[ad_1]

Wall Road’s first quarter earnings season began this week, with notable names like JPMorgan Chase (NYSE:) and Delta Air Traces (NYSE:) as a consequence of launch their newest financials at this time, and Citigroup (NYSE:) and UnitedHealth (NYSE:) reporting on Thursday.

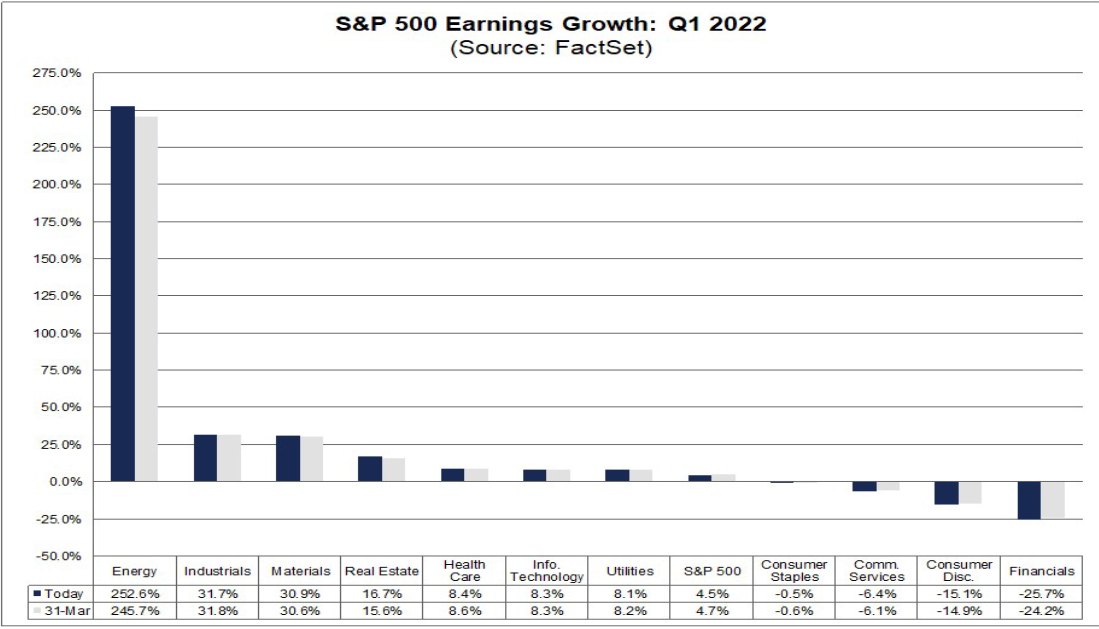

FactSet information exhibits analysts anticipate Q1 earnings will rise by 4.5% when in comparison with the identical interval final yr, primarily as a consequence of powerful year-over-year comparisons and ongoing macroeconomic headwinds, together with greater prices, provide chain disruptions, and labor shortages.

If confirmed, Q1 2022 would mark the bottom year-over-year earnings development price reported by the index since This autumn 2020.

On the sector degree, seven of the 11 sectors are projected to report YoY earnings development, led by the Power, , and Supplies sectors. Then again, 4 sectors are anticipated to report a YoY decline in earnings, led by the Financials and sectors.

