[ad_1]

Final Thursday, following the information Russia invaded Ukraine, I wrote this piece assessing the hedge capabilities of Bitcoin amid the disaster. With gold holding up its finish of the discount properly because it breached a 17 month excessive, Bitcoin let the group down and fell 7%.

Gold bugs mocked the crypto fans, as Bitcoin seemingly blew its excellent alternative, rendering the long-supported argument that Bitcoin is a sovereign hedge as wishful pondering. Bitcoin was buying and selling at circa $37,400, whereas Gold was at circa $1,920.

Bitcoin Revives

However there’s by no means a uninteresting second in crypto, and issues have modified dramatically since. Bitcoin is up 17% from these lows, buying and selling at circa $44,000. Gold, in the meantime, is buying and selling at related ranges as earlier ($1,920).

It’s fascinating to revisit my evaluation from Thursday in mild of the latest actions of gold and Bitcoin, and the onslaught of financial sanctions which have been levelled towards Russia. Final week, following the announcement of the Russian invasion, I concluded that the 7% fall in Bitcoin proved that the cryptocurrency had not but achieved the standing of a retailer of worth asset. As an alternative, I argued that the purple candle proved traders had dumped it for secure haven belongings reminiscent of money and gold amid the market volatility. In crises, correlations go to 1, and there’s a flight to high quality. Folks shed crypto publicity because the world went bananas – identical to what occurred in March 2020, when the COVID pandemic got here knocking on our doorways.

So, does that conclusion must be revisited?

Effectively, sure and no. There’s nonetheless no getting round the truth that within the fast aftermath of the invasion, Bitcoin plummeted whereas the “hedge” asset that it’s striving to interchange – gold – held agency, climbing to a 17 month excessive. However such has been the dimensions of the rebound of crypto, we have to dig deeper and re-examine.

Financial Sanctions & The Trendy Fiat System

The important thing improvement since final week’s evaluation has been the onslaught of sanctions towards Russia. Airspaces are closed to Russian plane, Russian banks are getting frozen out of the SWIFT community and Moscow’s capability to make use of its warchest of $630 billion in international reserves has been restricted. This latter level relating to the international reserves is especially compelling when assessing Bitcoin’s worth actions. The US, UK, EU and Canada agreed to “forestall the Russian central financial institution from deploying its worldwide reserves in ways in which undermine the influence of our sanctions”.

Keep in mind, within the trendy monetary system, fiat cash is definitely one thing you might be owed, moderately than one thing tangible which you even have. So whereas the money you maintain in your checking account is taken into account one thing you “have”, in actuality it’s owed to you by your financial institution, which you gather when you withdraw from an ATM or switch to a different account (at which level the recipient of the switch will then be “owed” the financial institution’s legal responsibility).

What we’re seeing within the markets now could be that these belongings, given Russia don’t fairly “have” them, may be minimize off. Putin has came upon the exhausting method that these $630 billion in international reserves aren’t fairly as liquid as he thought.

Options

After all, there are alternate options to fiat. Had been Russia’s $630 billion in reserves held in gold bullions, there could possibly be no such restrictions. Gold locked away in a Russian vault is no one else’s legal responsibility, Russia merely “have” it, in each sense of the phrase. As Canadian residents might have realised just lately following the freezing of financial institution accounts for protesters, fiat can not at all times assure that entry.

After all, within the final decade now we have seen the emergence of one other asset which presents this high quality – Bitcoin. Holding your personal keys is each bit nearly as good as stashing a gold bullion below your mattress (and considerably simpler). Nevertheless, as Bloomberg’s Joe Weisenthal identified in his newsletter this morning, it’s not fathomable for Russia to carry vital reserves in Bitcoin, given the dimensions of the market. Whereas gold’s market cap hovers round $12 trillion, Bitcoin’s market cap is merely $826 billion (with a propensity at instances to dip a lot decrease). So it’s not possible for governments to carry massive quantities of Bitcoin on the present market cap (Russia’s $630 billion in international reserves would quantity to 3 quarters of the Bitcoin provide).

Different Implications

So till Bitcoin matures and expands to extra lofty ranges, it will probably’t provide what gold can proper now. Certainly, many analysts often level to gold’s market cap in extrapolating the potential for Bitcoin’s development, and it definitely presents a compelling benchmark. However for now, all traders aren’t as massive because the Russian state and Bitcoin can nonetheless have worth. The Russian ruble’s actions in the previous couple of days present this distinctly. Shedding 20% of its worth towards the US greenback, Russian residents have seen their internet price crater in actual phrases.

