[ad_1]

When you’ve sat out oil shares till now, it’s simple to assume you missed the boat. In any case, oil’s huge run has despatched shares of producers (and pipeline operators) hovering. That’s meant decrease dividend yields—and better valuations—for people who resolve to tiptoe in now.

However there’s a method we will “flip again the clock” and squeeze 8.1%, 8.7%, and even 8.9% dividends out of vitality shares. (These are the precise yields on three ignored funds I’ll present you in a second.)

These are the sorts of yields you would solely get again in April 2020, within the enamel of the COVID disaster, when oil shares had been on their backs, their depressed costs sending their yields hovering. Nowadays, people who purchase these shares independently or via an exchange-traded fund (ETF) must accept quite a bit much less revenue.

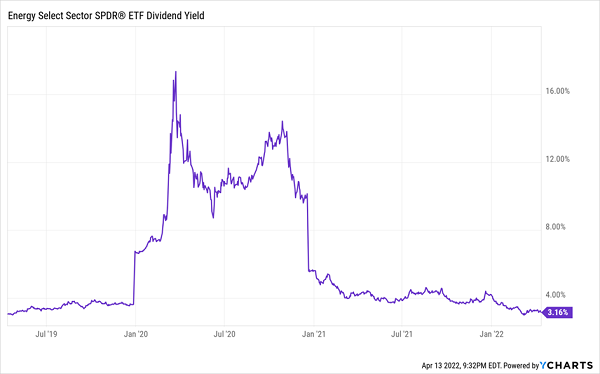

Contemplate the benchmark ETF for the area, the Vitality Choose Sector SPDR® Fund (NYSE:), which holds shares of main producers like ExxonMobil (NYSE:), Chevron (NYSE:), and ConocoPhillips (NYSE:).

Again in March 2020, its yield spiked north of 15%! However (no) because of the vitality rally, it pays simply over 3% immediately:

XLE Solely Gives A Respectable Yield In Coronary heart-Stopping Plunges

XLE-Yield Chart

I’m not telling you this to place you off shopping for vitality shares now. Removed from it! I’m writing to inform you that we will nonetheless get huge yields from vitality with out having to purchase in a selloff, and at a reduction to immediately’s costs. The important thing? My favourite investments: high-yield closed-end funds (CEFs).

Let’s speak tickers, with these three energy-focused CEFs (yielding 8%+) I discussed a second in the past:

Vitality CEF No. 1: An 8.1% Payer That Crushes Its Benchmark

Let’s begin with the bottom yielding of our trio, the “mere” 8.1%-paying Tortoise Vitality Infrastructure Closed Fund (NYSE:), which nonetheless pays properly over double what XLE will get you.

Because the title suggests, TYG invests within the firms concerned within the primary infrastructure of manufacturing and distributing vitality, which is why Williams Corporations (NYSE:), NextEra Vitality Companions (NYSE:), and ONEOK (NYSE:) are prime holdings.

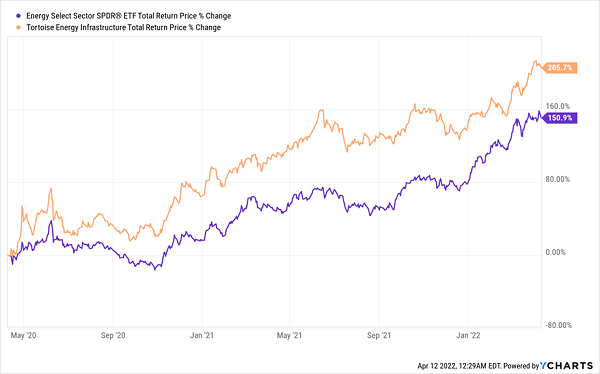

These shares have helped TYG far outperform even the record-beating two years the broader vitality sector has put in.

TYG Outruns A Scorching Oil Market

TYG-Complete Returns

TYG additionally trades on the largest low cost of our trio, with a market worth 17.6% beneath the precise liquidation of its portfolio. This low cost to web asset worth (NAV, or the worth of the shares in TYG’s portfolio) means we’re basically paying 82 cents for each greenback of TYG’s property.

