[ad_1]

The USD is generally decrease to begin the day. Month finish. Shares decrease. Yields down.

The Omicron ghost has spooked the market once more at the moment after a reprieve yesterday.

Moderna CEO warned that the present vaccines won’t be efficient with the variant. Regeneron stated that the antibiotic cocktail is much less efficient towards Omicron virus (outcomes from early assessments).

That information helped to ship shares decrease, yields decrease, and oil decrease.

Fed chair Powell will testify on Capitol Hill. His pre-released remarks have been extra hawkish saying that inflation is prone to linger nicely into subsequent 12 months and that the considerations with the virus may scale back individuals’s willingness to work in particular person, growing provide constraints. Feds Williams and Clarida are additionally scheduled to talk at the moment. Treasury Secretary Yellen can also be testifying.

European inflation charges have been greater than expectations with the flash CPI estimate for November rising to 4.9% versus 4.5% anticipated. On the opposite finish of the spectrum, German unemployment change got here in higher than anticipated at -34K versus -25K estimate.

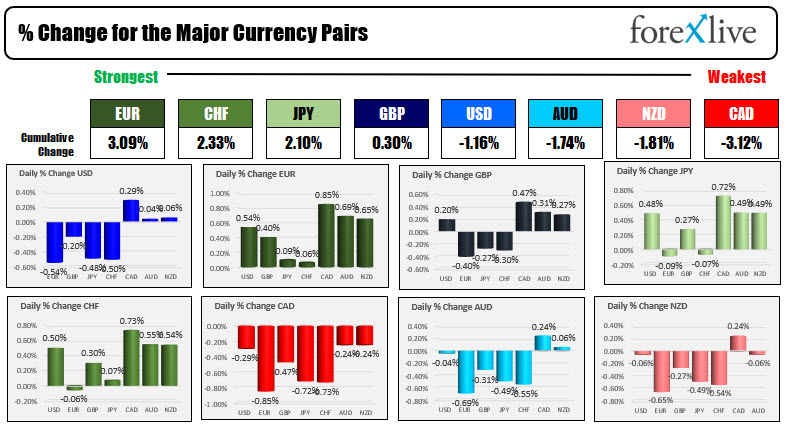

Within the foreign exchange, the snapshot of the market at present exhibits the EUR is the strongest of the main currencies whereas the CAD is the weakest. Decrease oil costs are serving to to push the CAD to the draw back with the CAD the weakest vs the USD since September 22.

In different markets, the US opening snapshot exhibits:

- Spot gold is up $8.65 or 0.48% at $1792.50

- Spot silver is down and two cents or -0.08% at $22.87

- WTI crude oil futures are buying and selling down almost 2 {dollars} at $68.04

- Bitcoin is buying and selling marginally greater $58,209

Within the premarket for US shares, the key indices are decrease after yesterday’s rebound:

- Dow industrial common -379 factors after yesterday’s 236.6 level rise

- S&P index -44 factors after yesterday’s 60.65 level rise

- NASDAQ index -85 factors after yesterday’s 291.18 level surge

Within the US debt market, yields are sharply decrease with the ten 12 months buying and selling again beneath 1.5% at 1.443% (down -8.6 foundation factors). The two-10 12 months unfold is again beneath the 100 degree at 97.6 foundation factors. Final week the ten yield was as excessive as 1.691% (down 25 foundation factors). The 2 12 months was as excessive as 0.658% (down almost 20 foundation factors). Markets are implying a September 2022 fee hike versus June earlier than the Omicron information

Within the European debt market, benchmark 10 12 months yields are additionally decrease, reacting to the slower development prospects and regardless of the upper inflation knowledge (however much less reactive vs the US equal). UK 10 12 months yields are down -4.9 foundation factors. France’s 10 12 months is again towards parity at 0.016% after buying and selling as little as 0.001%.

[ad_2]