[ad_1]

is excessive, shares are shaky, and there’s a conflict in Europe. So we’ll take a cross on the highflyers and go for month-to-month dividends as a substitute. “Retire on dividends” of us have spent years build up a nest egg that might final eternally. Now, it’s time to show this pile of money into money stream.

I’m speaking about dividend payers that can carry on paying it doesn’t matter what occurs worldwide. We’ll talk about some elite month-to-month dividend payers in a second—the kinds that can dish us 9.8% per 12 months, paid each 30 days. (That’s $98,000 yearly in dividends on one million portfolio or $49,000 in yield wage on a $500K nest egg.)

We’ll get to this trio in a second. First, let’s respect monthlies.

Excessive Month-to-month Dividends = Peace of Thoughts

Most dividends pay as soon as each three months. The issue is, our payments are available month-to-month. Mortgage? Month-to-month. Water? Month-to-month. Automobile? Month-to-month. Cable?

Each 30 days, we have to pay, and that is no good after we’re getting paid each 90. Enter month-to-month dividend shares (and funds), which do exactly what the title suggests—they write out a dividend examine every month, according to your common Joe’s obligations and commitments.

And that’s it. There’s sometimes nothing totally different about these corporations and funds aside from how usually they serve up money.

Take a look at the desk under. Up prime is the dividend schedule for a particularly beneficiant 9.8%-yielding dividend portfolio of “regular” shares. Beneath is the revenue from a trio of dividend shares and funds yielding the identical quantity, simply delivering it every month. Each ship roughly $49,000 in annual revenue—not on a million-dollar nest egg however a mere $500,000 funding.

Earnings Stream By Month.

I do know which one I’d choose, and it’s not due to the additional 20 bucks. However in the end, what issues most is whether or not these high-yielding month-to-month dividend payers aren’t simply dividend traps in disguise. In spite of everything, what good is a big yield (month-to-month or in any other case?) if the checks received’t final?

So as we speak, we’ll take a look at three month-to-month dividends averaging practically 10% in yield to see whether or not any of them make the grade for a dependable retirement portfolio.

1. Gladstone Industrial – Dividend Yield: 7.0%

Gladstone Industrial Company (NASDAQ:) is a member of the Gladstone Firms: a bunch of publicly traded funding automobiles that additionally contains:

- Gladstone Funding Company (NASDAQ:)

- Gladstone Capital Company (NASDAQ:)

- Gladstone Land Company (NASDAQ:)

Every of those funds invests in (and buys) decrease middle-market corporations within the industrial and/or farmland actual property house. And every one pays out a month-to-month dividend.

Gladstone Industrial is a that invests in single-tenant and anchored multi-tenant net-leased industrial and workplace properties. Its portfolio consists of 129 properties in 27 states, leased out to 108 totally different tenants spanning 19 industries.

Telecommunications makes up 16% of the portfolio, adopted by conglomerate/diversified providers and automotive tenants at 13% apiece. Healthcare, manufacturing, and constructing every earn single-digit publicity. The remainder of the portfolio is unfold throughout 13 different industries.

Considered one of Gladstone’s largest attracts is how lively a landlord it’s. Fairly than simply sitting again and gathering rents, its administration workforce will assist tenants with every part from upgrading their parking heaps to increasing buildings. And it even goes a step additional,

“We create worth for our tenants by lowering working bills through tax appeals, nationwide buying energy, sustainability initiatives, and vitality audits.”

I’d be remiss to not level out that GOOD missed its most up-to-date . Occupancy additionally slipped, however to a still-healthy 97.2%, and it is a firm that not often lets occupancy slip under 95.0%.

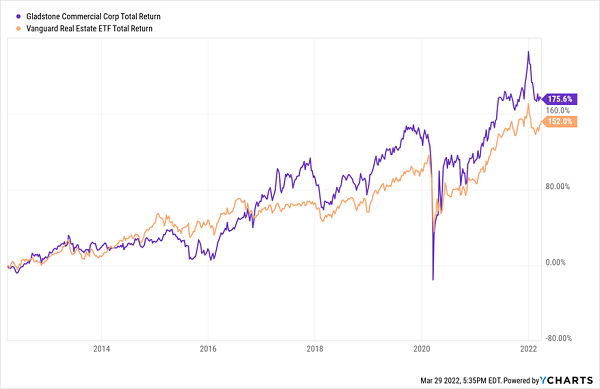

Extra encouraging is that shares have misplaced a few of their froth of late. This long-time outperformer within the REIT house trades for 14 instances estimated funds from operations (FFO, a vital REIT profitability metric). That’s not a screaming discount, however it’s a greater present deal than the overpriced REIT sector.

Gladstone Is a “GOOD” Egg within the Actual Property House

GOOD Outperforms.

2. Broadmark Realty Capital – Dividend Yield: 9.8%

Broadmark Realty Capital (NYSE:) is a , which differs out of your garden-variety REIT in that it offers in paper slightly than bodily properties. Particularly, it borrows cash at short-term charges to purchase bundles of securitized mortgages that drip down money at (hopefully increased) longer-term charges. The distinction between these charges (“internet curiosity revenue,” or NII) is the mREIT’s revenue.

