[ad_1]

Might the Fed set off the subsequent “monetary disaster” as they start to hike rates of interest? Such is actually a query price asking as we glance again on the Fed’s historical past of earlier financial actions. Such was a subject I mentioned in To wit:

“With the whole lot of the monetary ecosystem extra closely levered than ever, the “instability of stability” is probably the most important danger.

“The ‘stability/instability paradox’ assumes all gamers are rational and implies avoidance of destruction. In different phrases, all gamers will act rationally, and nobody will push ‘the massive crimson button.’

“The Fed is very depending on this assumption. After greater than 12 years of probably the most unprecedented financial coverage program in U.S. historical past, they’re trying to navigate “

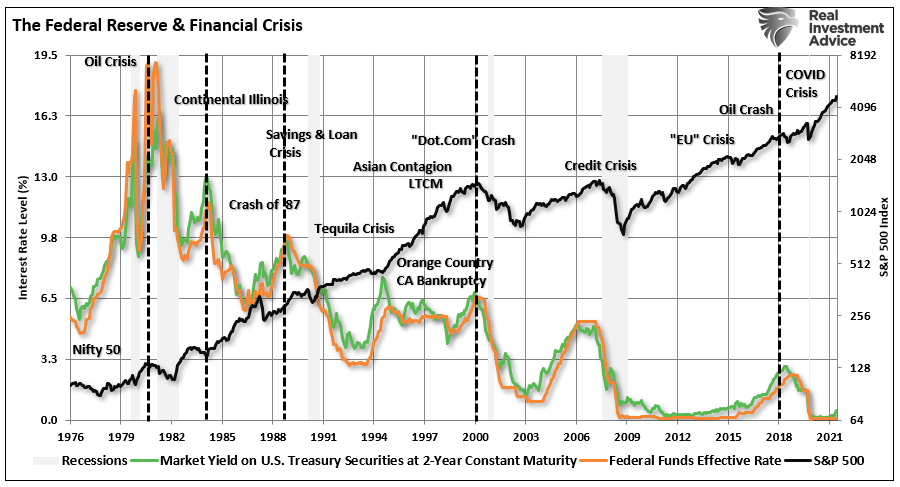

The issue, as proven beneath, is that all through historical past, when the Fed begins to hike rates of interest somebody inevitability pushes the “huge crimson button.” Such has been the case every time.

The behavioral biases of people stay the most critical danger dealing with the Fed. Whereas they might hope that people will act rationally as they hike charges and tighten financial coverage, traders have a tendency to not act that means.

Importantly, every earlier disaster in historical past was primarily a operate of utmost excesses in a single space of the market or financial system.

- Within the early 70’s it was the “Nifty Fifty” shares,

- Then Mexican and Argentine bonds a number of years after that

- “Portfolio Insurance coverage” was the “factor” within the mid -80s

- Dot.com something was an excellent funding in 1999

- Actual property has been a increase/bust cycle roughly each different decade, however 2007 was a doozy

What about at present?

A Bubble In “Every part”

It doesn’t matter what nook of the market or financial system you have a look at, there are excesses.

- Actual property,

- FANG-NATM (Fb (NASDAQ:), Apple (NASDAQ:), Netflix (NASDAQ:), Google (NASDAQ:), Nvidia (NASDAQ:), Amazon (NASDAQ:), Tesla (NASDAQ:) and Microsoft (NASDAQ:))

- EVs – Tesla is a $1 Trillion greenback firm

- Company debt

- Credit score

- Non-public fairness

- SPACs

- IPOs

- “Meme” shares

- Choices hypothesis

The checklist may go on, however you get the concept.