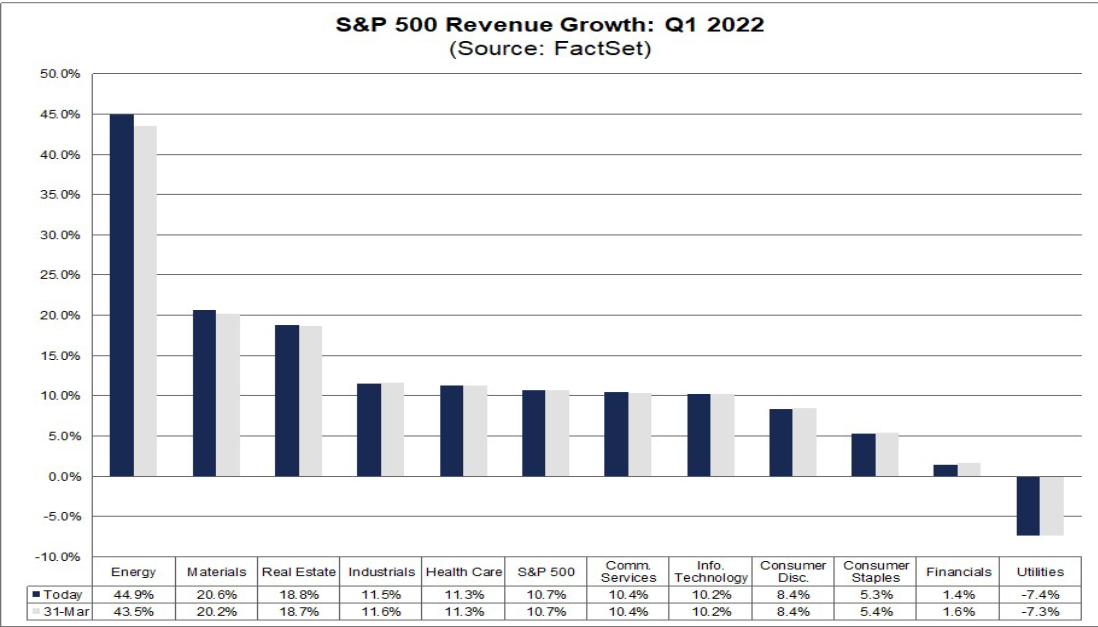

Income expectations are barely extra promising, with gross sales development anticipated to extend 10.7% from the identical interval a yr earlier. If confirmed, it’ll mark the fifth straight quarter of income development above 10%. Nevertheless, it’ll additionally characterize the bottom annualized gross sales development price reported by the index since This autumn 2020.

Ten of the 11 sectors are anticipated to report YoY development in revenues, led by the Power, Supplies, and sectors.

Beneath we break down two sectors whose monetary outcomes are projected to indicate vital enchancment from the year-ago interval and one sector whose earnings are anticipated to take the deepest dive amid the present market circumstances.

1. Power: Surging Oil And Gasoline Costs Set To Enhance Outcomes

- Projected Q1 EPS Progress: +252.6% YoY

- Projected Q1 Income Progress: +44.9% YoY

The Power sector was hit arduous by COVID-related shutdowns a yr in the past, however, is predicted to report the most important YoY achieve in earnings of all 11 sectors, with a formidable 252.6% surge in first quarter EPS, in response to FactSet.

With greater costs benefitting the sector—the common worth of WTI crude in Q1 2022 was $95.10 per barrel, 63% above the common worth of $58.14 in Q1 2021. Based mostly on FactSet information, the sector can also be projected to report the best YoY improve in income of all 11 sectors at 44.9%.