But when we’re being correct, Broadmark isn’t your typical mREIT.

BRMK is extra of a cash lender specializing in numerous loans. Its main enterprise is development loans, although it additionally provides heavy rehab/redevelopment loans, land improvement loans, bridge financing, and development completion loans. These loans are offered to builders, and more often than not, they’re searching for a fast turnaround, which permits Broadmark to set fairly excessive charges.

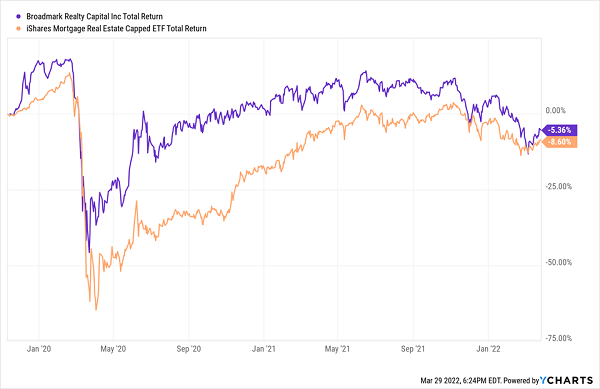

You’d suppose that, amid a booming housing market, that BRMK can be off to the races. And it was, for a second.

The Submit-COVID housing surge lifted BRMK (for a time).

BRMK Complete Returns.

In Q2 2020, as an illustration, BRMK informed traders that “COVID-19 has stimulated demand for housing inventory at historic ranges which is driving residential development and, in flip, mortgage development.” Not dangerous.

Of late, nonetheless, the enterprise has been weighed down by non-accruals (sometimes, loans during which principal and/or curiosity is at the very least 90 days late). That’s more likely to weigh on within the short-term, and that—in addition to the prospects for rising charges—have in flip hampered the inventory and will preserve it anchored for a number of quarters to come back.

However preserve your eye on the younger Broadmark, which got here public only a few years in the past, in 2019. Non-accruals finally shall be resolved, and if it could possibly get by this tough patch with its month-to-month dividend nonetheless intact, it may very well be a way more engaging long-term prospect.

3. Eagle Level Credit score Firm – Dividend Yield: 12.5%

Eagle Level Cred (NYSE:) pays month-to-month, however it’s a black field, to place it frivolously.

ECC is a —and whereas I’ll inform you that CEFs are superior to exchange-traded funds (ETFs) for any variety of causes, a technique during which they fall brief is transparency. CEFs aren’t practically as forthcoming about their holdings, which suggests it’s harder to peek at what’s inside; you need to belief that the supervisor is aware of what they’re doing.

On prime of that, ECC invests in a very murky asset—collateralized mortgage obligations (CLOs)—that, amongst different issues, makes it troublesome to match to most different forms of fixed-income options.

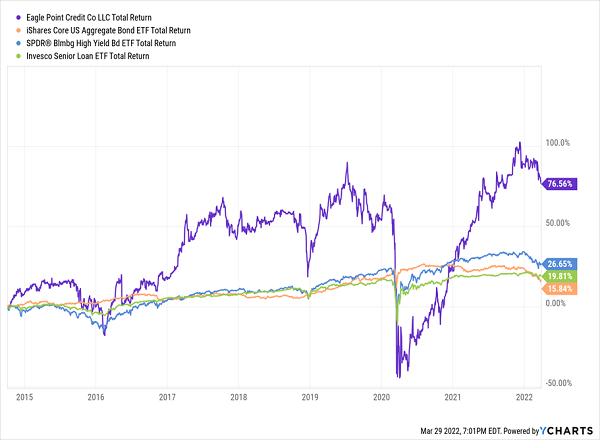

However typically talking, the rewards might be richer.

ECC Complete Returns.

CLOs are successfully securitized swimming pools of enterprise loans—sometimes first-lien senior-secured financial institution loans, although they will embrace second-lien loans and even unsecured debt. Inside the CLOs, there are totally different tranches of debt with various dangers and an fairness tranche. Eagle Level Credit score primarily invests within the fairness and junior debt tranches.

Briefly, the typical investor can’t get a transparent image of the underlying portfolio, not to mention analyze it.

That’s the place the belief half is available in. And to administration’s credit score, they’ve put up a lot stronger longer-term returns than simply about any kind of mounted revenue product on the market, partially thanks to an enormous yield properly above 12%.

However it’s no picnic—ECC is rife with volatility, which you’ll be able to at the very least partially chalk as much as excessive leverage above 30%. It’s costly, too—not solely does the fund cost a whopping 9.7% in annual charges (administration, curiosity, and different bills), however ECC at present trades at 5% above NAV, that means you’re paying $1.05 on the greenback for this portfolio.

Disclosure: Brett Owens and Michael Foster are contrarian revenue traders who search for undervalued shares/funds throughout the U.S. markets.

[ad_2]