[ad_1]

The low ticks under the November 9 low of 112.719

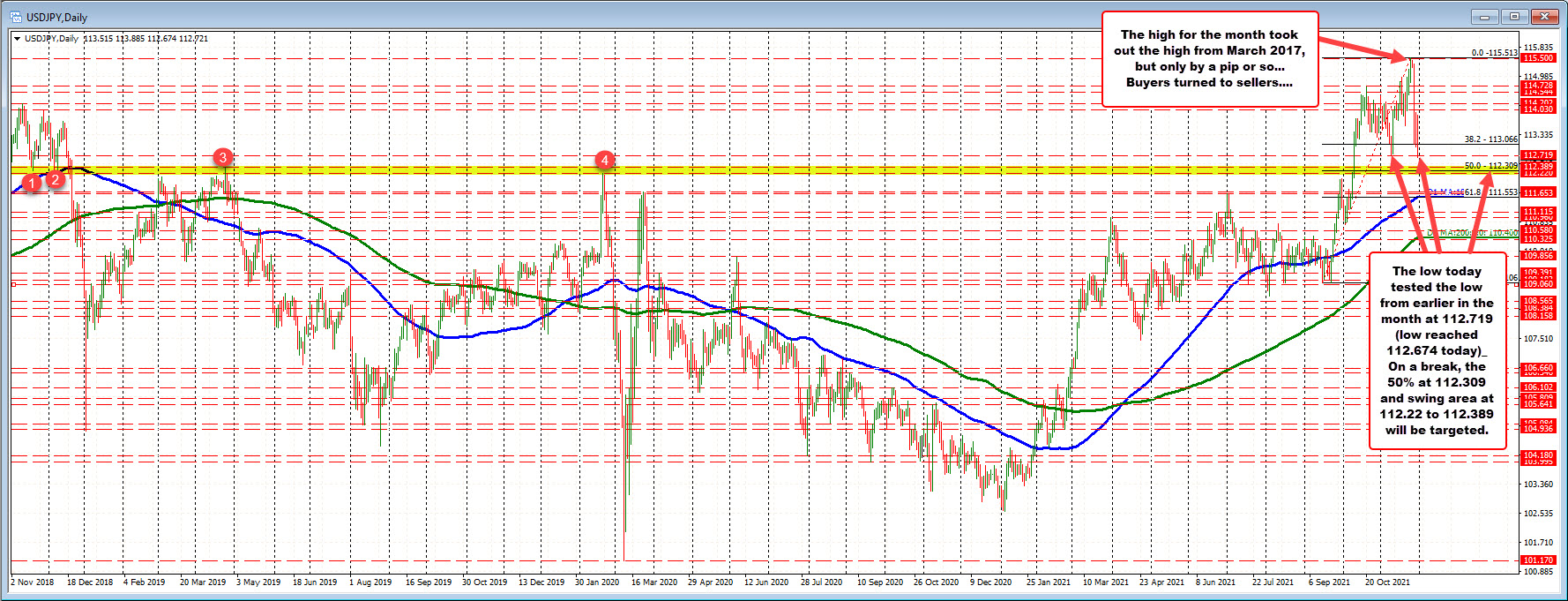

The USDJPY reached the very best degree since January 2017 final week when the value ticked as much as 115.513. That prime ticked above the March 2017 excessive of 115.501 taking the pair to the very best degree because the week of January 15, 2017. Nonetheless the 1.2 pip break didn’t impressed the consumers, they usually turned to sellers.

The final 4 days has seen the value transfer decrease and within the course of, retrace your complete transfer greater in November. The earlier low was set on November 9 at 112.719. The low value right this moment ticked to 112.674 earlier than a modest bounce. The present value trades at 112.77.

Will the modest break under the November low give dip consumers a degree to lean in opposition to now?

It might. Just like the modest break on the highs simply 5 days in the past, the modest break on the lows may give the intense merchants a degree to outline and restrict threat. Remember.

