[ad_1]

This submit was first printed at TopDown Charts

-

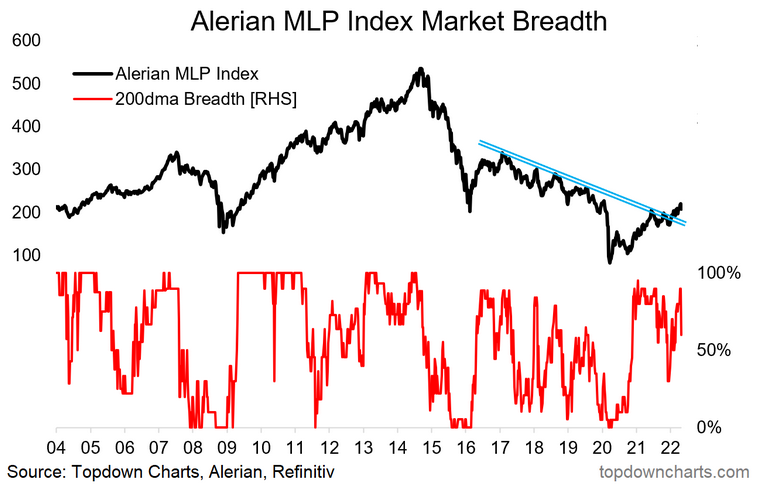

The Alerian MLP Index is up strongly YTD and has damaged a multi-year downtrend

-

Worth and dividend themes have been relative winners this 12 months

-

Buyers proceed to place a premium on proudly owning money circulation turbines

-

Longer-term, a dearth of power capex and excessive commodity costs ought to help the MLP trade

Buyers stay thirsty for yield even with authorities bond charges climbing all over the world. One of the best-performing sectors and kinds in 2022 have typically been these that includes excessive payouts to shareholders. Contemplate that Vitality, Staples, Utilities, and Actual Property are high of the pack as worth re-asserts itself. There’s loads of nuance to this commerce as a key theme has been traders flocking to corporations that generate sturdy present free money circulation.

Driving the Free Money Circulate Wave

One other strategy to play the overall development towards worth, power, and excessive dividends is through the (grasp restricted partnership) index. There are ETFs that provide publicity to that index. A well-liked one is, not surprisingly, the Alerian MLP ETF (NYSE:). It’s the greatest fund by AUM, at almost $7 billion, within the class and is up about 20% to date this 12 months even with a pointy current correction.

Why AMLP?

The fund is chock stuffed with US midstream . With excessive however considerably steady costs and still-soaring costs, proudly owning a fund devoted to high-payout power corporations appeals to many traders. MLPs function the infrastructure wanted to develop power manufacturing. These corporations are very important to the transportation, storage, and processing of power commodities. The ETF yields greater than 7%, too. So MLPs hit on a number of key present themes. Additionally think about that now greater than ever, power independence is seen as a barometer of nationwide safety and financial stability.

Capex Comeback

We stay bullish on power shares as an entire over the approaching one to a few years. Valuations are enticing now that commodity costs are up large whereas traders are nonetheless not uncovered a lot to the house. Furthermore, the group options improved relative energy versus a number of years in the past. General underinvestment in commodity infrastructure may additionally present a tailwind to MLPs within the years forward ought to return to its former glory.

Featured Chart: AMLP Breakout

Our featured chart illustrates AMLP’s breakout. After notching a capitulation low in early 2020, costs rebounded sharply after hit minus $40 two years in the past. Maybe extra intriguing is value motion simply within the final a number of months: following the near-term peak in mid-2021, the index consolidated earlier than vaulting to new highs this 12 months. Whereas there’s overhead resistance on the chart, the downtrend off the 2017 peak has been damaged. Close to-term, a current 10% drop might provide a good entry level.

Backside Line: We want worth to development proper now and are additionally bullish on international power capex, notably within the commodity and infrastructure arenas. AMLP is a compelling strategy to play it for these looking for US publicity.

[ad_2]