[ad_1]

Additional, Bhagwat Ok Karad additionally mentioned, “In a bid to foster blockchain expertise for offering varied monetary providers, banks have put in place IBBIC.”

The federal government on Tuesday mentioned there is no such thing as a proposal as of now to merge public sector basic insurance coverage firms.

There are 4 basic insurance coverage firms – New India Assurance Firm, Nationwide Insurance coverage Firm Restricted (NICL), United India Insurance coverage Firm Restricted (UIICL) and Oriental Insurance coverage Firm Restricted (OICL).

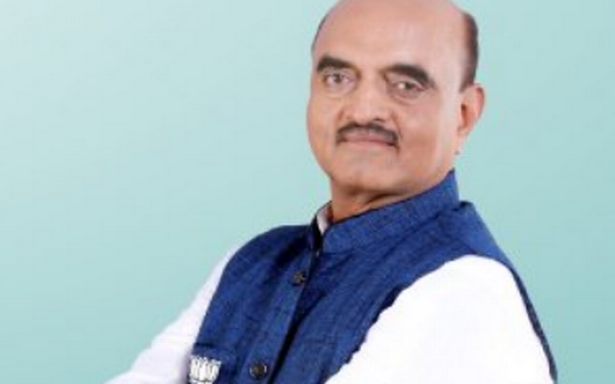

In a written reply to the Rajya Sabha, Minister of State for Finance Bhagwat Ok Karad mentioned there is no such thing as a proposal into account of the federal government at current for merger of public sector basic insurance coverage firms.

In a bid to foster blockchain expertise for offering varied monetary providers, banks have put in place Indian Banks’ Blockchain Infrastructure Firm Non-public Restricted (IBBIC), Mr. Karad mentioned in one other written reply.

The Reserve Financial institution of India (RBI) has knowledgeable that it has been pro-active in offering steering for improvement of blockchain-based software via its new regulatory sandbox atmosphere, he mentioned.

“State Financial institution of India (SBI) and Canara Financial institution are a part of an organization referred to as Indian Banks’ Blockchain Infrastructure Firm Non-public Restricted (IBBIC) for utilizing blockchain expertise for offering varied monetary providers. SBI has knowledgeable that as part of IBBIC improvement, it has initiated steps to include blockchain expertise in commerce associated transactions,” he mentioned.

Additional, he mentioned, SBI has been onboarded on a blockchain enabled platform, for exchanging fee associated compliance queries.

Canara Financial institution has knowledgeable that it had shaped a small expertise innovation crew, which is engaged on figuring out the potential use instances finest suited to banking operations, he added.

Replying to a different query, Mr. Karad mentioned share of whole non-performing belongings (NPA) has witnessed rise since 2018-19 beneath the Pradhan Mantri Mudra Yojana (PMMY).

Throughout the 2018-19, the overall NPA towards disbursement stood at 2.51% (₹17,712.63 crore). This elevated to 2.53% or ₹17,712.63 crore in 2019-20 and three.61% or ₹34,090.34 crore in 2020-21, he mentioned.

On the finish of March 31, 2021, greater than 16.92 lakh Mudra playing cards have been issued, he mentioned in one other reply.

As on March 31, 2021, he mentioned, ₹5.81 lakh crore was disbursed by Public Sector Banks (together with Regional Rural Banks) beneath PMMY with present excellent quantity of ₹1.81 lakh crore. The reimbursement ratio thus works out to approx 69%, he added.

Supply- thehindu