[ad_1]

The dilemma confronted by Indian traders as they attempt to gauge the affect of the speed hike cycle isn’t totally different from what their international friends face whereas attempting to foretell the fallout from essentially the most aggressive Federal Reserve tightening in a long time. RBI might begin elevating charges as quickly as subsequent month.

Yields have risen, and shares pared features because the Reserve Financial institution of India shifted focus to inflation from progress in April and not directly tightened coverage by introducing the next flooring rate of interest. Right here is how a few of India’s prime fund managers are positioning.

Authorities over company paper

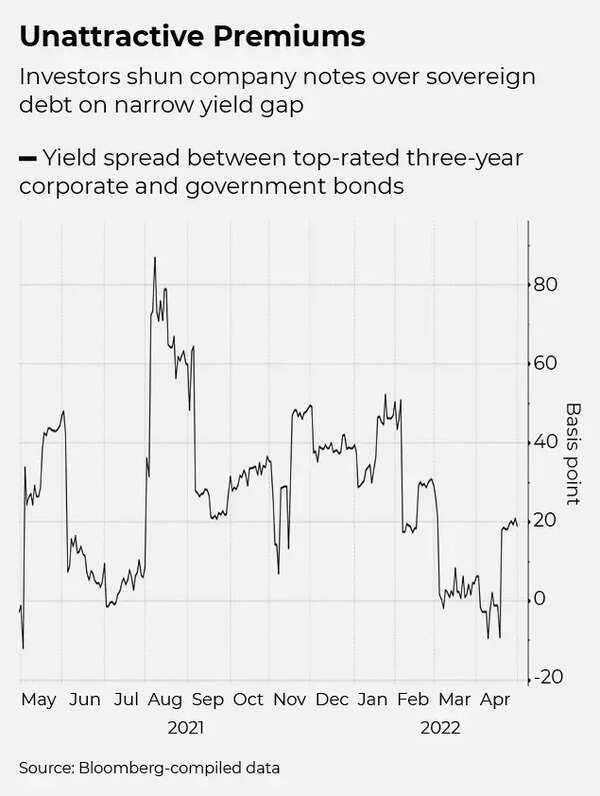

Debt managers desire authorities bonds over company papers, because the sharp unfold compression makes sovereign securities a greater wager, stated Lakshmi Iyer, chief funding officer (debt) at Kotak Mahindra Asset Administration Firm.

The yield unfold between three-year authorities papers and related top-rated firm bonds had turned detrimental in April from round 87 foundation factors in August, in accordance with Bloomberg knowledge.

The profitable spot on the steepening yield curve is the four-five 12 months section, stated Suyash Choudhary, head of fixed-income at IDFC Asset Administration Ltd. The longer-tenor papers are prevented because the bond provide premium isn’t absolutely factored in, he stated.

Add brief carry property

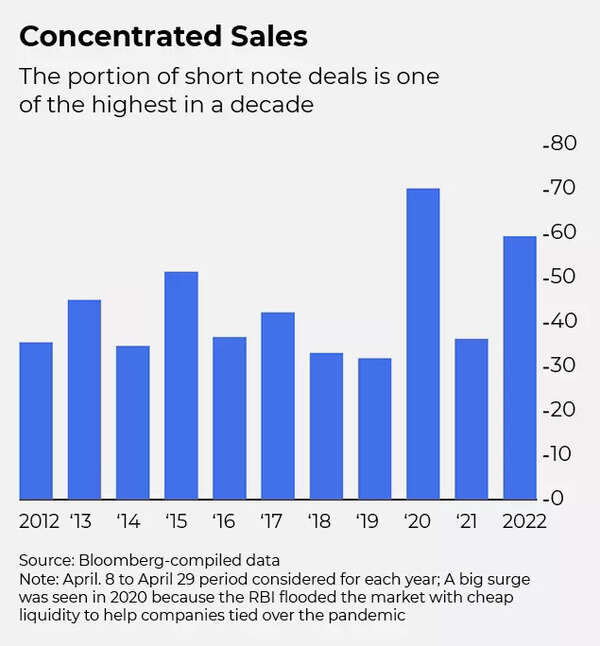

Hoarding money in these unsure instances will weigh on the portfolio’s general efficiency. Fund managers say they’re including brief carry trades to spice up general returns with out piling on dangers.

