[ad_1]

- Shares of Zoom have misplaced about half their worth since January

- Q1 figures on Might 23 anticipated to indicate how firm is dealing with the return to the workplace

- Lengthy-term traders might contemplate shopping for ZM inventory at present ranges

- For instruments, knowledge, and content material that can assist you make higher investing selections, attempt InvestingPro+.

Shareholders of the video conferencing firm Zoom Video Communications Inc (NASDAQ:) have seen the worth of their funding drop roughly 71.5% over the previous 52 weeks and 51.6% up to now this yr.

Supply: Investing.com

By comparability, the tech-heavy has misplaced 23.6% up to now this yr. In the meantime, the ARK Innovation ETF (NYSE:), which has about 8% of its portfolio in ZM shares, is down 54.3% since January.

In October 2020, Zoom inventory was altering palms simply shy of $590, a document excessive. Since then, it has been a painful experience decrease.

As staff began returning to the workplace, on Might 12 the inventory hit a multi-year low of $79.03. ZM inventory’s 52-week vary is $79.03-$406.48, whereas the market capitalization at present stands at $26.7 billion.

California-based Zoom turned a family title throughout the ‘work-from-home’ days of the coronavirus pandemic, partially, as a consequence of its user-friendly format. In consequence, in fiscal 2021, income reached $2.7 billion, up 326% year-over-year (YoY). Nevertheless, as on-line conferences lower in numbers, the corporate could not be capable to repeat this stellar efficiency within the coming quarter.

But, the worldwide trade is forecast to achieve $24.4 billion in 2028. Such a rise would imply a compound annual development fee (CAGR) of 15.5%. Analysts concur that Zoom, which leads the video conferencing market, will profit from such a rise in international revenues. In the meantime, administration is targeted on rising the product’s ecosystem.

How Current Metrics Got here In

Zoom launched on the finish of February. Quarterly income elevated by 21% year-over-year to $1.07 billion. Adjusted earnings per share (EPS) was $1.29, up from $1.22, in the identical interval final yr.

As of Jan. 31, whole money stood at $5.42 billion. Zoom serves 191,000 enterprise prospects, a rise of 35% YoY.

On the outcomes, CEO Eric S. Yuan said:

“In fiscal yr 2022, we delivered sturdy outcomes with whole income of greater than $4 billion, rising 55% yr over yr together with elevated profitability and working money move development as our international buyer base continued to develop and discover new use instances for our broadening communications platform.”

Nevertheless, Wall Road raised eyebrows on the Q1 FY23 outlook. Administration forecasts that whole income will come between $1.070 and $1.075 billion and adjusted EPS between 86 and 88 cents.

Previous to the discharge of the fourth quarter outcomes, ZM inventory was altering palms round $132. On the time of writing, it’s at $89.30, down roughly 30%.

Q1 metrics are anticipated to be launched Might 23. Buyers ought to anticipate elevated volatility within the coming days.