Nonetheless, it can probably take some assist from rates of interest and/or shares. Each are at the moment down with the Dow down -305 factors and the Nasdaq down -81 factors in premarket buying and selling. The ten yr yield is decrease by -9.5 foundation factors to 1.4340. The cycle excessive reached 1.69% simply final week. PS Chair Powell testimony can be a key occasion right this moment as properly.

From a technical perspective, what would give the consumers some hope for additional upside probing?

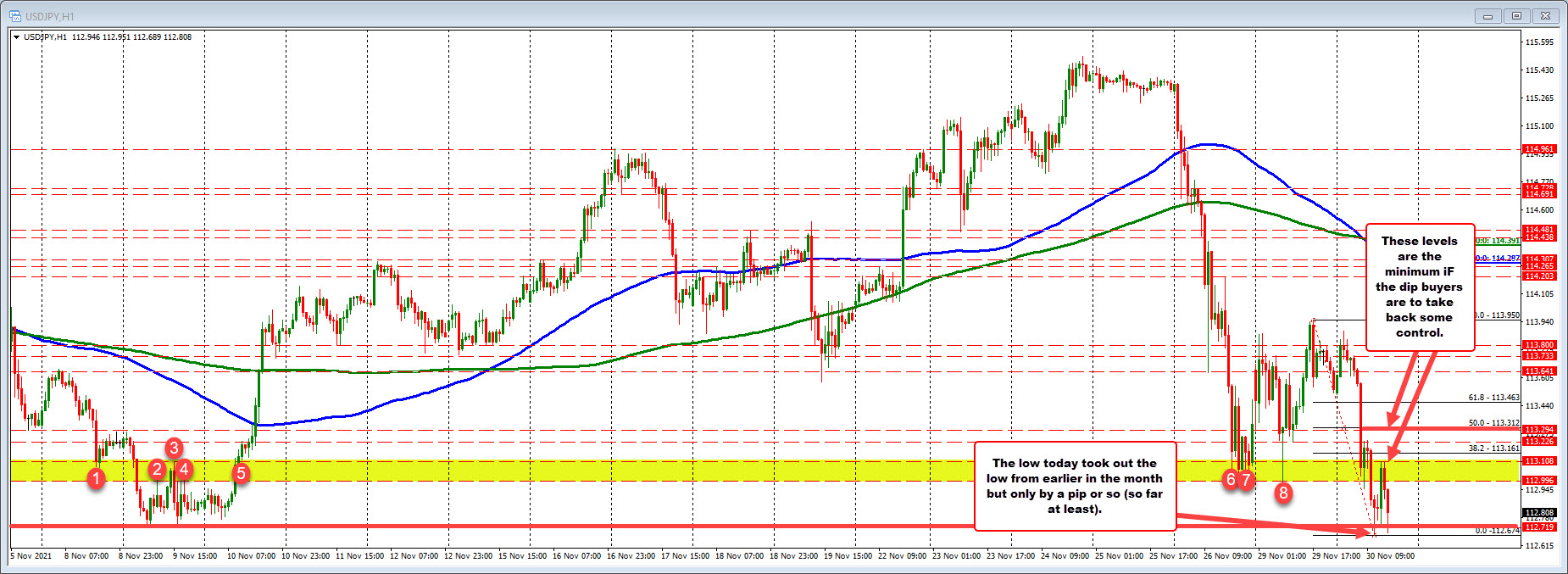

Drilling to the hourly chart under, the final corrective excessive off the brand new month low, stalled close to the excessive of a swing space between 112.996 and 113.108 (see yellow space on the hourly chart under). Getting again above that space would give the dip consumers some consolation. One other goal could be the midpoint of the transfer down from yesterday’s excessive at 113.312.

Each these targets are the MINIMUM corrective targets wanted to be surpassed by the consumers. Failure and the the sellers stay in FIRM CONTROL.

SUMMARY: There’s hope for dip consumers (in opposition to the month of November low), however it’s primarily based on hope vs. value motion up to now. Get above some upside targets and there could also be some reduction, however there’s nonetheless work to do for the consumers.

[ad_2]