Enticing carry and roll down advantages make top-rated company papers of lower than three-year maturity a very good wager, in accordance with Murthy Nagarajan, head of fixed-income at Tata Asset Administration Pvt. Carry is the distinction between the yield on the bond and the price of borrowing, with features coming in when yields dip in step with time left to maturity.

Purchase progress and financial institution shares

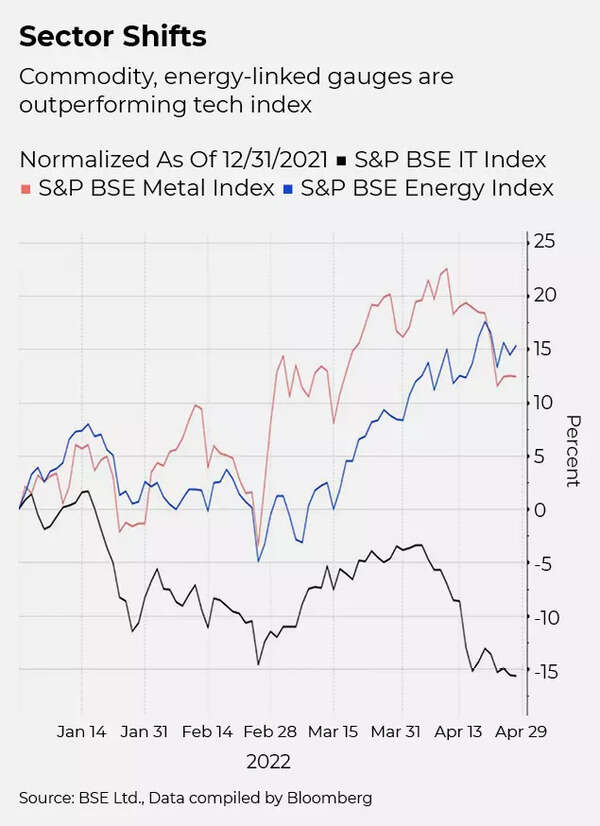

Whereas consumption-focused shares will do properly in the meanwhile, companies that would profit from an uptick in capital expenditure might do higher, stated Mrinal Singh, chief government and chief funding officer at InCred Asset Administration.

Given the inflationary surroundings, selecting shares that may move on larger prices is essential. Banks can even move on larger charges shortly in a rising interest-rate situation, stated Mihir Vora, chief funding officer at Max Life Insurance coverage Co. He advised holding shares of corporations in commodity-linked sectors as a hedge, given that offer disruptions will take a while to resolve.

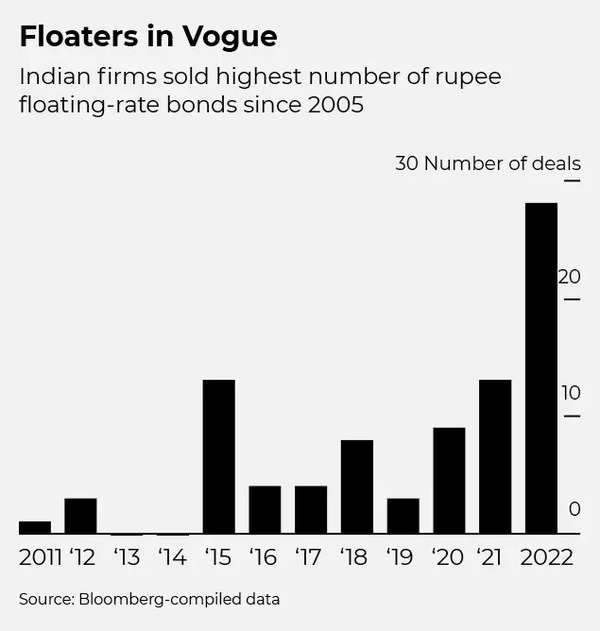

Rush to floaters

Cash managers are including floating-rate notes as a result of they act as a hedge in a rising price surroundings with the coupon transferring in step with market benchmarks. Issuers have achieved 28 floater offers up to now this 12 months, essentially the most ever since 2005, Bloomberg-compiled knowledge present.

Floaters are a very good hedge in a tightening cycle, stated Mahendra Jajoo, chief funding officer for fastened revenue at Mirae Asset Funding Managers Pvt., although he warned that the gross sales momentum might not proceed as a result of the devices danger larger prices for issuers if yields enhance sharply.

[ad_2]