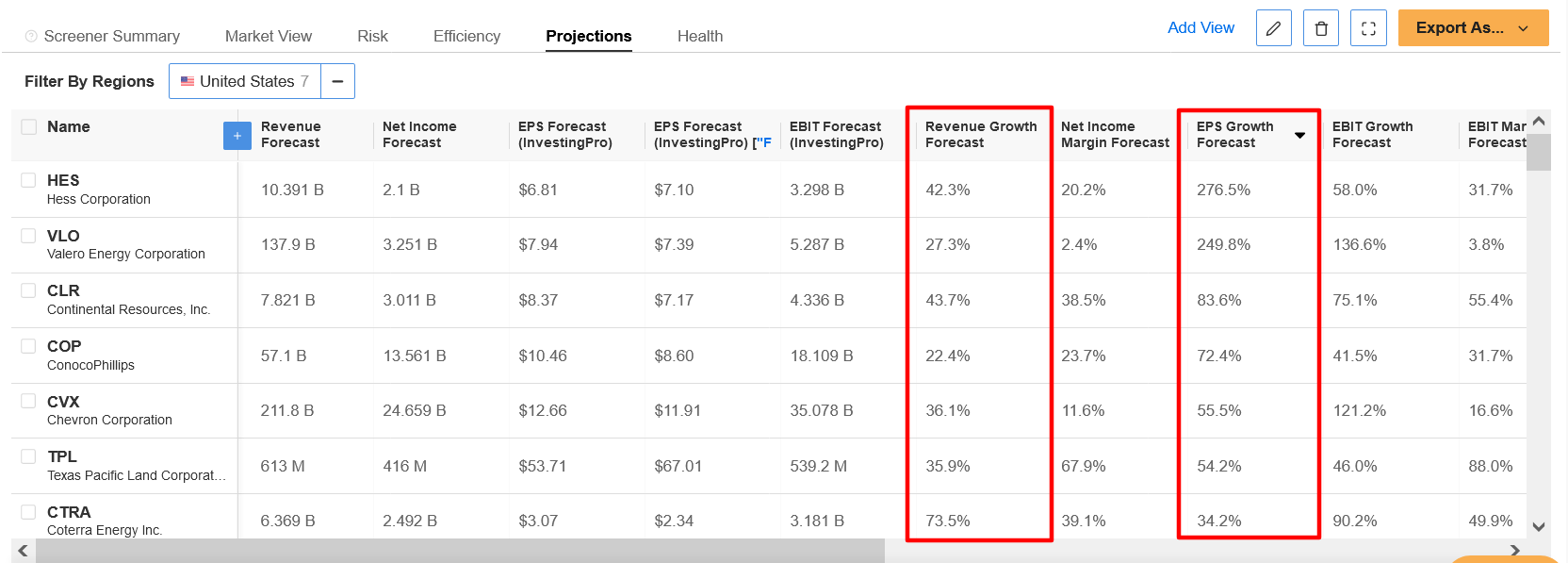

On the firm degree, ExxonMobil (NYSE:), Chevron (NYSE:), and ConocoPhillips (NYSE:) are anticipated to be the biggest contributors to the YoY surge in earnings for the sector, with all three vitality behemoths forecast to report double-digit revenue and gross sales development.

Two different notable names within the group which can be set to get pleasure from vital enhancements of their Q1 monetary outcomes are Occidental Petroleum (NYSE:), which is projected to put up EPS of $1.75, in comparison with a loss per share of $0.15 within the year-ago interval, and Marathon Petroleum (NYSE:), which is anticipated to report a 700% YoY improve in EPS.

Based on the InvestingPro+ Power Inventory Screener, a number of extra outstanding names are prone to get pleasure from strong Q1 revenue and gross sales development, together with Hess (NYSE:), Valero Power (NYSE:), Continental Sources (NYSE:), and Coterra Power (NYSE:).

Supply: InvestingPro

The Power Choose Sector SPDR® Fund (NYSE:), the ETF which tracks a market-cap-weighted index of U.S. vitality corporations within the S&P 500, is up 41.3% year-to-date, making it the highest performing sector of 2022 by a large margin. Compared, the S&P 500 is down by 7.7% over the identical timeframe.

Along with Exxon, Chevron, and ConocoPhillips, a few of XLE’s largest holdings embody, EOG Sources (NYSE:), Schlumberger (NYSE:), Pioneer Pure Sources (NYSE:), Williams Firms (NYSE:), and Devon Power (NYSE:).

2. Supplies: Metals Rally Set To Energy Revenue, Gross sales Progress

- Projected Q1 EPS Progress: +30.9% YoY

- Projected Q1 Income Progress: +20.6% YoY

The Supplies sector consists of corporations within the metals and mining, chemical substances, building supplies, and containers and packaging trade. Q1 forecasts a print of the third highest YoY earnings soar of all 11 sectors, with EPS anticipated to extend roughly 31% from the turbulent year-ago interval, in response to FactSet.

Metals, akin to , , , , , and have seen their stronger costs serving to the sector, with expectations for the sector to report the second largest YoY improve in income, with gross sales forecast to develop nearly 21%.

