[ad_1]

With all of the panic over the headlines as of late, it’s a very good time for us contrarians to step again and take inventory—as a result of there are high-yield bargains on the market that may assist us navigate this mess.

(Trace: one of the best searching floor for us contrarians right now is in a bunch of roughly 500 funds referred to as closed-end funds, or CEFs, a lot of which pay 8%+ yields and commerce at ridiculous reductions. Extra on them, and a 9.9%-paying fund that could be a very good match for you should you’re investing for the long run, in a second.)

First, should you’re feeling nervous about your portfolio, let’s step again a bit. As a result of there are causes for optimism. For one, contemplate that the stock-market rebound popping out of the COVID-19 crash stays strong, regardless of the mess 2022 has been.

Buyers who simply purchased an again then are nonetheless sitting on 84% positive factors in simply over two years!

Shares Are Nonetheless Manner Up From The COVID Trough

SPY Whole Returns

What’s extra, we had much more purpose to assume the world was ending again then than we do now. Whereas the warfare in Ukraine stays a humanitarian catastrophe, many of the remainder of the world’s inhabitants is out of their houses and going about their lives. That’s not one thing you would say about March 2020.

The takeaway is that selloffs have at all times been—and stay—alternatives for long-term traders. However stepping into shares is simply step one. You possibly can compound your earnings by buying your shares (and bonds, and REITs, and most well-liked shares …) by CEFs.

CEFs have the same construction as ETFs, with one key distinction: whereas ETFs commerce just about on the market worth of their portfolios (their web asset worth, or NAV), CEFs commerce at a worth greater or decrease than their NAV—and most commerce at reductions. Contrarians who purchase when these reductions are unusually giant have an opportunity to enhance their earnings whereas hedging their threat.

The CEF Low cost In Motion

To point out you ways this works, contemplate the Highland World Allocation Fund (HGLB), a diversified CEF that splits its belongings throughout completely different geographies and belongings, with a mixture of shares, actual property, loans and bonds issued to US firms (which all collectively make up three-quarters of the fund) and international corporations (which make up the remainder).

HGLB yields 9.9% now and trades at a 22% low cost, making it one of many most cost-effective CEFs in the marketplace right now.

This isn’t its greatest low cost, nonetheless. When markets hit backside in 2020, HGLB was actually oversold, with a forty five% low cost to NAV that was nearly inconceivable earlier than the pandemic hit. Buyers who noticed alternative in others’ concern have been amply rewarded.

HGLB’s Low cost Makes the Distinction

HGLB Efficiency

With a market-doubling return from the lows of the COVID-19 pandemic, HGLB introduced appreciable earnings to traders who noticed previous the concern available in the market and purchased the fund’s irrational markdown. And HGLD continues to carry out nicely, even because the falls.

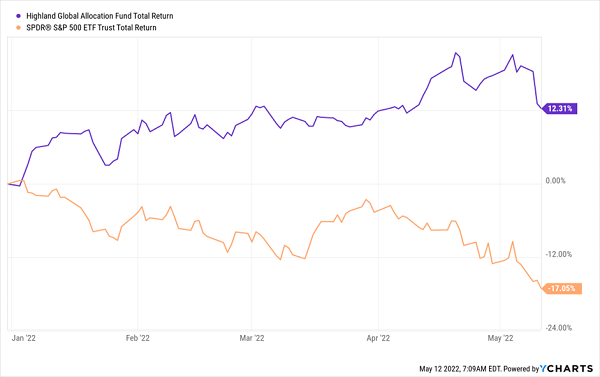

HGLB Is Nonetheless Going Sturdy

HGLB 2022 Returns

HGLB is an effective instance of how shopping for a CEF buying and selling at an enormous low cost will help hedge your portfolio in a downturn whereas enhancing your positive factors in a rising market. Whereas its low cost could go down additional within the brief time period, a long-term play right here may see vital capital positive factors because the market goes from fearful to grasping—because it at all times does.

The Most cost-effective CEFs Now

It is a notably fascinating time for CEFs, as a result of the selloff has resulted in numerous funds which are oversold. Simply contemplate these info:

- The common CEF now yields 8% at a time whereas US Treasuries yield 3% and shares yield 1.3%.

- The common CEF trades at a 5.3% low cost to NAV, versus a 1.3% low cost to NAV only a yr in the past.

- A complete of 89 CEFs commerce at a reduction of 10% or greater, probably the most within the final 5 years (excluding the primary half of 2020).

- Of these 89 CEFs, each single one which has been round for a decade or longer has had a optimistic return in that point, with a number of funds incomes annualized returns over 10%.

The underside line is that we’ve got a chance to make use of the selloff to safe an 8%+ revenue stream from oversold CEFs. That might provide you with a wholesome money stream at a time when of us who primarily stick with the pathetic yielders of the S&P 500 should promote shares at right now’s low costs to make sure they come up with the money for coming in.

Disclosure: Brett Owens and Michael Foster are contrarian revenue traders who search for undervalued shares/funds throughout the U.S. markets. Click on right here to discover ways to revenue from their methods within the newest report, “7 Nice Dividend Progress Shares for a Safe Retirement.”

[ad_2]