What To Count on From Zoom Inventory

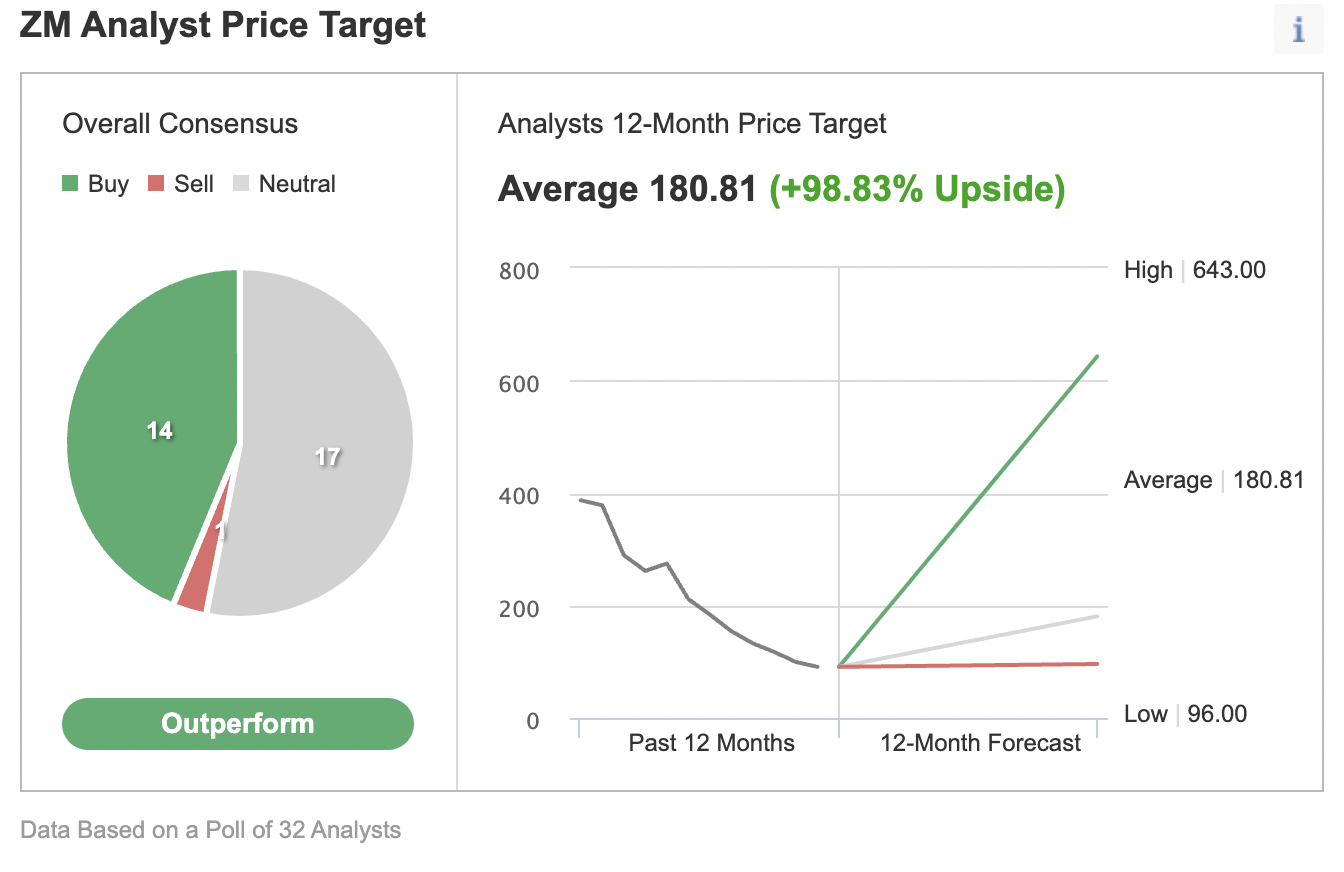

Amongst 32 analysts polled through Investing.com, ZM inventory has an “outperform” ranking with a mean 12-month value goal of $180.81 for the inventory. Such a transfer would recommend a rise of about 98% from the present value. The goal vary stands between $643 and $96.

Supply: Investing.com

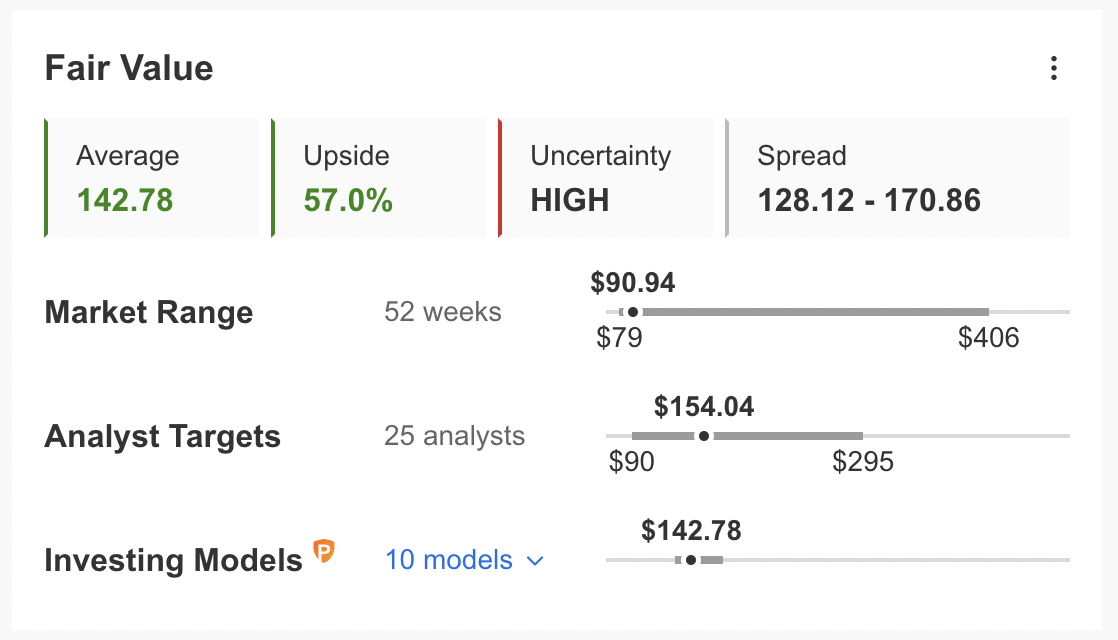

Equally, in line with quite a lot of valuation fashions, together with P/E or P/S multiples or terminal values, the common honest worth for ZM inventory on InvestingPro stands at $142.78

Supply: InvestingPro

In different phrases, basic valuation suggests shares might enhance near 57%.

