[ad_1]

- Cisco is refocusing to compete in a cloud-driven world

- The corporate’s development aspirations rely on a service-based mannequin

- The Wall Avenue consensus outlook is bullish

- The market-implied outlook is bullish

- CSCO must ship increased development than in recent times

Networking big Cisco (NASDAQ:) has tailored considerably slowly to the large shift in IT spending, which now favors cloud-based options. Going ahead, the corporate is emphasizing software program subscriptions, cloud options and work-from-anywhere as its focus for development.

Whereas administration is saying all the appropriate issues, CSCO’s in recent times is disappointing. The consensus for anticipated earnings development signifies a prevailing perception that the San Jose, California-based agency’s turnaround efforts won’t be very profitable. The consensus for 3-5 12 months EPS development is 5.9% per 12 months, far beneath the 15.5% median anticipated development price for the IT sector.

Supply: Investing.com

CSCO has fallen 12.4% from its TTM excessive shut of $63.96 on Dec. 29 however its 12-month complete return of 30.4% is much above that of the . The TTM complete return for Invesco QQQ Belief (NASDAQ:) is 9.1%.

Over the long run, CSCO’s efficiency lags, with a three-year annualized complete return that’s about half that of the and the present share value is beneath ranges the inventory reached in July of 2019.

The quarterly EPS has been flat over the previous three years, and the expectations over the subsequent 12 months and past are for extra of the identical. Regardless that the TTM P/E of 21.2 for CSCO is low for an enormous tech agency, the shortage of earnings development over the previous three years is certainly a priority.

Supply: E-Commerce. Inexperienced values are the quantities by which earnings exceeded the consensus anticipated stage.

I final wrote about CSCO on Oct. 21 and assigned a bullish/purchase ranking. The important thing drivers of the ranking had been:

- low valuation for an enormous tech agency,

- bullish Wall Avenue consensus outlook and

- bullish consensus outlook from the choices market.

Whereas most readers shall be acquainted with (1) and (2), using choices to type an outlook could also be new.

The value of an possibility on a inventory displays the market’s consensus estimate of the likelihood that the share value will rise above (name possibility) or fall beneath (put possibility) a selected stage (the choice strike value) between now and when the choice expires. By analyzing the costs of name and put choices at a spread of strikes, all with the identical expiration date, it’s doable to calculate a possible value forecast that reconciles the noticed choices costs. That is known as the market-implied outlook and displays the consensus view of consumers and sellers of choices.

Since my final evaluation was printed, CSCO has had a complete return of +1.58%, as in contrast with -3.3% for the S&P 500 over the identical interval.

I’ve up to date the market-implied outlook for CSCO to the center of 2022 and to the beginning of 2023 and in contrast it with the Wall Avenue consensus outlook.