Not surprisingly, three of the 4 industries within the sector are anticipated to get pleasure from double-digit Q1 EPS and income development, with the group set to see revenue and gross sales spike 69% and 35%, respectively from the year-ago interval.

In distinction, the Supplies Choose Sector SPDR® Fund (NYSE:), which tracks a market-cap-weighted index of U.S. primary supplies corporations within the S&P 500, is down 2.8% in 2022.

XLB’s ten largest inventory holdings embody Linde (NYSE:), Freeport-McMoRan Copper & Gold (NYSE:), Newmont Mining (NYSE:), Sherwin-Williams (NYSE:), Air Merchandise & Chemical substances (NYSE:), Ecolab (NYSE:), Dow (NYSE:), Corteva (NYSE:), Nucor (NYSE:), and DuPont de Nemours (NYSE:).

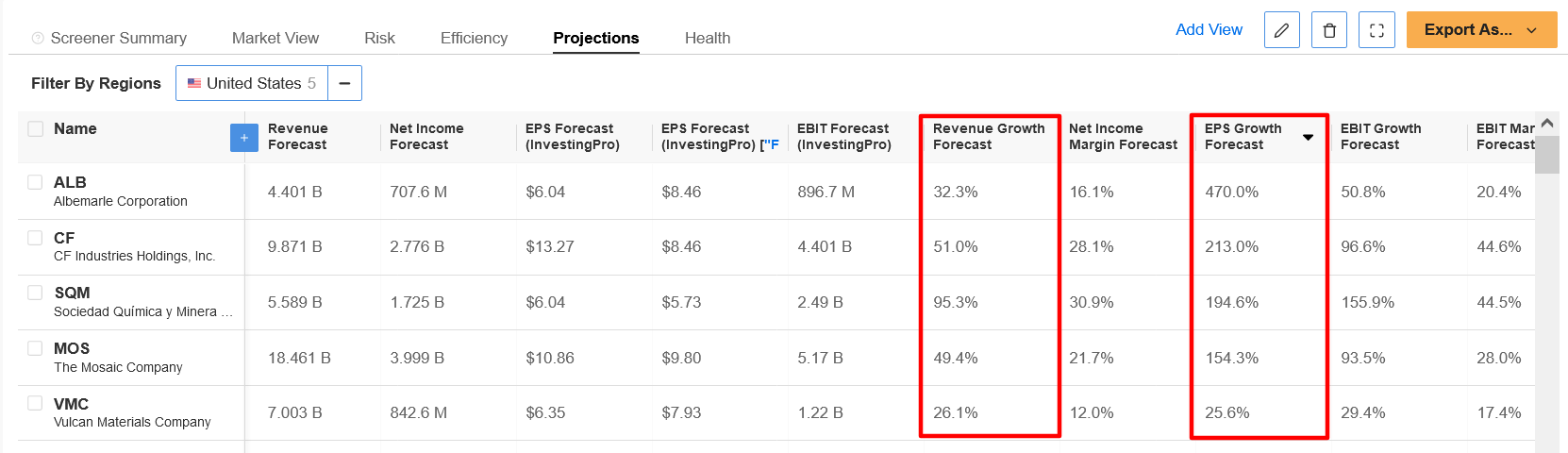

Based on the Professional+ Supplies Inventory Screener, a number of corporations from the group stand out for his or her potential to report spectacular outcomes.

The primary is specialty-chemicals producer Albemarle (NYSE:), which is predicted to report earnings development of 470% from the year-ago interval. The second is CF Industries (NYSE:), which is predicted to put up Q1 EPS of $4.26, enhancing considerably from EPS of simply $0.67 in the identical interval a yr earlier.

Mosaic (NYSE:) and Vulcan Supplies (NYSE:) are two extra to look at as each corporations have seen their enterprise thrive amid the present inflationary surroundings.

