[ad_1]

This week, I used to be talking on the Italian Inventory Trade’s TOLEXPO occasion; a vital occasion in Milan that gave me the chance to talk and interact with a number of traders.

The sentiments I heard expressed ranged from concern to anxiousness to uncertainty. Typically, there was a great deal of pessimism. Just a few traders have been additionally inclined to speculate as a result of when the markets go down you purchase higher, however once more that was a small minority.

But, as soon as once more, we should put the state of affairs in context…

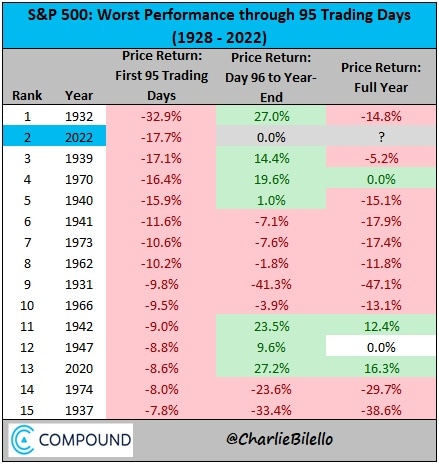

The inventory market, if we have a look at the , has misplaced 18.16% for the reason that starting of the yr. We additionally word that the drawdown (calculated from Wednesday’s shut) for the reason that starting of the yr is the second-worst in historical past.

Supply: CharlieBilello

Right here we will have a look at the glass as half empty or half full. We are able to deal with how detrimental this era is, or we will deal with the alternatives it gives.

I personally deal with the latter, however I accomplish that for a selected purpose: I’m an investor, and my technique is constructed for its first main milestone in 2030. This risky interval can be simply one among many who I’ll in all probability need to face.

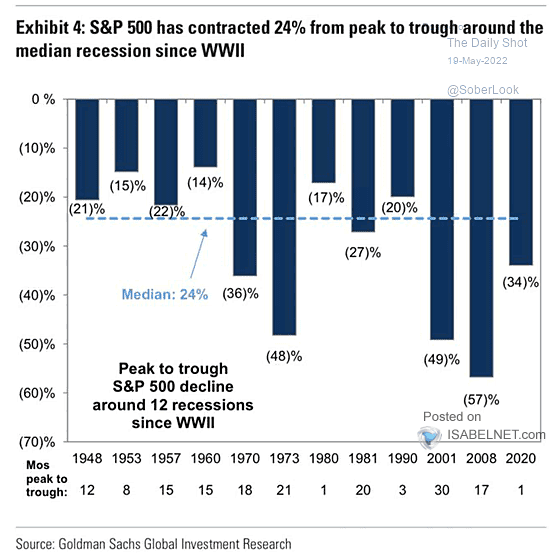

Additionally, as I all the time remind readers now that everybody is speaking about recession, the typical drawdown in recessionary intervals is -24% (see under). Once I say prudently let’s maintain the potential of a -25%/-30% market in thoughts, that is additionally inclusive of comparable reasoning. In fact there have additionally been worse drawdowns, however we have now to have a look at likelihood and statistical frequency.

Supply: Goldman Sachs

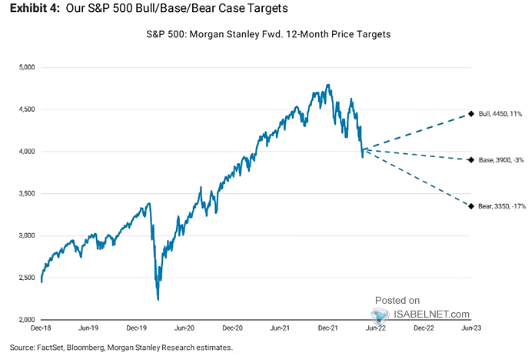

Just lately, Morgan Stanley launched a report relating to the potential ranges of the S&P 500 between now and subsequent yr, in 3 eventualities (primary, pessimistic, optimistic) and starting from a 17% drop from the present stage to an 11% rebound, as per the picture under.

As soon as once more, nevertheless, I really feel that predictions of this type are of virtually no worth, if not purely for barroom fashion dialog, as one can not predict the longer term.

Higher as I all the time say to deal with technique, and the right way to behave ought to sure eventualities really happen. I discover that rather more sensible.

Supply: Morgan Stanley

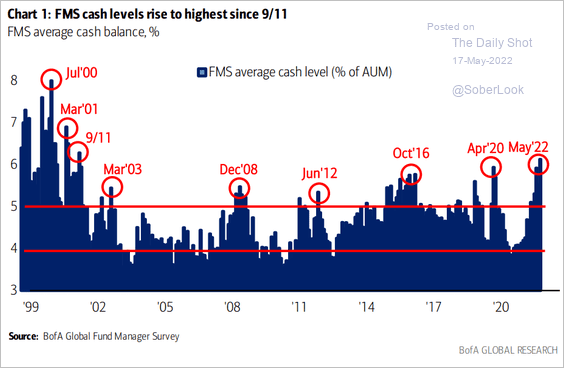

Lastly, as soon as once more we word that regardless of a -18% drop available in the market, prudent traders’ money ranges have surpassed not solely the COVID interval, however even the subprime disaster.

Supply: BoFA

That is yet one more demonstration that going with the circulate and getting slammed left and proper by the markets is frequent follow. These money positions are in all probability a results of promoting (at a loss) positions that have been evidently mismanaged earlier than.

As soon as once more, I all the time need to chuckle: individuals do the alternative of what they need to do when shopping for in a retailer, i.e. buying merchandise on the regular charge as an alternative of ready for discounted costs.

It is a contradiction that has no parallel in human behaviour, and will make us mirror on how fairly often disappointing outcomes come not from the market, however from oneself.

Till subsequent time!

For those who discover my analyses helpful and want to obtain updates once I publish them in real-time, click on on the FOLLOW button on my profile!

Desirous about discovering your subsequent nice concept? InvestingPro+ provides you the possibility to display screen by means of 135K+ shares to search out the quickest rising or most undervalued shares on this planet, with skilled information, instruments, and insights. Be taught Extra »

Disclaimer

This text is written for informational functions solely; it doesn’t represent a solicitation, supply, recommendation or suggestion to speculate as such and is on no account supposed to encourage the acquisition of property. I want to remind you that any kind of asset, is valued from a number of factors of view and is very dangerous and due to this fact, any funding choice and the related danger stays with you.

[ad_2]