Wall Avenue Consensus Outlook For CSCO

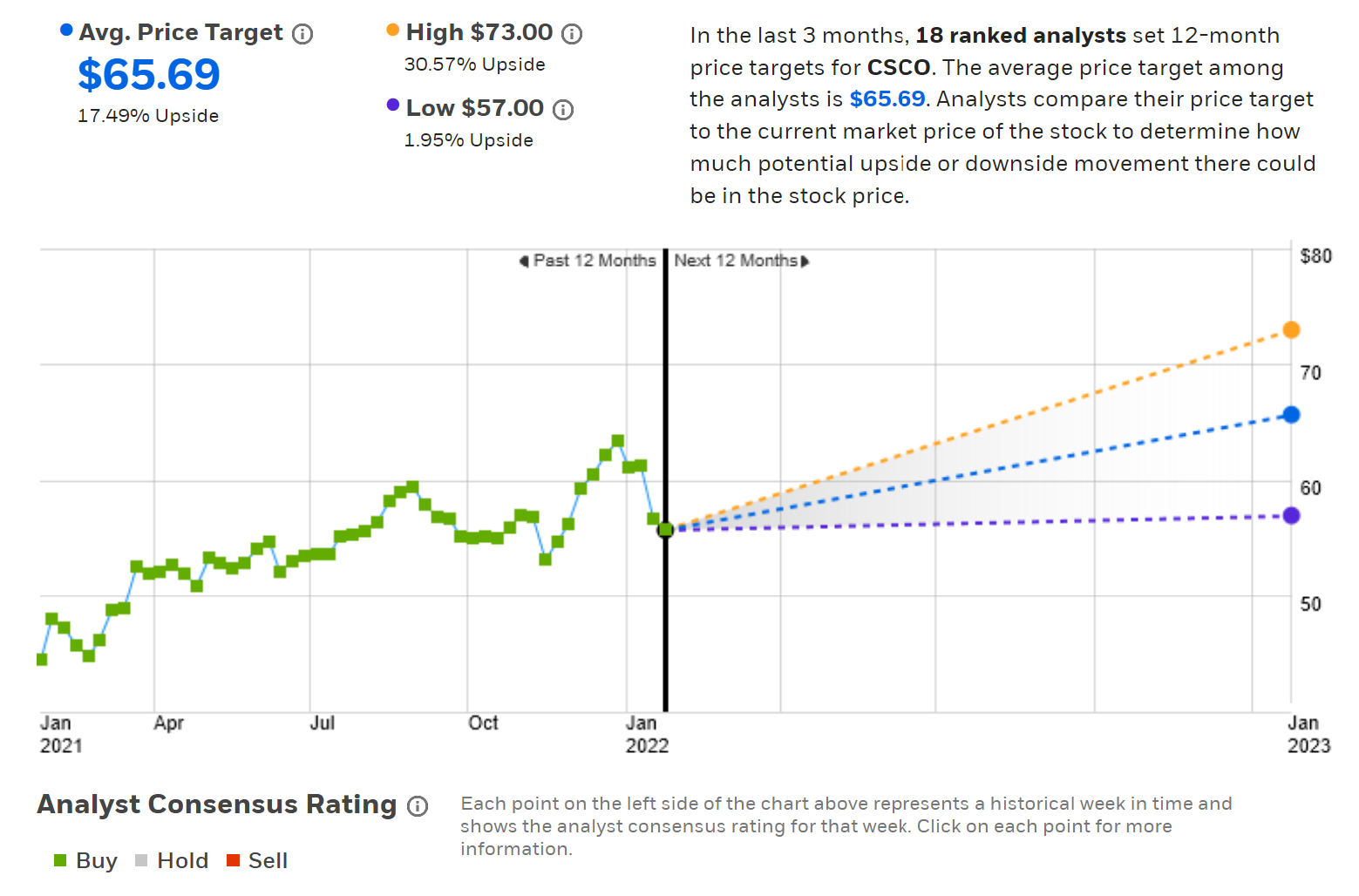

E-Commerce calculates the Wall Avenue consensus outlook by combining the views of 18 ranked analysts who’ve printed rankings and value targets for CSCO over the previous 90 days. The consensus ranking is bullish, because it has been for the previous 12 months, and the consensus 12-month value goal is 17.5% above the present share value. The consensus 12-month value goal is barely increased than it was three months in the past ($63.78). Of the 18 analysts, 9 assign a purchase ranking and 9 assign a maintain.