By way of XE.com

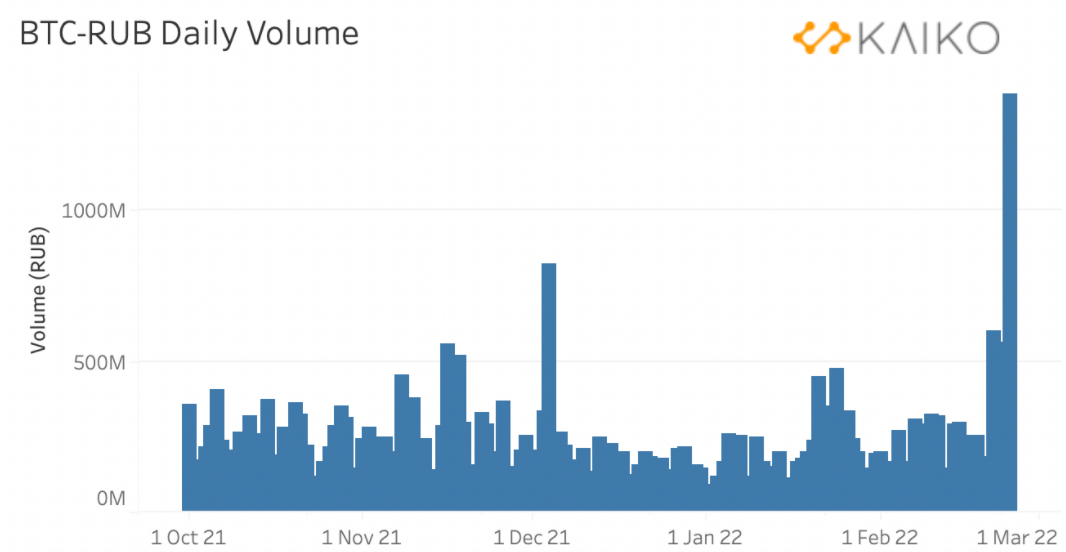

After all, if they’d Bitcoin, they may have escaped this fiat debasement. So how about we try the amount on the BTC-Ruble exchanges? Ah sure, yesterday we hit a 9 month excessive, as Russians fled to exchanges as they feared additional sanctions and ruble weak point.