Vitality CEF No. 2: An 8.7% Payer With Upside Forward

Subsequent up, the Kayne Anderson MLP Funding Closed Fund (NYSE:) equally trades at a 15.3% low cost to NAV whereas providing a barely greater yield of 8.7%.

That’s due to its concentrate on grasp restricted partnerships (MLPs), which exist to go via revenue from vitality tasks on to buyers within the type of dividends.

Main MLPs like MPLX (NYSE:), Enterprise Merchandise Companions (NYSE:), and Vitality Switch LP (NYSE:) are its largest holdings.

Matching The Market

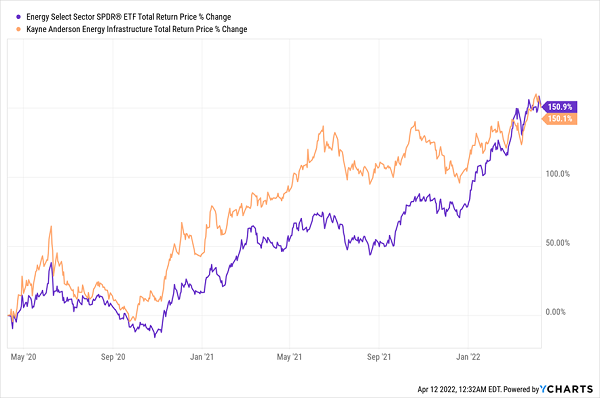

KYN-Complete Returns

KYN’s latest return, matching the vitality market, isn’t as spectacular as that of TYG, however that additionally means there’s extra room for KYN’s property to climb if costs proceed to rise (and even maintain regular).

The fund additionally has much less publicity to producers, and with MLPs extra geared to income-seekers, it hasn’t been bid to the degrees TYG has.

That explains KYN’s greater dividend and opens the door to additional upside as buyers look to hedge on the always-unpredictable vitality sector by getting extra of their return in money.

One other factor you will have heard about MLPs is that they ship you a sophisticated Okay-1 bundle for reporting the revenue you get from these investments. However you don’t have to fret about that while you purchase your MLPs via KYN. The fund sends you a easy Kind 1099 at tax time.

Vitality CEF No. 3: The Final Inflation Hedge

Lastly, there’s the GAMCO World Gold, Pure Assets & Revenue Fund (NYSE:), which is priced at a narrower 6% low cost to NAV.

A part of that is perhaps due to its excessive yield, at 8.9%. One other half is probably going as a result of GGN is among the few funds that permits you to purchase each gold shares and vitality shares—each confirmed inflation hedges—in a single purchase.

And GGN holds main firms in each areas, together with Exxon, Chevron, and Shell (NYSE:) on the vitality facet and main gold miners equivalent to Newmont Goldcorp (NYSE:), Barrick Gold (NYSE:), and Franco-Nevada (NYSE:).

There’s another excuse to think about GGN: its latest efficiency offers it room to run.

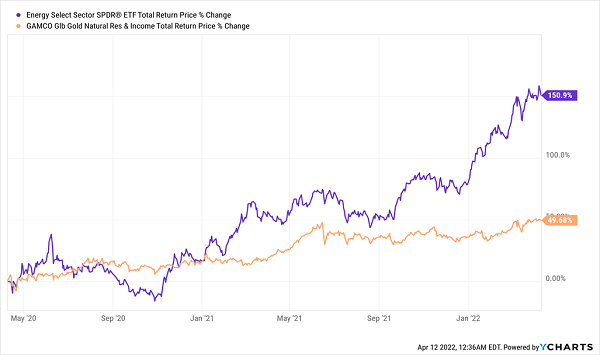

A Modest Two Years

GGN-Complete Returns

The comparatively low returns for GGN over the past two years make sense; in 2020 and the primary half of 2021, inflation wasn’t a top-of-mind concern, however rising inflation worries helped bump up the fund’s returns in the midst of final yr.

However the fund has since leveled off, though inflation expectations stay heightened, setting it up for one more upside bounce. Whilst you await that to occur, you’ll be pocketing the fund’s wealthy 8.9% yield.

Disclosure: Brett Owens and Michael Foster are contrarian revenue buyers who search for undervalued shares/funds throughout the U.S. markets. Click on right here to discover ways to revenue from their methods within the newest report, “7 Nice Dividend Development Shares for a Safe Retirement.”

[ad_2]