Crypto property and inventory futures fell in tandem on the information that U.S. has are available in at 7.5%, even greater than projected.

The market is reacting negatively to the patron value index’s report on U.S. inflation.

Bitcoin, Ethereum Dip on Inflation Replace

U.S. inflation has hit a 40-year year-on-year excessive, and crypto property are sliding in response.

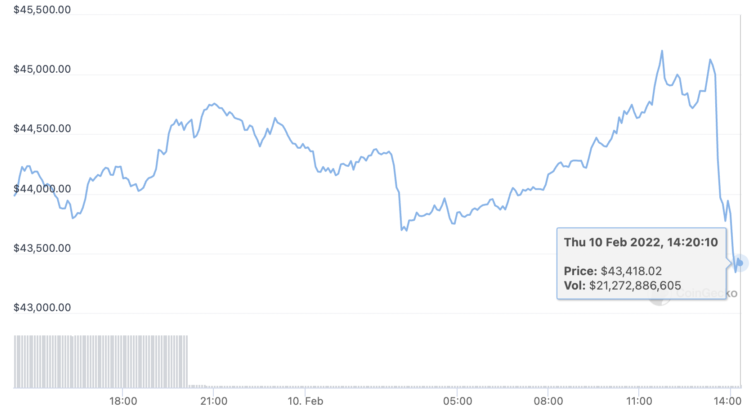

BTC/USD (Supply: CoinGecko)

and each dipped Thursday instantly after the Labor Division reported that the patron value index had jumped 7.5% since final yr. Worth hikes in January contributed to the yearly rise as the price of all gadgets elevated by 0.6%.

The 7.5% determine is the very best U.S. inflation charge the CPI has recorded since 1982. The had estimated that the determine would are available in at 7.2%. Markets shortly reacted because the information that the speed had surpassed predictions broke, with futures on the and respectively falling 0.8% and 1.3%.

Bitcoin took a 3.5% dip from round $45,000 to $43,400, whereas Ethereum fell from round $3,250 to $3,100. Many different decrease cap property, together with the choice Layer 1 cash , , and , have been more durable hit.

The stoop throughout world markets marks a stark distinction to the response to the information that U.S. inflation had hit document ranges in November, when Bitcoin and Ethereum each rallied to all-time highs on the identical day. The distinction this time round is that the 7.5% leap signifies that the Federal Reserve is more likely to push forward with important rate of interest hikes in 2022 as deliberate (when rates of interest improve, risk-on property are likely to tumble as the price of borrowing cash jumps).

The Fed first signaled that rate of interest hikes can be coming in December, and crypto property dipped on the information. Markets then dipped when Jerome Powell confirmed the speed will increase in January. The market has appeared shaky since, with each Bitcoin and Ethereum preserve momentum. They’re respectively down 37.5% and 36.2% from their highs recorded in November.

With rate of interest hikes trying more and more doubtless this yr, crypto believers might be hoping that the market could make a restoration with out spilling an excessive amount of extra blood.

Authentic Put up