[ad_1]

LIC’s is the primary divestment supply to have an anchor guide. Via an anchor allocation, some choose, marque buyers of world and home reputation are allotted about 35% of the whole supply a day forward of the opening of the difficulty. Until now the federal government was not prepared to offer preferential remedy to a handful of buyers forward of the opening the IPO to all sorts of buyers.

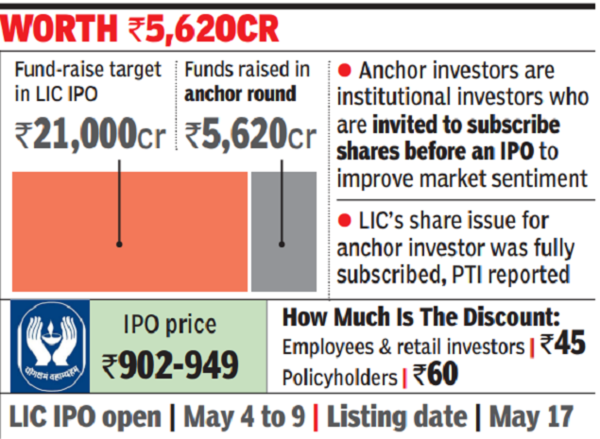

Via this IPO, the federal government is promoting 22.1 crore shares of the life insurance coverage main at a value band of Rs 902-949-per-share, aiming to boost about Rs 21,000 crore. This would be the largest IPO within the historical past of the Indian capital market, forward of the Rs 18,300-crore PayTM IPO that closed final November.

The problem would open on Could 4 and shut on Could 9. Retail buyers will get a Rs 45-per-share low cost on the supply value whereas LIC’s policyholders will get a reduction of Rs 60.

Of the about 22.13 crore LIC shares being bought by the federal government via the IPO, practically 10 crore shares are reserved for institutional buyers, about 3 crore shares for non-institutional patrons (excessive networth buyers) and about 2.2 crore shares are reserved for its policyholders.

The life insurance coverage main is predicted to be listed on the bourses on Could 17.

Earlier in February this 12 months, finance ministry officers had instructed TOI that the federal government was taking a look at a valuation of Rs 13-14 lakh crore. Nonetheless, after the beginning of the Russia-Ukraine struggle and the following fall available in the market, the federal government drastically lowered the valuation of the corporate by lower than half the sooner degree. On the present IPO measurement, LIC’s valuation is pegged at about Rs 6 lakh crore.

LIC’s embedded worth, probably the most accepted valuation metric for insurance coverage firms, was pegged at about Rs 5.4 lakh crore as of September 30, 2021. The valuation was finished by worldwide actuarial agency Milliman Advisors.

Whereas all of the listed Indian non-public life insurance coverage gamers are commanding a valuation of between 2.5 occasions to three.5 occasions their embedded worth, on the IPO value, LIC’s is 1.1 occasions. Based on some analysts this makes the IPO value enticing.

[ad_2]