[ad_1]

Each legendary investor price their salt has some form of phrase to explain what buyers must be doing proper this very minute.

“Be fearful when others are grasping, be grasping when others are fearful.”

“Purchase when there’s blood within the streets.”

Largely talking, most shares in the marketplace are on sale to some extent. And certain, we may exit and make a number of focused bets on these bargains.

However I’d want to squeeze much more worth out of the inventory market.

Enter closed-end funds (CEFs).

Why CEFs Are Our Finest Possibility Now

If we had been to exit and purchase an exchange-traded fund (ETF) that invests in, say, the or , or actually any space of the market you felt was underpriced, you’d be capable of get pleasure from within the collective reductions of all their holdings. No extra, no much less.

However with CEFs, we are able to do even higher.

My mother, to this present day, refuses to pay the sticker value. If there’s a coupon to be discovered, she’ll not solely discover it, however she’ll additionally discover one other coupon to safe a double-discount (even when it requires administration approval to use)!

And identical to my mother, we are able to safe a double-discount by investing via closed-end funds.

You see, in contrast to ETFs, which may create and destroy as many shares as wanted to fulfill market demand, CEFs go public with a particular variety of items, and that quantity doesn’t actually change over time.

Due to that, CEFs’ internet asset worth can change into untethered from the worth of its holdings. Typically, that NAV will be price considerably extra, by which case the closed-end fund will commerce at a premium, say $1.05 for each $1 in holdings.

However generally, you get the higher different fringe of that sword, and purchase a CEF at a reduction to NAV, paying, say, 95 cents for each $1 in holdings.

While you mix that with a broader market that’s already on sale, we contrarians can take a web page out of my mother’s playbook and get a double-discount that, within the case of the 5 funds that I’m about to indicate you, can enable us to buy shares for as little as 81 cents on the greenback!

Let me introduce you to 5 CEFs that may permit you to do precisely that. And along with buying and selling at a major {discount} (of 10% or extra), these funds supply fats yields of seven% and extra—and higher nonetheless, pay out their distributions each month.

We’ll begin out with a fund that’s really doing fairly effectively this 12 months:

1. First Belief MLP And Earnings Closed Fund – 7.7% yield

has been the market’s hottest sector in 2022, and it’s not even shut. The sector is up 38% up to now—and it’s the one one in constructive territory! Second-best is with “simply” a 1% decline.

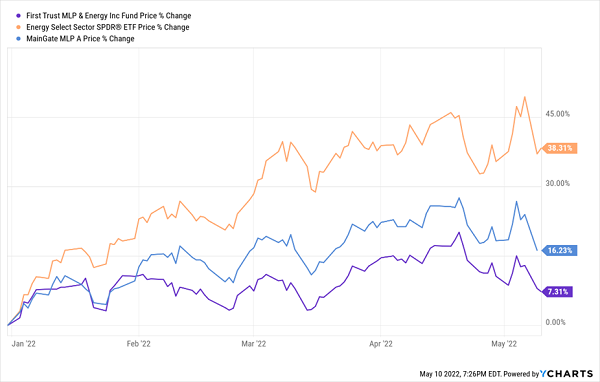

That mentioned, energy-infrastructure grasp restricted partnerships (MLPs) haven’t been fairly as explosive. First Belief’s, for example, is up simply 7%, which is way behind the broader vitality sector and solely half pretty much as good as most listed MLP exchange-traded funds.

Oil Costs Are Flying, However FEI Is Simply Hovering a Little

FEI Efficiency

Conversely, FEI may be one of many solely energy-sector bargains left.

First Belief MLP & Earnings Closed Fund (NYSE:) is a good, concentrated portfolio of infrastructure performs primarily dealing in petroleum, , electrical energy and transmission.

Trade blue chips equivalent to Enterprise Merchandise Companions LP (NYSE:) and Magellan Midstream Companions LP (NYSE:) anchor the highest holdings checklist. That naturally would result in a excessive general yield, however about 20% in debt leverage helps FEI juice its payout to almost 8% at present costs.

Worth buyers will love that they’re getting twice the discount proper now, at a reduction to NAV of 14%, which is double the CEF’s five-year historic {discount} of about 7%.

Yow will discover a pair extra double-digit reductions to NAV within the following CEFs:

2. & 3. Neuberger Berman Subsequent Era Connectivity Fund – 11.4% Yield; MainStay CBRE International Infrastructure Megatrends Fund – 7.7% Yield

The very first thing that stands out? These aren’t conventional CEFs.

Neuberger Berman’s NBXG appears for shares with progress potential from “the event, development, use or sale of merchandise, processes or providers associated to the fifth-generation cellular community and future generations of cellular community connectivity and expertise.” In different phrases, 5G shares. NVIDIA (NASDAQ:). Palo Alto Networks (NASDAQ:), and Globant (NYSE:).

MainStay’s MEGI is rather less easy. The agency says its fund is “targeted on the funding megatrends of decarbonization, digital transformation and asset modernization, that are reshaping the demand for infrastructure property and driving earnings and progress potential.”

The portfolio itself is just about an vitality fund with some deal with renewables—high holdings embody Nationwide Grid (LON:) (NYSE:), Williams Firms (NYSE:) and Atlantica Sustainable Infrastructure PLC (NASDAQ:).

