[ad_1]

This text was first printed at TopDown Charts

-

April ended with an enormous drubbing for danger property

-

A pointy rise in international rates of interest damage high-duration shares probably the most, however sellers got here after a few of 2022’s winners too

-

Given an additional bearish flip in technicals and a number of other different macro headwinds, we stay cautious on shares

International equities had been rocked final week by intense promoting. There was hardly anyplace to cover. The misplaced greater than 3% whereas international shares ex-US had been down a bit lower than 2%. Bonds lastly caught just a few bidders with the US mixture ending roughly even over the past week of April.

Tech Shares On the Epicenter

It was a brutal month for high-duration property. The US yield rose from 2.33% to 2.89%. The NASDAQ 100 ETF (NASDAQ:) plummeted 13.6% to its worst month since late 2008 whereas the broader US market dropped 9.1%. China, as measured by the iShares China Massive-Cap ETF (NYSE:), fell solely 3.2% in April, besting each the US mixture bond market and the worldwide inventory market.

Lengthy-Time period Upside, however Close to-Time period Draw back

The place will we go from right here? We nonetheless see main headwinds.

Whereas our Weekly Macro Themes report bumps up anticipated returns searching 5 to 10 years, the subsequent six to 18 months seems to be to be a tough stretch. Seasonality can be on the facet of the bears by September provided that it’s a midterm election yr within the States (the standard S&P 500 drawdown is 17% throughout such years). We reiterate a bearish view for the steadiness of the yr on international equities, shares vs bonds, and on the general economic system.

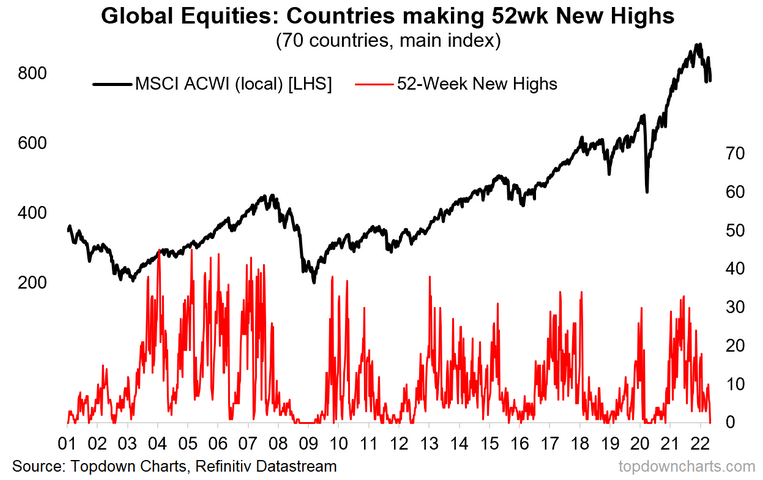

52-Week Highs Nowhere to be Discovered

This week’s report underscores dangers related to key points. An vital fallout from April’s dismal international market efficiency is a worsening technical image. Recall that shares bounced strongly off the January and February lows—the S&P 500 truly retraced greater than 70% of its early January to February nadir. It wasn’t sufficient.

Markets did not make new highs, then took out help. Our featured chart exhibits simply how broad-based the bearish transfer has been.

Featured Chart: Zero New 52-Week Highs Amongst 70 International Inventory Markets

Furthermore, we discover that different breadth indicators level to additional draw back—the proportion of nations rising on a year-on-year foundation is on the cusp of triggering a bear market sign. Even the S&P 500, a serious 2021 outperformer, is down from a yr in the past. Together with dividends, is up simply 1 foundation level.

Decrease Costs, However No Capitulation But

The clear collapse in bullish momentum warrants a re-rating downward in expectations for the steadiness of the yr. We have to see extra international locations hit technical bear market territory for an honest washout to be declared. Typically, bear markets finish with a crescendo of promoting, not a peaceful dip. Our weekly report additionally analyzes international fairness market internals to get a gauge of danger urge for food underneath the floor. A last piece of the bearish pie rests with may result in earnings headwinds for multinational corporations.

Backside Line: We stay cautious on international equities. 2022 was shaping as much as be a tricky yr for the bulls in our view, and the S&P 500’s worst begin to a yr since 1950 (value return) actually verifies that. Bearish technicals, weakening earnings revisions, and draw back dangers to financial development lead us to reiterate a bearish view on shares.

[ad_2]