[ad_1]

“Our account opening numbers have gone up by 35% week-on-week and this surge can immediately be attributed to the demand for the forthcoming LIC IPO,” mentioned Varun Sridhar, CEO, PayTM Cash.

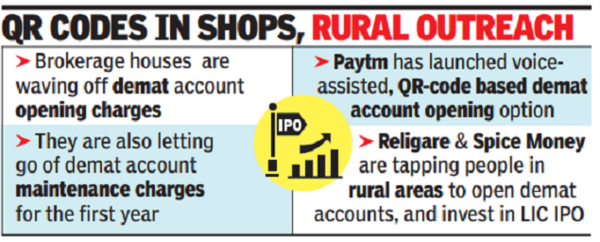

A number of broking homes are additionally waving off demat account opening prices in addition to not passing on stamp obligation and different statutory levies onto the in-coming new clients. As an extra profit, some are additionally waving off the demat upkeep prices for the whole lifetime whereas some is limiting the freebee to only the primary 12 months.

Religare Broking, a home broking home, just lately joined arms with Spice Cash, a fintech firm focussed on the agricultural India, to open demat accounts in India’s hinterlands. Below the partnership, Spice Cash’s brokers within the rural areas, referred to as Adhikaris, will help individuals to open demat accounts with Religare and in addition assist them spend money on the LIC IPO.

Based on Sanjeev Kumar, Co-Founder & CEO, Spice Cash, its partnership with Religare would carry forth the chance for rural residents to take part within the mega LIC IPO and different capital market-linked merchandise sooner or later. “Entry to the IPO of a model that instructions nation-wide belief, like LIC, will assist rural residents heat as much as the phenomenon of funding alternatives they’re hitherto unaware of,” Kumar was quoted in a launch.

PayTM Cash can be tapping potential clients within the hinterlands to open accounts with it and spend money on the life insurer’s IPO. It has positioned QR codes at kirana shops throughout the nation, to introduce the frequent man to the facility of investing with free demat accounts for lifetime, it mentioned in a launch. “Utilizing these QR codes, any particular person will be capable of simply create their free demat accounts…and place their bids for the LIC IPO.”

Built-in, a home broking home, is waving off Rs 500 for purchasers opening demat accounts with it, a mailer from the corporate mentioned.

[ad_2]