Supply: InvestingPro

3. Financials: Banks Anticipated To Lead YoY Decline

- Projected Q1 EPS Progress: -25.7% YoY

- Projected Q1 Income Progress: +1.4% YoY

The projected winner of the biggest YoY earnings stoop prize this quarter is predicted to go to the Financials sector, with EPS for the group set to drop 25.7% from a yr earlier, per FactSet. The group can also be anticipated to report the second smallest YoY improve in income, with a achieve anticipated to be simply 1.4%.

Amid greater provisions for mortgage losses, a slowdown in fairness buying and selling, and lowered M&A exercise, all 5 of the industries within the sector are anticipated to endure a decline in revenue of greater than 10%, led by banks (-36%), Client Finance (-26%), Capital Markets (-19%), and Insurance coverage (-10%).

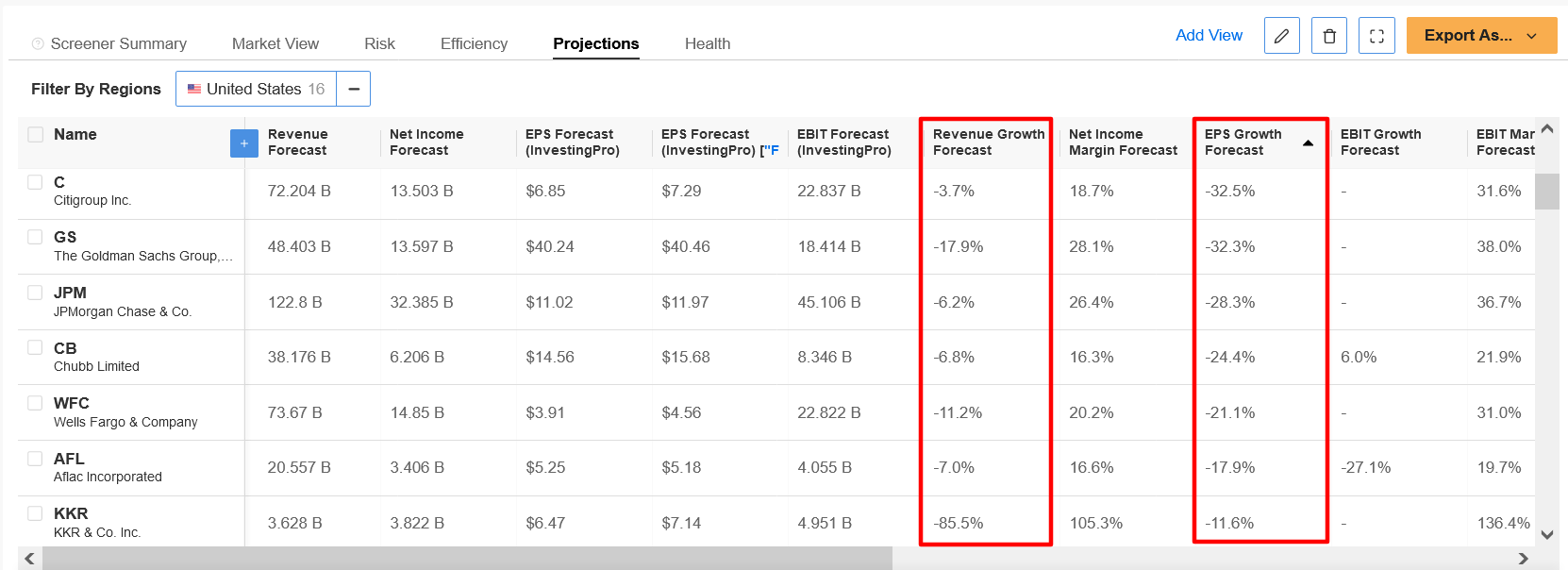

On the firm degree, Citigroup, Goldman Sachs (NYSE:), JPMorgan Chase, and Wells Fargo (NYSE:) are projected to be the most important contributors to the YoY lower in earnings for the sector, with all 4 banking giants anticipated to put up a drop in revenue and gross sales development.