By way of Kaiko

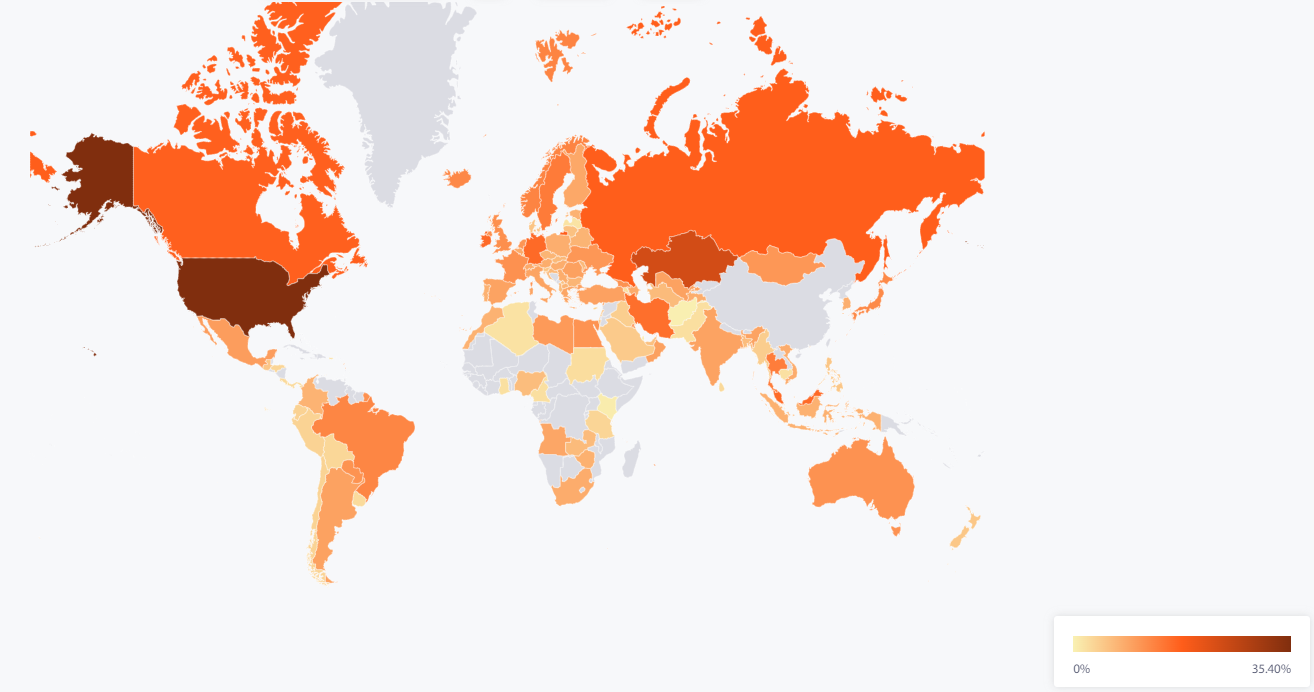

By way of Kaiko

It’s not the primary case of (hyper)inflation now we have seen (ask Venezuela or Zimbabwe) nor the primary case of residents fearing for his or her financial savings (whats up Greece and Cyprus) and it highlights simply how highly effective Bitcoin could possibly be as an asset class, ought to it proceed to develop and ever stabilise. So the way in which I take a look at the previous week of enthralling worth motion is that this: Bitcoin isn’t a good retailer of worth proper now, however we’re seeing all the suitable indicators that it’s getting there, and it’s given us a glimpse of the ability it may maintain.

Watershed Second

What’s occurring for the time being is a watershed second in historical past, in that beforehand autonomous central banks are now not in charge of the belongings they usually utilise to conduct monetary operations. And at this second, Bitcoin continues to be a toddler studying to stroll almost about its improvement and required infrastructure (in addition to the market cap talked about above), so it will be tough for a nation reminiscent of Russia to avoid sanctions by way of cryptocurrency. The problem can be exacerbated too by the clear nature of the blockchain – a key argument utilized by crypto fans in combating towards the thought that crypto could possibly be a device for sovereign malevolence down the road.

However it might not be too far off. Certainly, we have already got a distinguished instance of a state leaping into magical web cash to avoid sanctions, if not on the dimensions of what can be obligatory for Russia in combating towards half the world’s restrictions: Iran.

Iran’s crypto techniques

The center japanese nation faces strict sanctions from the US. Iran’s answer, nonetheless, is to transform what vitality it doesn’t want (Iran has an abundance of fossil fuels) into money by way of shopping for bitcoins from bitcoin miners (who use fossil-fuels of their mining). These bitcoins can then be used to buy no matter they please, together with imports. And the US can do nothing about it. Russia, for its half, is the third largest cryptocurrency miner on the earth (common month-to-month hashrate share of 11% as of Jul-21, in response to College of Cambridge). To stir the pot slightly extra, Putin appeared to melt his stance on cryptocurrency when the Russian central financial institution proposed a ban on the trade: “After all , we even have sure aggressive benefits, particularly within the so-called mining, I imply the excess of electrical energy and well-trained personnel out there within the nation”. Hmm.

Cambridge Bitcoin Electrical energy Index, with Russia the third largest crypto miner on the earth.

In wrapping up, it’s straightforward to see the route in the direction of a retailer of worth for Bitcoin, even when this week has confirmed that, whereas it’s getting there, it hasn’t fairly achieved the safe-haven standing but. However Satoshi let the genie out of the bottle when he invented the blockchain in 2009, and geo-political tensions on this more and more fragmented and chaotic world (to not point out a sure coronavirus and all of the vaccine mandates and different penalties born out of the pandemic) have thrown up all types of implications and potential use instances for Bitcoin.

Crypto may be good! Ukraine’s crypto wallets have, as of time of writing, obtained $31.7 million in donations, in response to blockchain analytics agency Elliptic. They’re additionally now accepting donations in Polkadot, with extra to be added quickly

We will debate whether or not the results are good or dangerous (and like most issues on the dimensions of Bitcoin, there are a number of each), however one factor which is turning into more and more clear is the basic worth and myriad use instances that a substitute for fiat presents.

Sure, there are benefits and drawbacks, however when it comes to the value, for those who zoom out sufficient, Bitcoin has solely trended a method traditionally – up. And with the way in which the world is heading, I definitely don’t see many causes that the long run will likely be any completely different.

[ad_2]