Supply: E-Commerce

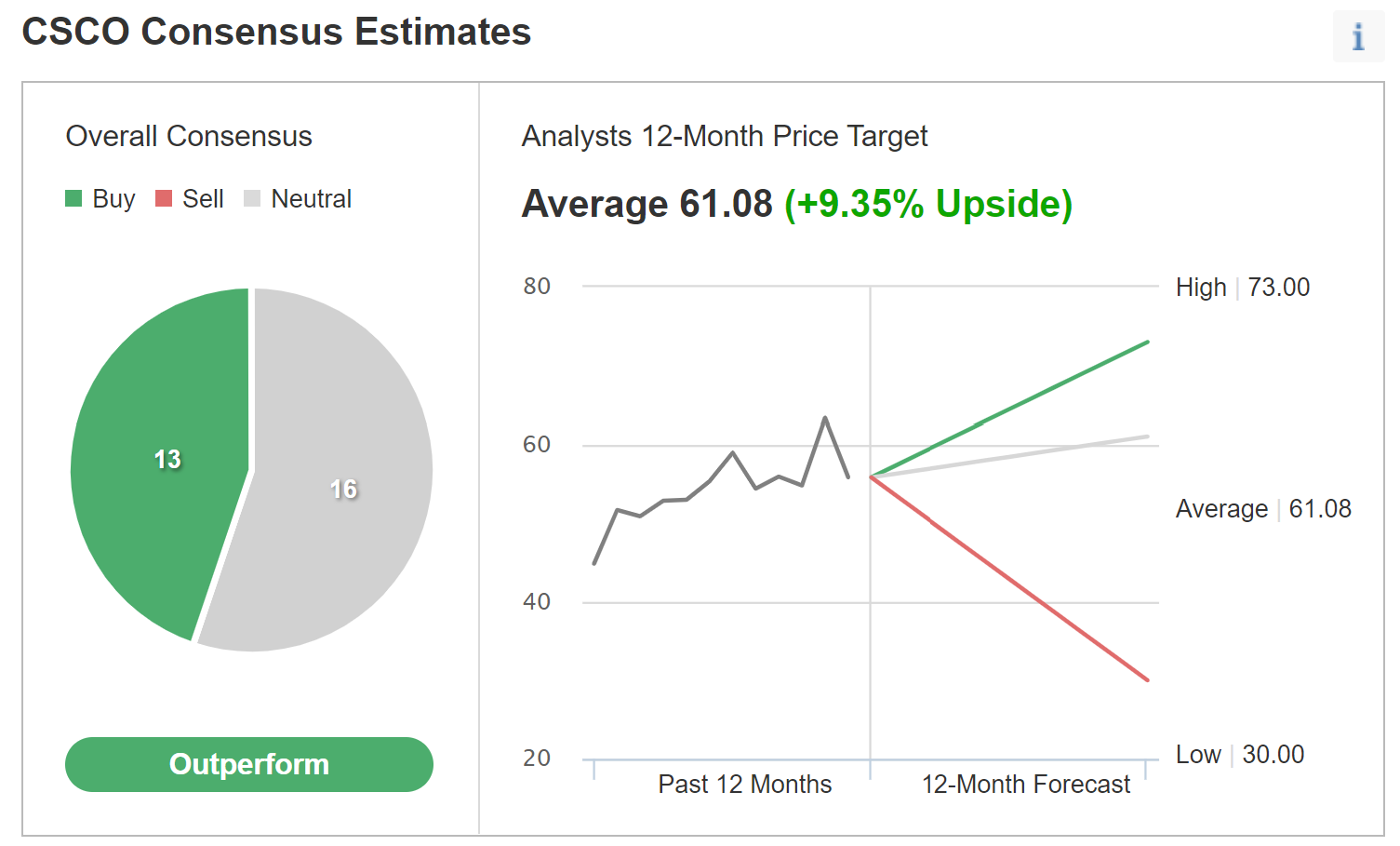

Investing.com’s model of the Wall Avenue consensus is calculated by aggregating the views of 29 analysts. The consensus ranking is bullish and the consensus value goal is 9.35% above the present value. The consensus value goal is markedly decrease than for E-Commerce due to an outlier analyst with a $30 value goal for the inventory. In step with E-Commerce’s outcomes, the analyst rankings are virtually evenly break up between purchase and maintain.

Supply: Investing.com

The distinction between the 12-month consensus value targets from these two sources has a serious impression on the anticipated value appreciation. To try to reconcile the unfold, I checked out Searching for Alpha’s calculation for the consensus value goal. At $63.5, Searching for Alpha falls between the 12-month consensus value targets from E-Commerce and Investing.com.

The typical of the Investing.com and E-Commerce’s 12-month consensus value targets, $63.39, implies 12-month value appreciation of 13.4%. Mixed with the two.6% dividend yield, the anticipated complete return is 16%, near the trailing five-year annualized return of 15.7% and properly above three-year annualized return of 10.3%.

