[ad_1]

Finance Minister Nirmala Sitharaman is scheduled to current the Union Funds 2022-23 in Parliament on February 1.

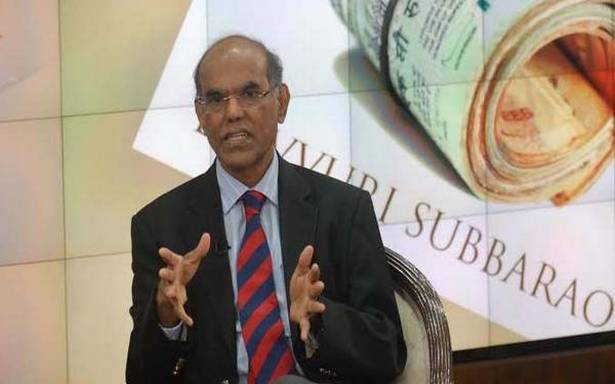

The upcoming Funds ought to give attention to creating jobs and bridging the widened inequality within the economic system moreover accelerating development, former RBI Governor D Subbarao stated on Thursday whereas observing thatgiven the persevering with want to lift spending on schooling, well being and infrastructure,there may be not a lot leeway for tax cuts.

Dr. Subbarao additionally opined that have reveals export promotion behind protectionist partitions is seldom aggressive, so there’s a case for lowering the tariffs.

“Accelerating development is the target of each Funds appropriately of this one. However this Funds ought to pay particular consideration to bridging the widened inequality within the economic system,” he informed PTI in an interview.

Whereas noting that the COVID-19 pandemic has precipitated huge misery to the low-income segments who function within the casual economic system, Dr. Subbarao saidthe higher earnings segments haven’t solely been in a position to defend their incomes however have actually been in a position to develop their financial savings and wealth.

Citing the newest World Inequality Report which had stated that India is among the many most unequal international locations on the earth, he stated,” Such huge inequality will not be solely morally incorrect and politically corrosive, however it’ll additionally dent our long-term development prospects.” Finance Minister Nirmala Sitharaman is scheduled to current the Union Funds 2022-23 in Parliament on February 1.

“We want job intensive development. If there’s a theme for this Funds, it must be jobs,” he stated.

The previous RBI Governor identified that jobs have been misplaced due to the expansion slowdown and in addition due to the shift in exercise from the labour-intensive casual sector to the capital-intensive formal sector.

“Progress is important to generate jobs, however not adequate,” he stated, including that there isa want forstronger emphasis on enhancing the benefit of doing enterprise by means of governance reforms in order that funding turns into a promising possibility for each home and overseas buyers.

Subbarao identified thatraising the extent of exports is nice not only for steadiness of funds causes but additionally from a jobs perspective as a result of export manufacturing is labour intensive. “Expertise reveals that export manufacturing behind protectionist partitions is seldom aggressive. There’s a case subsequently for rolling down the tariffs,” he stated.

Requested if there may be any scope for discount in taxes within the upcomingBudget as that may present some aid to the poor, Dr. Subbarao stated as per media stories, this yr’s tax collections can be higher than the budgeted goal which, he stated, can be largely offset by decrease privatization proceeds and better expenditure on meals and fertilizer subsidies.

“So, the online constructive impression on the fiscal deficit is prone to be marginal,” he stated.

Additionally, Dr. Subbarao famous that the tax buoyancy the nation noticed this yr will dissipate subsequent yr because the casual sector revives.

“Apart from, given the persevering with want to lift spending on schooling, well being and infrastructure, I don’t imagine there may be a lot leeway for tax cuts,” he argued.

Askedwhether the federal government shouldcontinue with stimulus measuresin order to stimulate development, Dr. Subbarao stated within the final Funds, the finance minister dedicated to a fiscal consolidation path of lowering the fiscal deficit to 4.5 per cent of GDP by 2025/26. “I imagine it’s essential to function inside that area. Any deviation from the fiscal consolidation path will impair credibility, dent investor sentiment and damage our development prospects.” he stated. Requested how massive a priority is inflation, Dr. Subbarao stated inflation has remained within the higher reaches of the RBI’s goal band for a lot of the final two years.

Going ahead, he stated there can be stress on inflation due to an unfavourable base impact, rising commodity costs and output value hikes by corporations.

“Controlling inflation can go an extended option to redress the misery of the poor,” Dr. Subbarao noticed.

On the danger ofstagflation, he saidhe thinks that’s being too alarmist.

“Sure, inflation has been persistent over the past two years however observe that it’s nonetheless throughout the RBI’s goal band. RBI ought to be capable to deliver it right down to the mid-point of the goal band by normalizing the coverage,” Dr. Subbarao stated.

Stagflation is outlined as a scenario with persistent excessive inflation mixed withlow development.

Retail inflation in India rose to five.59 per cent in December 2021, whereas the wholesale price-based inflation eased to 13.56 per cent final month.

On financial development, he stated if Omicron stays gentle, mobility restrictions are prone to be focused and decentralized.

“Within the base case state of affairs subsequently, we should always obtain 9.2% development for the complete yr.If actually these assumptions about Omicron don’t maintain, there can be a draw back danger to the 9.2% development estimate,” Dr. Subbarao stated.

Supply- thehindu