[ad_1]

The artwork and science of modelling returns of monetary belongings is perpetually unsatisfying as a result of nobody mannequin absolutely captures the true habits of asset performances. Because of this, there comes a degree when researchers are pressured to choose a poison that seems much less incorrect than the options.

Subjectivity on this entrance is unavoidable for any variety of duties in portfolio administration and design. From simulating to forecasting and past, each modelling train in finance tends to come back right down to utilizing a set of approximations that don’t offend our expectations too harshly.

As a easy instance, think about the distribution of US fairness market returns. Are they usually distributed? The reply depends upon the time window. In flip, the implications forged an extended shadow on what you may, and might’t, fairly obtain with modelling.

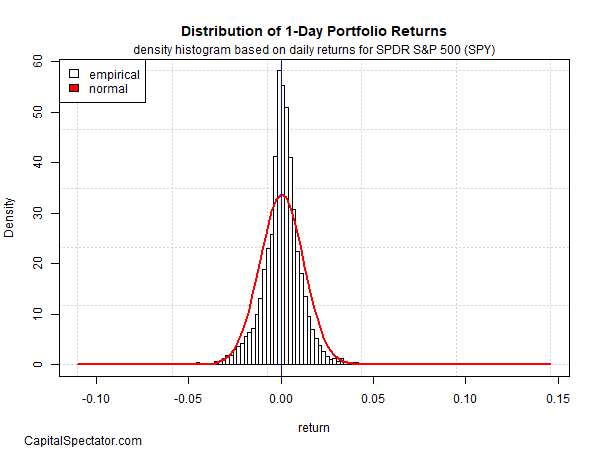

Contemplate how one-day returns are distributed by way of SPDR S&P 500 (NYSE:), an ETF proxy for the US inventory market (based mostly on information for 1993-2022). Within the chart under, it’s clear that returns are principally symmetric round 0. SPY’s one-day performances don’t precisely match a theoretically pure random distribution (crimson line), however they’re shut sufficient in order that more often than not, and for many modelling functions, you may assume normality prevails.

SPY 1-Day Distribution

This assumption has a variety of implications. For instance, if one-day returns carefully comply with a traditional distribution, forecasting one-day returns is futile, no less than more often than not.

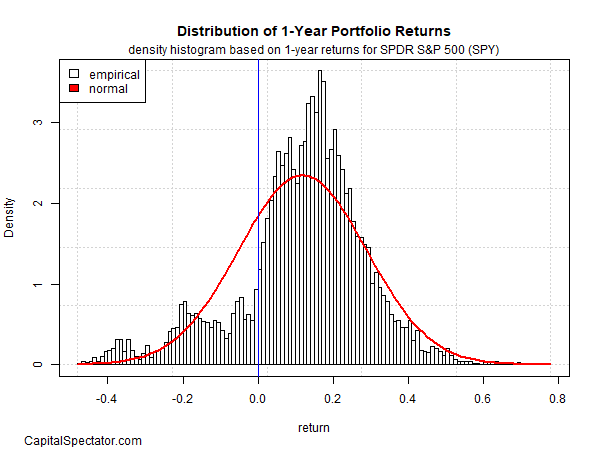

However there’s nothing regular in regards to the one-year return distribution for SPY, because the second chart reminds. The outcomes are positively skewed and there’s a transparent incidence of fats tails. The one-year distribution, in brief, tells a really completely different story from one-day returns and so the alternatives for this time window are fairly completely different vs. one-day outcomes.

SPY 1-Yr Distribution

As one instance, the distinction implies that one-year returns present the idea for comparatively dependable forecasts. You don’t want a Ph.D. in finance to see that your odds are forecasting success are significantly greater with a one-year time horizon vs. at some point. Or maybe it’s extra correct to say that you simply’re more likely to be much less incorrect with one-year forecasts vs. one-day estimates.

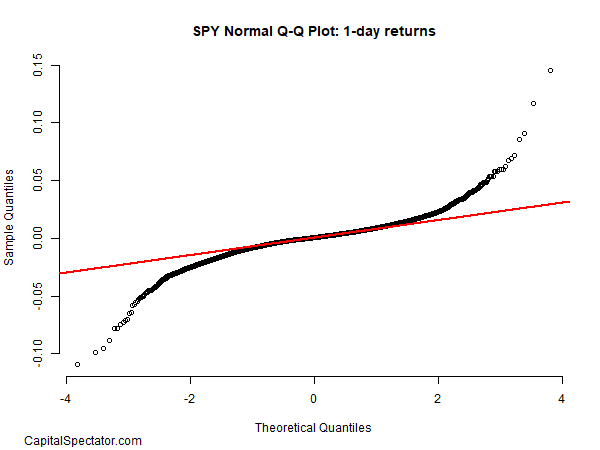

However whereas one-day returns are roughly random, they’re not completely random. Though it’s exhausting to see within the distribution chart above, one-day modifications have fats tails – comparatively excessive outcomes that run afoul of a traditional distribution. For a clearer view on this entrance, we are able to run a Q-Q plot, or quantile-quantile plot, which compares the empirical information (black circles) with a theoretical distribution – on this case a traditional distribution (crimson line).

SPY 1-Day QQ Plot

If SPY’s one-day returns had been completely regular, they’d match the crimson line. That’s true for a considerable portion of the information set, however on the extremes there are clear divergences. On the left facet, day by day losses are a lot steeper than anticipated in a traditional distribution. The alternative is true for comparatively giant beneficial properties.

An identical profile applies to the one-year outcomes. The principle takeaway: departures from the conventional distribution recommend that forecasting, simulating and different modelling duties may be improved by factoring in fats tails and different options relevant to non-normal distributions.

However alternative is a two-sided coin. In case you’re not going to make use of a traditional distribution to mannequin the information, which distribution is acceptable? There are a number of prospects, and every comes with its personal set of professionals and cons. The problem is that irrespective of which distribution mannequin you choose, will probably be incorrect in some extent. Regardless of a long time of analysis, nobody has but recognized or developed a distribution that good matches how fairness returns range in the true world.

That conjures up some researchers to stay with the historic report, which relieves us of the necessity to choose a particular mannequin. However that results in its personal set of points. Simulating returns based mostly on the historic report is straightforward and arguably correct, however there are challenges with deciding easy methods to keep the serial correlation of monetary time collection, for instance.

Each time you resolve one problem in modelling market returns, threat and different aspects of monetary belongings, you create one other problem. No shock, then, that transferring nearer to an ideal mannequin, whereas perpetually elusive, usually requires modelling from a number of views and maybe utilizing common outcomes as a benchmark.

“All fashions are incorrect, however some are helpful,” the statistician George Field famously quipped. Deciding which of them are helpful, or not, nonetheless includes a hearty dose of instinct and subjectivity. Irrespective of how lengthy you torture the information, it by no means tells you all of the secrets and techniques you’re determined to listen to.

[ad_2]