Market-Implied Outlooks For CSCO

I’ve calculated the market-implied outlook to mid-2022 (utilizing choices that expire on June 17, 2022) and thru 2022 (utilizing choices that expire on Jan. 20, 2023).

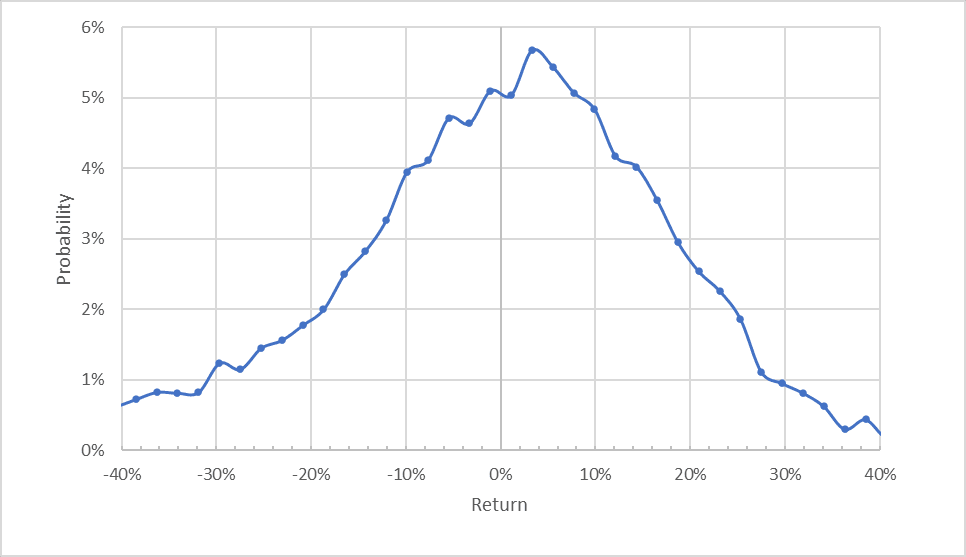

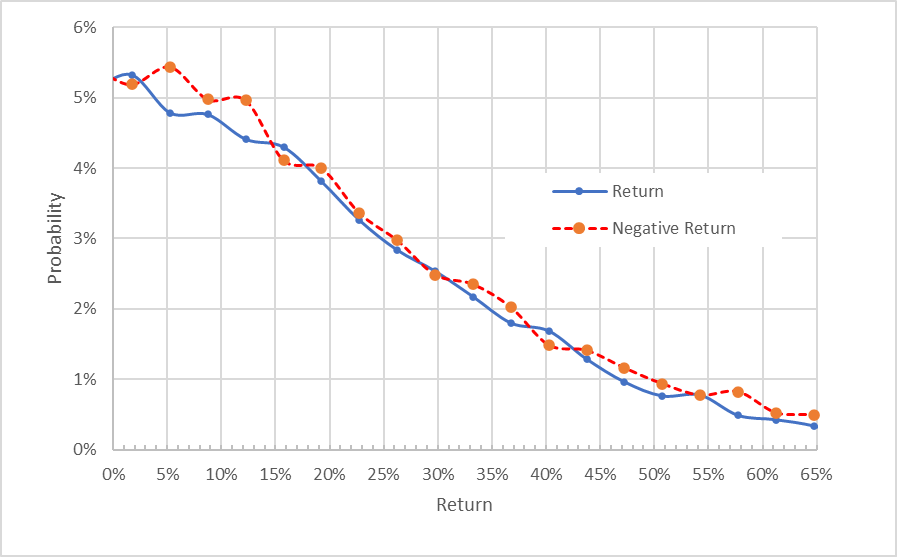

The usual presentation of the market-implied outlook is within the type of a likelihood distribution of value return, with likelihood on the vertical axis and return on the horizontal.

Supply: Writer’s calculations utilizing choices quotes from E-Commerce

Whereas the market-implied outlook is mostly symmetric, the height possibilities are shifted in the direction of constructive returns, a bullish indicator. The utmost-probability consequence corresponds to a value return of +3.4%. The annualized volatility calculated from this distribution is 32.2%.

