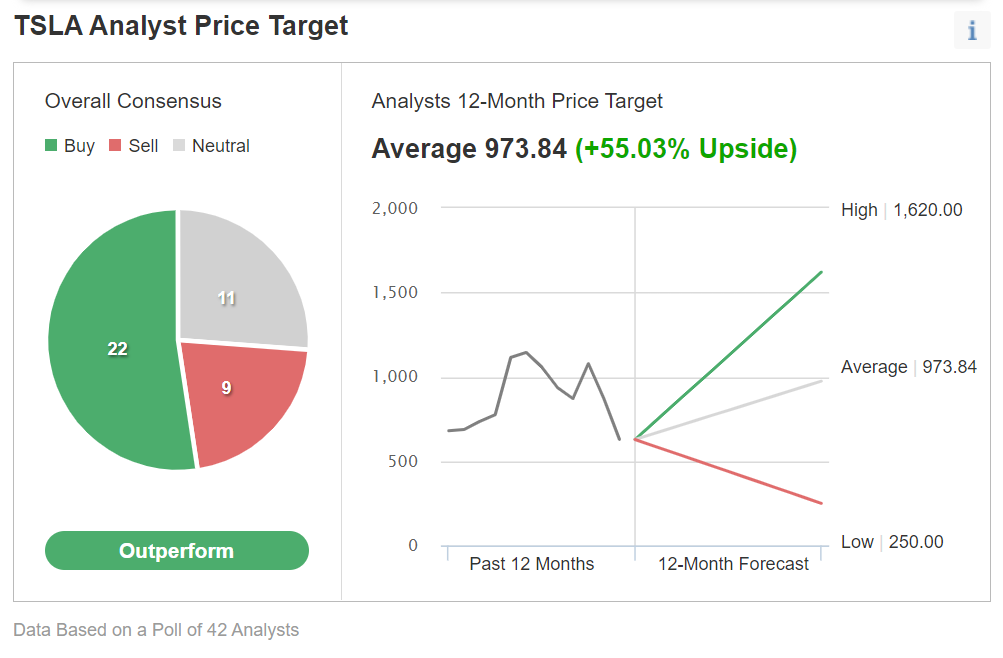

Amongst 42 analysts polled by Investing.com, although 22 people surveyed gave TSLA a purchase score, an nearly equal quantity rated it both a promote or take into account it impartial.

Supply: Investing.com

Their common 12-month value goal of $973.84 signifies a 55.03% upside, however the value vary is broad: from a low of $250 to a excessive of $1,620, an indication of simply how unsure analysts are of the inventory’s future trajectory.

In a word on Tuesday, Bernstein stated it is involved that Elon Musk’s buy of Twitter might trigger Tesla shares to say no but additional. The word stated:

“Maybe the larger – however much less possible – monetary danger is that Musk completes the deal, and TSLA’s share value declines materially, triggering a margin name.”

Nonetheless, Tesla bulls have a strong purpose to remain trustworthy. Tesla’s shares have climbed greater than 22,000% because it went public in 2010, offering traders an annual return of 58%. The , then again, has returned 373%, together with dividends over the identical interval, averaging 15% a yr.

Whereas reiterating Tesla’s value as obese, Piper Sandler stated in a word that the inventory continues to be a “cornerstone holding.”

“We’re reducing our estimates and value goal to mirror COVID-related weak spot in China, in addition to a better WACC (weighted common value of capital) assumption in our DCF mannequin. Nonetheless, we nonetheless regard TSLA as a cornerstone holding in any ‘superior mobility’ portfolio.”

Backside Line

Any pullback in Tesla shares has confirmed to be a profitable commerce for dip consumers. However this time appears to be like completely different, given the multitude of challenges the corporate faces, together with manufacturing disruptions in China, a worsening macro atmosphere, and the uncertainty surrounding Musk’s Twitter deal.

***

Interested find your subsequent nice inventory or ETF thought? InvestingPro+ provides you the prospect to display screen by way of 135K+ shares to seek out the quickest rising or most undervalued shares on this planet, with skilled knowledge, instruments, and insights. Study Extra »

[ad_2]