Retail mortgage repayments confirmed a marked enchancment in July after a pointy spike in defaults throughout the previous three months as thousands and thousands of Indians skipped funds both as a result of they misplaced revenue throughout the pandemic’s second wave or used up their financial savings to pay for Covid therapy.

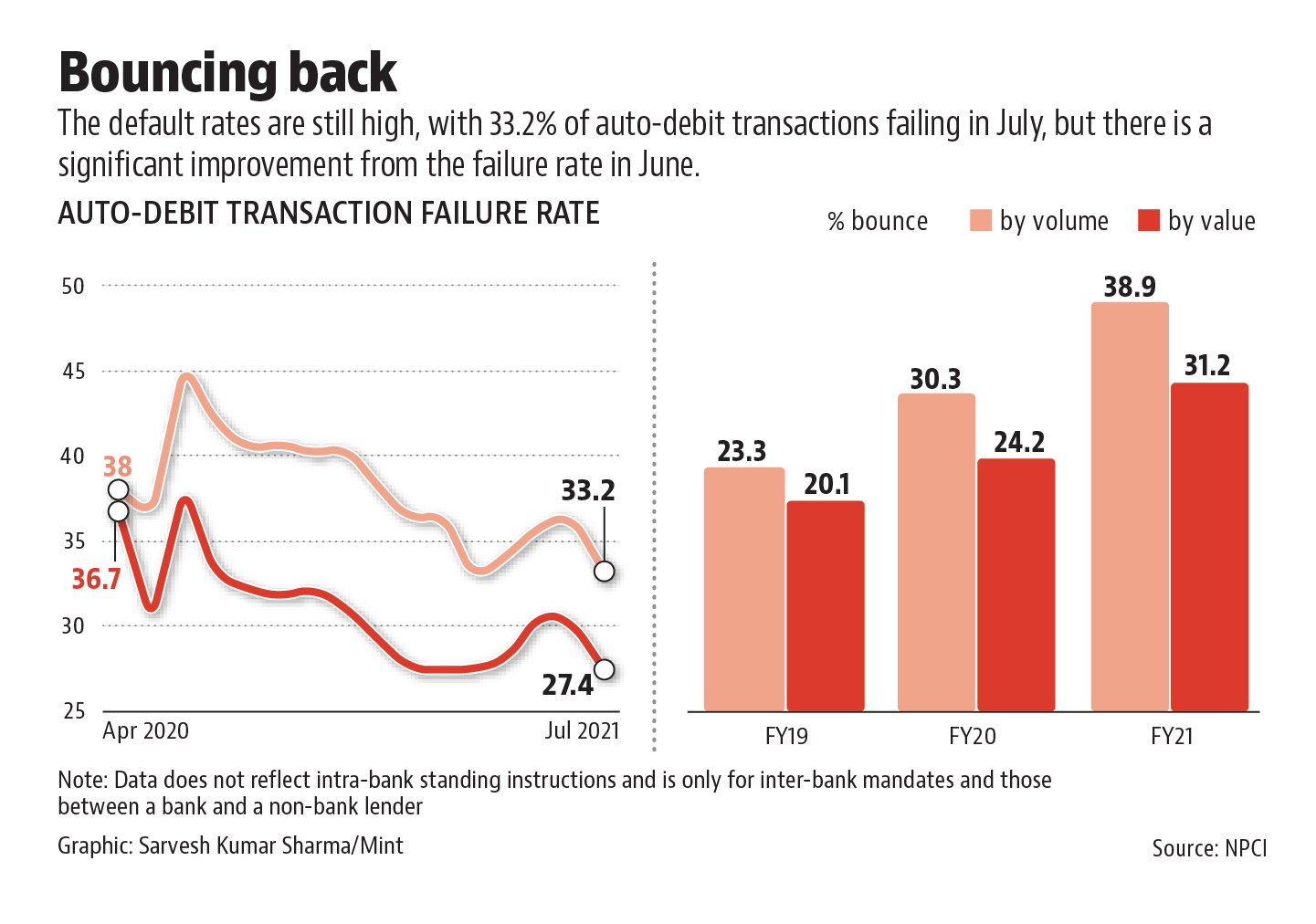

Whereas the default charges are nonetheless excessive, with 33.2% of auto-debit transactions failing in July, primarily due to inadequate funds, it’s nonetheless a major enchancment from the 36.5% failure fee within the earlier month, information from the Nationwide Funds Corp. of India confirmed.

The figures are for transactions performed by way of the Nationwide Automated Clearing Home for inter-bank mandates and doesn’t replicate intra-bank standing directions. These are recurring funds the place funds are drawn month-to-month from their financial institution accounts.

The advance signifies that debtors are regularly recovering from the pandemic’s toll on funds. The second wave and the following lockdowns led to misplaced revenue for an enormous part of non-salaried Indians, leaving them with out the means to maintain up with their money owed.

“Given the unlocking that’s taking place, the default fee ought to see some enchancment. Nonetheless, it could take some extra months for the bounce fee to return to pre-Covid ranges,” mentioned Anil Gupta, vice-president of ranking firm ICRA Ltd.

In worth phrases, 27.4% of transactions had been unsuccessful in July towards 30.3% within the earlier month.

In keeping with Macquarie Analysis, the present bounce charges are just like these seen in January-March interval, simply earlier than the second wave hit India. Nonetheless, the bounce charges by worth are a whopping 700-800 foundation factors greater than the pre-Covid degree, highlighting the ache amongst debtors. “Many banks have mentioned they’ve already recovered near 30-40% of the slippages seen in Q1FY22 in July. The big slippages had been notably in segments corresponding to gold loans, microfinance, business automobile loans the place collections had been impacted on account of lockdowns in addition to the well being of staff or assortment workforce,” Macquarie Analysis mentioned in a current observe.

There was a gradual decline in failure charges between December and March, dropping 5.3 proportion factors by quantity to 32.8%. Nonetheless, the second wave turned out to be deadlier than the primary onslaught final 12 months. The impression was evident in banks reporting decrease assortment numbers for April and turning cautious.