[ad_1]

ended Friday with a optimistic word, as the value created a nice-looking bullish physique, and the brand new week began even larger. Does that imply we ended the painful correction and are again in an uptrend? Many merchants rely on that, however technical evaluation isn’t so optimistic about it.

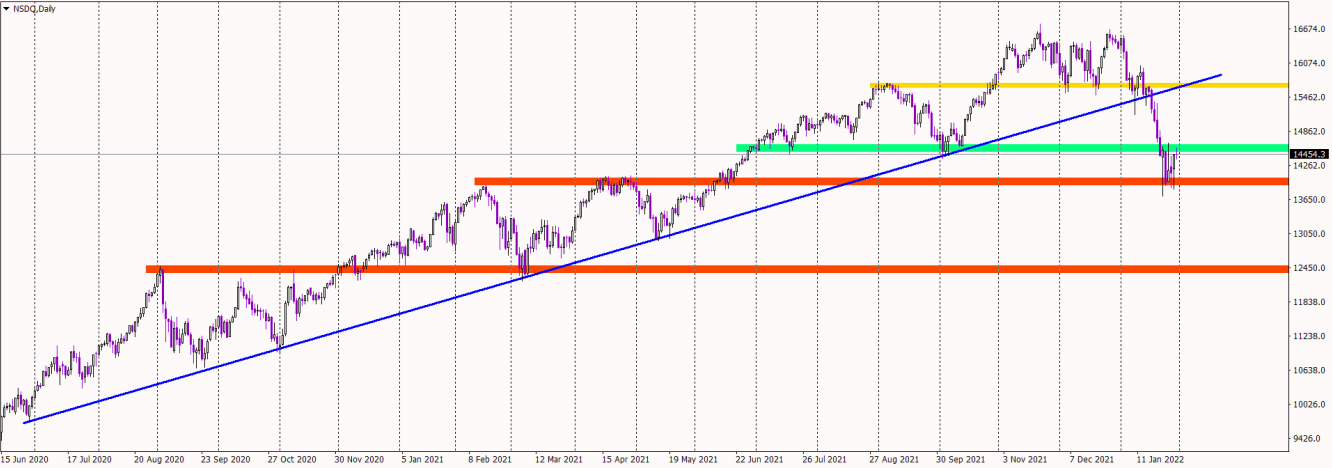

The latest selloff stopped on the psychological barrier of 14000 (purple). However, the bounce itself isn’t encouraging from the value motion standpoint. Within the shorter time period, we’ve a sideways pattern, locked between the 14000 from the underside and 14600 (inexperienced) from the highest.

Normally, we’ve a consolidation like this after a major drop. It signifies that it’s not the top, and the selloff ought to proceed. This may be the case right here, too, as you realize that NASDAQ tended to bounce utilizing V-shaped reversals for the previous a number of months, not consolidations like this.

Consolidation above such vital help factors to sellers preparing for a decisive breakout than patrons for a bounce. Fortunately, there may be fairly a straightforward solution to discover out.

Worth breaking the inexperienced resistance and aiming larger will verify the bullish reversal. However, the value staying between the 14k and 14.6k will improve the probabilities for an additional slide and one other bearish wave on tech-heavy NASDAQ.

Fusion Media or anybody concerned with Fusion Media won’t settle for any legal responsibility for loss or harm on account of reliance on the knowledge together with knowledge, quotes, charts and purchase/promote alerts contained inside this web site. Please be totally knowledgeable relating to the dangers and prices related to buying and selling the monetary markets, it is without doubt one of the riskiest funding kinds doable.

[ad_2]