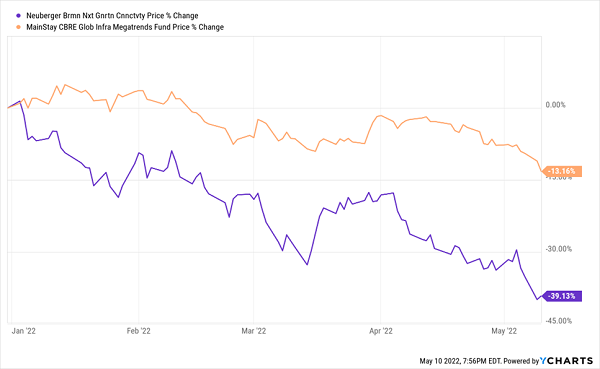

In brief, they’re thematics—a kind of fund that may cross sectors to harness an investable theme. They’re huge in ETFs; not a lot in CEFs. However, NBXG and MEGI are a brand new breed. Very new, in actual fact. Each began buying and selling in 2021 and have little or no buying and selling historical past, although each are getting pounded this 12 months.

Powerful Love For The New Youngsters

New Thematic CEFs Efficiency Chart

Each additionally commerce at mouth-watering reductions (NBXG: -18.4%; MEGI: -13.2%), although each even have little or no historical past to check that to.

They’re bold choices that might shake up the CEF world. Nevertheless it’s laborious to inform whether or not you possibly can depend upon them for earnings—month-to-month dividends and all.

4. BlackRock Well being Sciences Belief II – 11.4% Yield

BlackRock Well being Sciences Belief II (NYSE:) is on the greener aspect, too, having launched in January 2020. And regardless of the seemingly particular title, that is only a broad, actively managed healthcare fund. Holdings are break up roughly 50-50 between pharma/biotech/life sciences and well being care gear/providers.

Thus, high holdings embody every thing from biotech Vertex Prescribed drugs (NASDAQ:) to insurer Anthem (NYSE:) to Japanese Massive Pharma agency Daiichi Sankyo Co Ltd ADR (OTC:).

It’s laborious to know what to make of this younger fund, although.

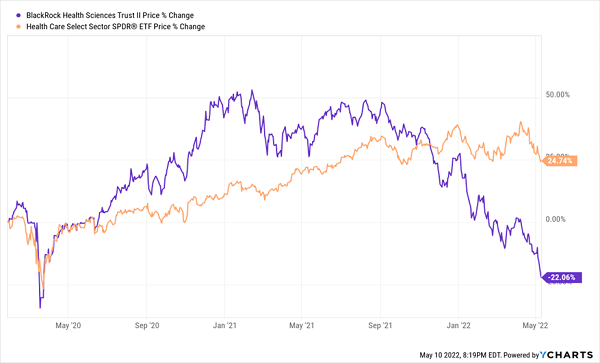

BlackRock’s CEF Has Taken A Dive In 2022

BMEZ Efficiency In 2022

BMEZ is off roughly 40% in 2022 versus a mere 10% loss for the broader healthcare sector. You possibly can’t blame leverage, both—the fund solely makes use of a marginal quantity.

This appears like merely unlucky choices coming to roost, however greater than a 12 months in the past, Wall Avenue would have been patting fund administration on the again for its extensive outperformance.

For those who nonetheless wish to take an opportunity on BMEZ, although, you couldn’t ask for a greater value. It at present trades at a 14% {discount}, or 86 cents on the greenback—greater than double its 6.4% one-year common—for an 11% yield paid month-to-month.

5. Aberdeen Whole Dynamic Dividend – 8.4% Yield

For those who’re searching for one thing actually easy and simple, it doesn’t get far more primary than the Aberdeen Whole Dynamic Dividend Fund (NYSE:), which is buying and selling at a 12% {discount} to NAV that’s barely higher than its norm. It is a international fund that seeks to pay out excessive dividends. If it delivers capital good points, nice, however that’s secondary to the money.

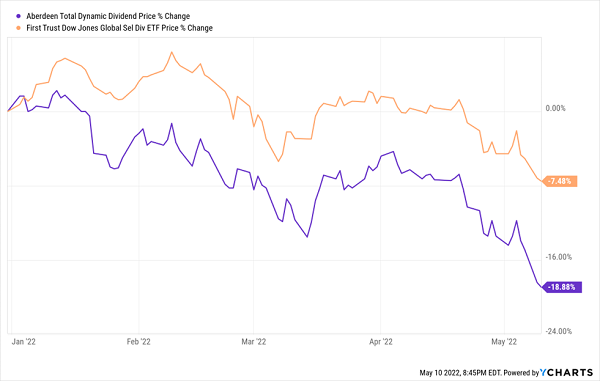

Up to now in 2022, it’s clear that capital good points are secondary.

AOD Has Struggled Out Of The Gate

AOD Efficiency

“International,” for the uninitiated, is Wall Avenue for “home and worldwide.” Sometimes, international funds are not less than half-invested in U.S. shares (AOD is, at 53%), with the remaining unfold round various developed and/or rising markets. Right here, AOD has single-digit weights to France, Germany, Switzerland and a bunch of primarily developed markets.

The issue is, regardless of having a reasonably growthy portfolio that features the likes of Apple (NASDAQ:), Microsoft (NASDAQ:), and Alphabet (NASDAQ:), AOD has really been a laggard over the very long run.

This International Dividend Index Fund Has AOD Beat

AOD Lags Lengthy-Time period

Because of this it pays to look past headline yield. As a result of regardless of yielding an enormous 8%-plus and holding onto shares which were on fireplace over the previous decade or so, AOD nonetheless has struggled to match, not to mention beat, cheaper listed merchandise.

Disclosure: Brett Owens and Michael Foster are contrarian earnings buyers who search for undervalued shares/funds throughout the U.S. markets. Click on right here to learn to revenue from their methods within the newest report, “7 Nice Dividend Progress Shares for a Safe Retirement.”

[ad_2]