Based on the InvestingPro+ Monetary Inventory Screener, two different notable names within the group which can be poised to report weak Q1 monetary outcomes are Prudential Monetary (NYSE:), which is projected to put up EPS of $2.73, down 33.5% from EPS of $4.11 within the year-ago interval, and Allstate (NYSE:), which is anticipated to report a 54% YoY decline in EPS.

Supply: InvestingPro

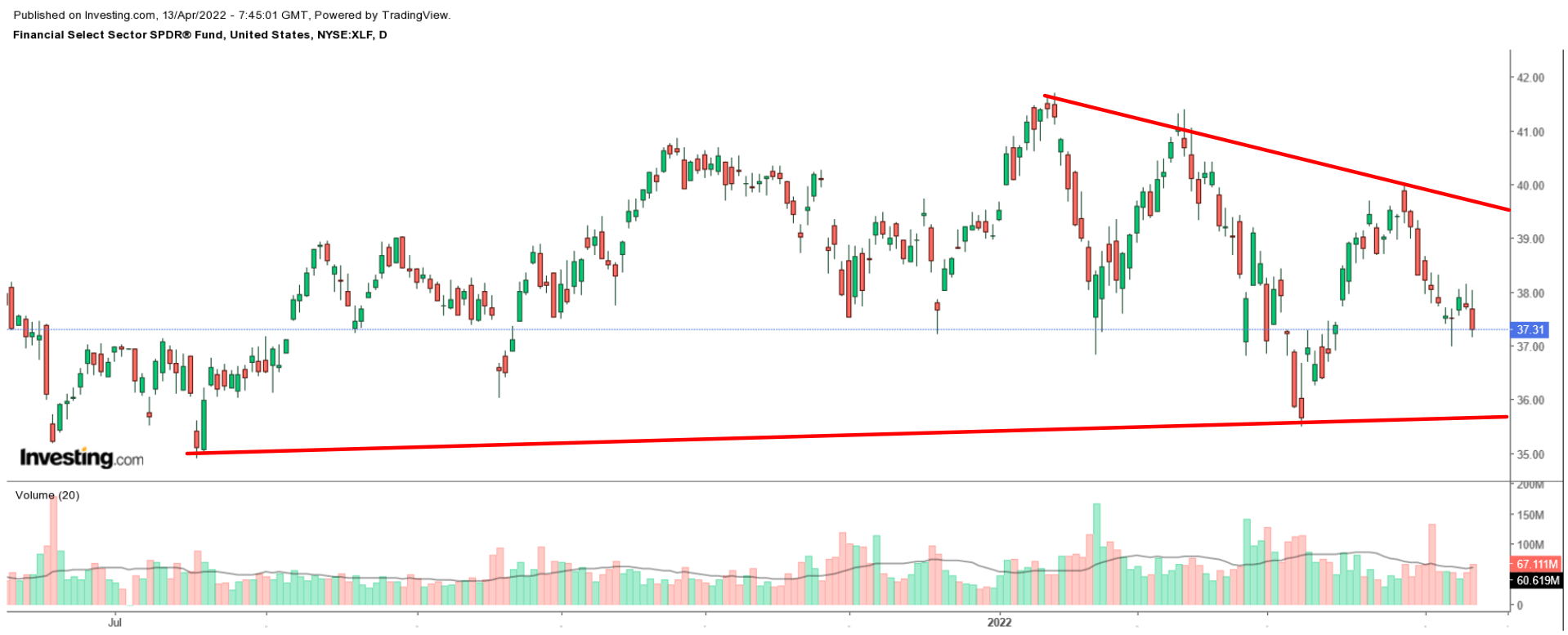

The Monetary Choose Sector SPDR® Fund (NYSE:) tracks a market-cap-weighted index of monetary sector shares drawn from the S&P 500, and it’s down roughly 4.5% because the begin of the yr.

XLF’s high ten holdings embody Berkshire Hathaway (NYSE:), JPM, Financial institution of America (NYSE:), Wells Fargo, Morgan Stanley (NYSE:), Charles Schwab (NYSE:), American Categorical (NYSE:), Citi, Goldman, and BlackRock (NYSE:).

[ad_2]