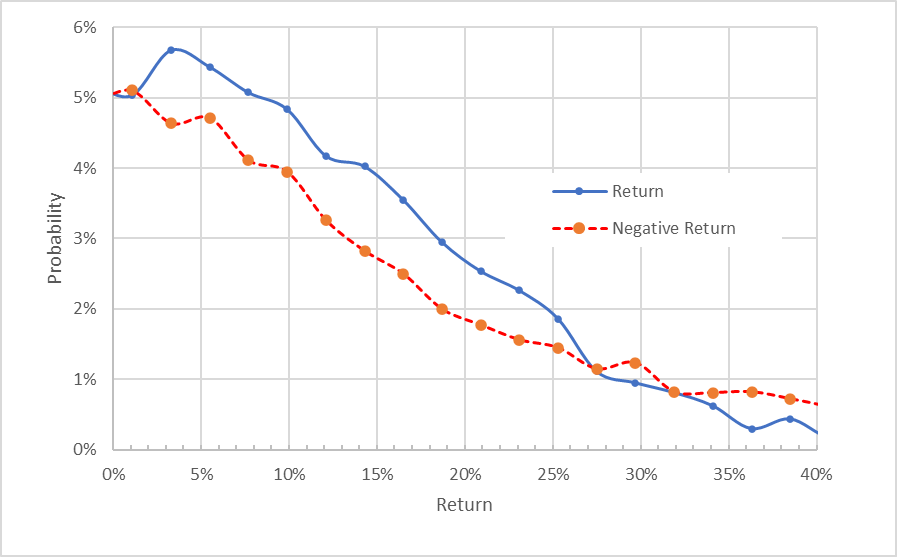

To make it simpler to instantly evaluate the possibilities of constructive and damaging returns, I rotate the damaging return aspect of the distribution in regards to the vertical axis (see chart beneath).

Supply: Writer’s calculations utilizing choices quotes from E-Commerce. The damaging return aspect of the distribution has been rotated in regards to the vertical axis.

This view makes the bullish tilt of the market-implied outlook very evident. The chances of constructive returns are markedly and constantly increased than for damaging returns of the identical magnitude for a variety of the most-probable outcomes (the stable blue line is properly above the dashed purple line over the left ⅔ of the chart). It is a bullish outlook for CSCO to the center of 2022.

Principle means that the market-implied outlook will are likely to have a damaging bias, reinforcing the bullish view to mid-2022.

The market-implied outlook for the subsequent 11.8 months is much less bullish, with intently matching possibilities of constructive and damaging returns. The chances of damaging outcomes are typically very barely above these for constructive outcomes. Due to the anticipated damaging bias, that is nonetheless interpreted as a impartial outlook with a barely bullish tilt. The annualized volatility calculated from this distribution is 31.3%.

Supply: Writer’s calculations utilizing choices quotes from E-Commerce. The damaging return aspect of the distribution has been rotated in regards to the vertical axis.

The market-implied outlooks are bullish to the center of 2022 and impartial with a slight bullish tilt for the complete 12 months. The anticipated volatility is secure at about 31.7%.

Abstract

Whereas CSCO’s valuation is sort of modest for an enormous tech agency, the corporate’s income and earnings development in recent times is sub-par.

Cisco is making an attempt to meet up with the market shift in the direction of the cloud and everything-as-a-service. The consensus outlook is that development will proceed to lag, however the valuation supplies some potential for value appreciation.

The Wall Avenue consensus outlook for CSCO is bullish, with anticipated 12-month complete return of about 16%. As a rule of thumb for a purchase ranking, I need to see an anticipated 12-month return that’s at the very least half the anticipated volatility, and CSCO simply meets this criterion utilizing the Wall Avenue consensus value goal and the anticipated volatility from the market-implied outlook.

The market-implied outlook for CSCO is bullish to the center of 2022 however impartial, albeit with a slight bullish tilt, for the complete 12 months. I’m sustaining my general purchase ranking for CSCO, however plan to re-evaluate after the center of the 12 months.

[ad_2]