[ad_1]

An professional has claimed that crypto is buying and selling like threat property and looking out like development equities, and because the conventional market is more likely to proceed to see excessive volatility over the subsequent months, the institutional adoption of crypto is slowing down till world fairness markets discover stability.

Crypto Institutional Adoption

The institutional adoption of digital property is believed to be key to the longer term maturity and consolidation of the cryptocurrency market. The panorama of cryptocurrencies will doubtless carry on altering as a response to the methods worldwide rules, macro setting, and mass adoption develops within the following years.

Though many vital firms have began to progressively strategy digital cash like bitcoin, there could be nonetheless a protracted approach to go for institutional cash to massively enter the market.

Lately, Bloomberg reported a JPMorgan strategists’ be aware through which they declare that “The most important problem for bitcoin going ahead is its volatility and the increase and bust cycles that hinder additional institutional adoption.”

Equally, Alex Kuptsikevich, a senior monetary analyst at FxPro, defined to Forbes that Bitcoin’s value “is decided not a lot by volatility as by crowd curiosity. With out investor curiosity, it shortly goes bitter, and with it, it picks up simply as quick. In bitcoin’s favor is the decreased provide development charge and its finiteness.”

“We must also be aware that the entry of institutional traders, the growing acceptance of bitcoin as an asset for portfolio diversification, and the elevated buying and selling turnover in cryptocurrencies make the worth much less unstable over time.”

Associated Studying | Goldman Sachs: Mainstream Adoption Gained’t Enhance Bitcoin Worth

Why Progress Shares Can Drive Traders In

In a Bloomberg Tv interview with Adam Levinson, chief funding officer at Graticule Asset Administration Asia, the professional famous that the present volatility of development shares and the merchants’ concern over the Federal Reserve (FED) elevating rates of interest is slowing down the tempo at which establishments determine to speculate.

Levinson claims that many conventional establishments have already determined to allocate in crypto, however the present volatility has saved them away from investing.

“They don’t need their first foray into the area to be a money-losing proposition shortly.[…] Institutional allocations will wait till the worldwide fairness markets, significantly development equities, have stabilized.”

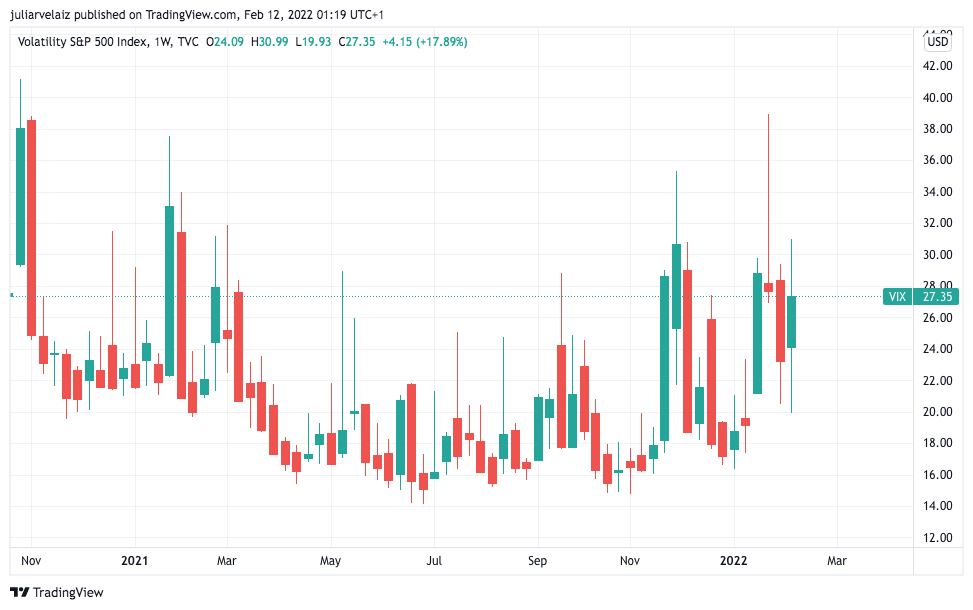

The U.S. inflation has elevated considerably and consequently so did the Vix ‘concern’ index, which measures the expectation of volatility for the inventory market based mostly on S&P 500 index. Excessive inflation numbers create extra strain for the FED to extend rate-hikes and plenty of traders consider the standard markets are probably set for an enormous sell-off.

Since bitcoin has been buying and selling extra like a inventory, this instantly impacts the crypto market. The full capitalization has been recovering up to now week, however may see extra volatility quickly.

As Levinson famous, “What has occurred this 12 months is that you just transfer to an setting the place the Fed is being pressured to lift charges, as are different central banks, and you might be seeing a change within the extraordinarily ample liquidity setting.” Consequently, “Crypto suffered. Crypto is principally traded as a threat asset, wanting like a development fairness,” he added.

Nonetheless, Lenson thinks that over the center of the 12 months there shall be a scenario “the place crypto trades higher than development equities,” which might lead to extra institutional traders going ahead and investing in crypto.

Associated Studying | Might Crypto Adoption Symbolize a Compliance Alternative for Banks?

[ad_2]