We will additionally have a look at ZM’s monetary well being as decided by rating greater than 100 components towards friends within the data know-how sector.

For example, when it comes to money move and development, it scores 4 out of 5. It scores 5 out of 5 for profitability. Its general rating of 4 factors is a superb efficiency rating.

At current, ZM’s P/B and P/S ratios are 20.1x, 4.6x and 6.7x. Comparable metrics for its friends stand at 13.5x and 11.3x. These numbers present that following the current decline, ZM inventory affords higher worth than a lot of its friends.

As a part of the short-term sentiment evaluation, it will be essential to take a look at the implied volatility ranges for Zoom inventory choices as nicely. Implied volatility usually exhibits merchants the market’s opinion of potential strikes in a safety, nevertheless it doesn’t forecast the route of the transfer.

ZM’s present implied volatility is about 27.3% larger than the 20-day shifting common. In different phrases, implied volatility is trending larger, whereas the choices markets recommend elevated choppiness forward. As we’ve already famous, shares are prone to be uneven forward of the Q1 outcomes launch.

Our expectation is for ZM inventory to construct a base between $80 and $100 within the coming weeks. Afterwards, shares might doubtlessly begin a brand new leg up.

Bull Name Unfold On ZM Inventory

Zoom bulls who aren’t involved about short-term volatility might contemplate investing now. Their goal value can be $153.49, as per the goal offered by analysts.

Alternatively, traders who count on ZM inventory to bounce again within the weeks forward might contemplate organising a bull name unfold.

Most choice methods are not appropriate for all traders. Due to this fact, the next dialogue on ZM inventory is obtainable for academic functions and never as an precise technique to be adopted by the common retail investor.

Bull Name Unfold On Zoom Inventory

Intraday Worth At Time Of Writing: $89.30

In a bull name unfold, a dealer has a protracted name with a decrease strike value and a brief name with a better strike value. Each legs of the commerce have the identical underlying inventory (i.e., Zoom) and the identical expiration date.

The dealer needs ZM inventory to extend in value. In a bull name unfold, each the potential revenue and the potential loss ranges are restricted. The commerce is established for a internet value (or internet debit), which represents the utmost loss.

At present’s bull name unfold commerce entails shopping for the July 15 expiry 95 strike name for $10.60 and promoting the 100 strike name for $8.70.

Shopping for this name unfold prices the investor round $1.90 ($10.60 – 8.70), or $190 per contract, which can also be the most threat for this commerce.

We must always be aware that the dealer might simply lose this quantity if the place is held to expiry and each legs expire nugatory, i.e., if the ZM inventory value at expiration is under the strike value of the lengthy name (or $95 in our instance).

To calculate the most potential acquire, we are able to subtract the premium paid from the unfold between the 2 strikes, and multiply the end result by 100. In different phrases: ($5 – $1.90) x 100 = $310.

The dealer will understand this most revenue if the Zoom inventory value is at or above the strike value of the brief name (larger strike) at expiration (or $100 in our instance).

Lastly, we are able to additionally calculate the break-even inventory value at expiration. In our instance, it’s $95 + $1.90 = $96.90. In different phrases, we add the online premium paid to the strike value of the lengthy name, which is the decrease strike (or $95 right here). Due to this fact, on the day of expiry, the dealer would want Zoom shares to shut above $96.90 to interrupt even from this commerce.

These merchants anticipating a gradual value enhance in ZM inventory towards the strike value of the brief name (i.e., $100 right here) might contemplate a bull name commerce. Please be aware that the numbers we’ve used within the calculations don’t embrace brokerage fee or charges.

Backside Line

Over the previous yr, Zoom inventory has come below vital strain. But, the decline has improved the margin of security for buy-and-hold traders who might contemplate investing quickly. Alternatively, skilled merchants might additionally arrange an choices commerce to profit from a possible run-up within the value of ZM inventory.

Considering discovering your subsequent nice thought? InvestingPro+ offers you the prospect to display screen by means of 135K+ shares to seek out the quickest rising or most undervalued shares on this planet, with skilled knowledge, instruments, and insights. Study Extra »

[ad_2]