[ad_1]

In what’s a extremely uncommon begin to 2022, each single bond and inventory asset class has unfavourable returns for 2022 YTD, which given the historic relationships, notably between fairness asset class returns and Treasury returns, appears fairly outstanding.

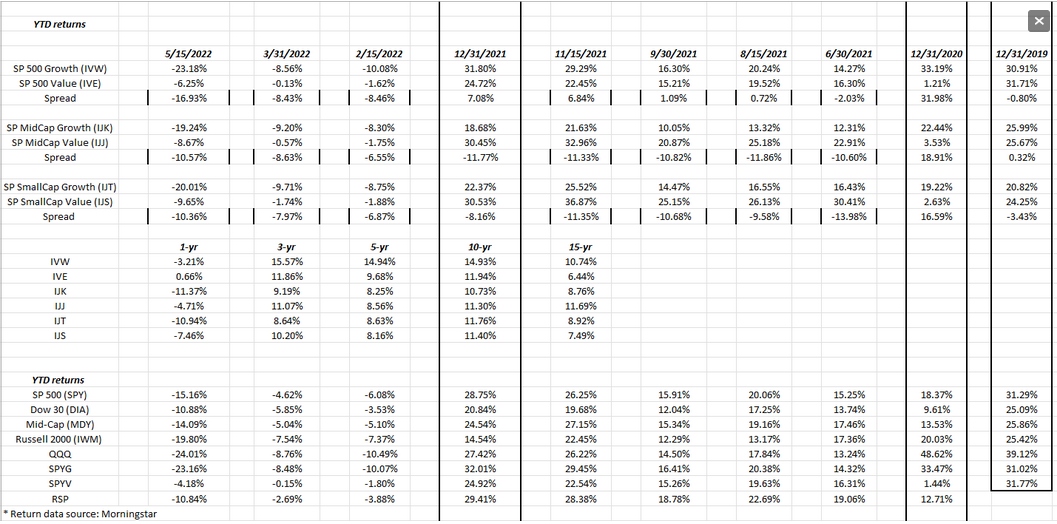

Right here’s the spreadsheet monitoring “progress versus worth” throughout fairness asset courses:

Worth is clearly outperforming progress, in all probability as a result of , and sectors, which, in case you observe the sector SPDR® ETFs to trace sector returns, all have optimistic returns YTD for 2022.

However apart from that, 2022 is wanting fairly grim.

This replace began monitoring common annual returns in 2021: take a look at the common, annual returns for large-cap progress, notably the return premium for the 5-year interval. That tells me {that a} restoration in fairness values would possibly begin with the small and mid-cap asset courses first or, put one other means, large-cap progress may lag for some time.

The underside part of the spreadsheet reveals YTD returns (full-year returns are within the heavy-bordered columns). The ’s YTD decline of -15.16% appears regular given the cumulative, two-year return for the S&P 500 of 47.72% (the sum of 2020 and 2021 S&P 500 whole returns), whereas the Invesco QQQ Belief (NASDAQ:) decline this yr of -24.01%, additionally appears proportional with the 2-year (calendar 2020 and 2021) cumulative return for the Qs of 76.04%.

As of mid-Could, 2022 up to now anyway, this looks as if a standard correction for the large-cap indices, given the 2020 and 2021 capital market returns, with a watch in the direction of the longer-term common annual returns.

Assume all of that is perspective and none of this can be a prediction.

The outstanding stat for me comes from the sentiment perspective: I believed I learn that “bullish” market sentiment is or was the bottom since 1992 in keeping with the AAII survey.

Abstract/conclusion: Worth continues to trounce progress shares throughout the fashion asset class throughout all market caps, and the longer-term returns inform us that progress would possibly proceed to lag for a while.

It’s unimaginable to say how lengthy the fashion “alpha” can be sustained. Development shares had a outstanding decade from 2010 via the top of the pandemic. That doesn’t imply worth’s outperformance can be of an equal time-frame.

If progressively larger rates of interest proceed to prevail, my guess is worth will probably see outperformance versus it’s progress market-cap equal.

That’s strictly a guess.

None of this can be a prediction. None of this can be a suggestion to purchase, maintain or promote. It’s strictly an opinion and people opinions—just like the markets—can change shortly.

[ad_2]