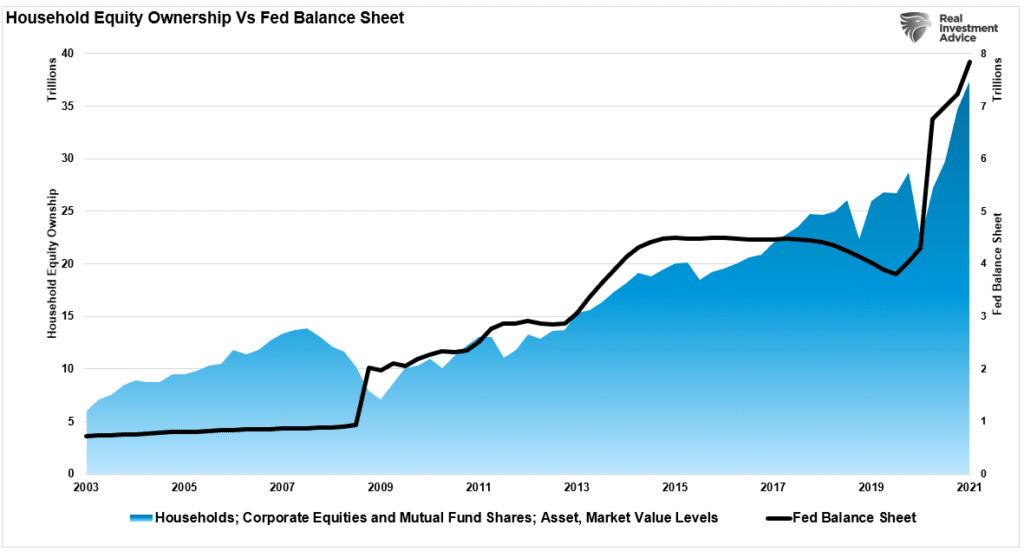

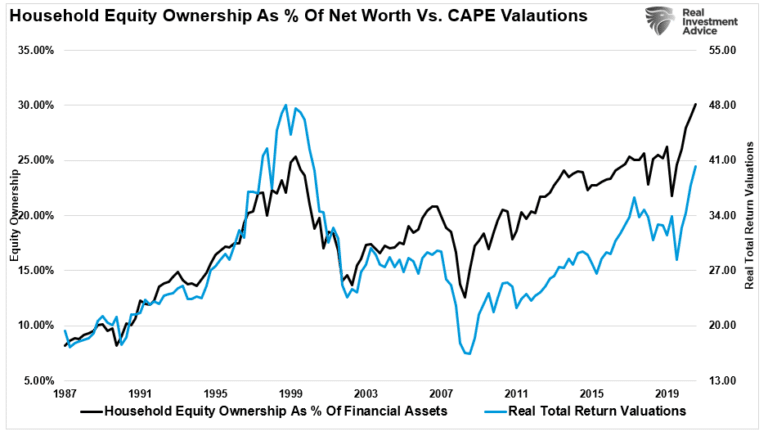

There’s a correlation between the Fed’s interventions and the surge in speculative risk-taking. As proven, family fairness possession is very correlated to the Fed’s steadiness sheet.

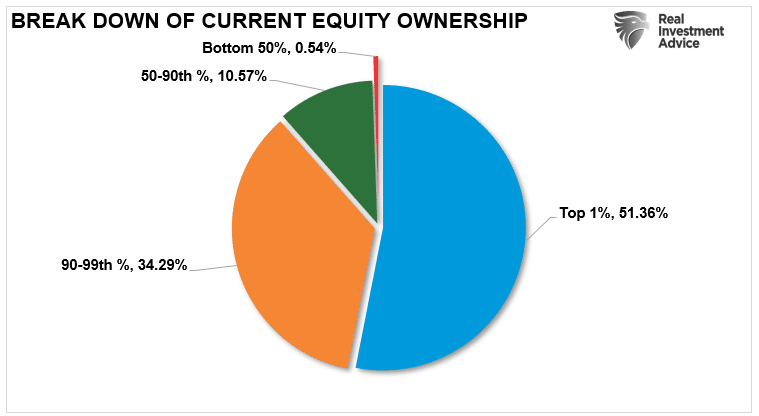

Sadly, with a purpose to spend money on the monetary markets, people should have disposable earnings with which to speculate. Nevertheless, whereas the large interventions by the Fed inflated probably the most distinguished monetary bubble in historical past, it did little to spice up financial development or prosperity. In consequence, the highest 10% of earnings earners personal roughly 90% of the monetary market property.

Not surprisingly, after greater than a decade of ultra-accommodative financial insurance policies, danger appetites surged as individuals got here to consider the Fed eradicated all “danger.”

In fact, if there may be “no danger of loss,” why not tackle extra danger? Such is precisely what everybody did.

A Bubble In Leverage

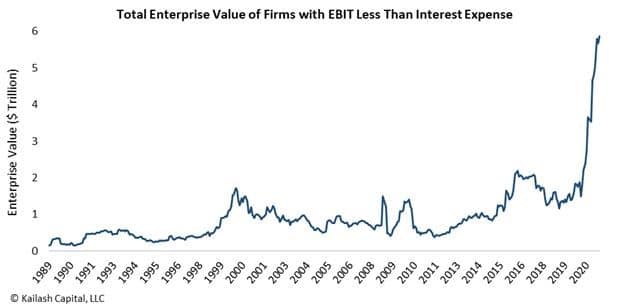

In Seth Klarman’s well-known guide, “A Margin Of Security,” he mentioned the 1980’s bond mania earlier than it imploded. At the moment, many firms issued bonds though they might not afford to pay the curiosity bills. As we speak, we name such firms “zombie firms,” as they have to feed on low-cost debt to remain alive. At the moment, the market capitalization of those zombie corporations is at a document.

Whole EV of Companies with EBIT Lower than Curiosity Expense

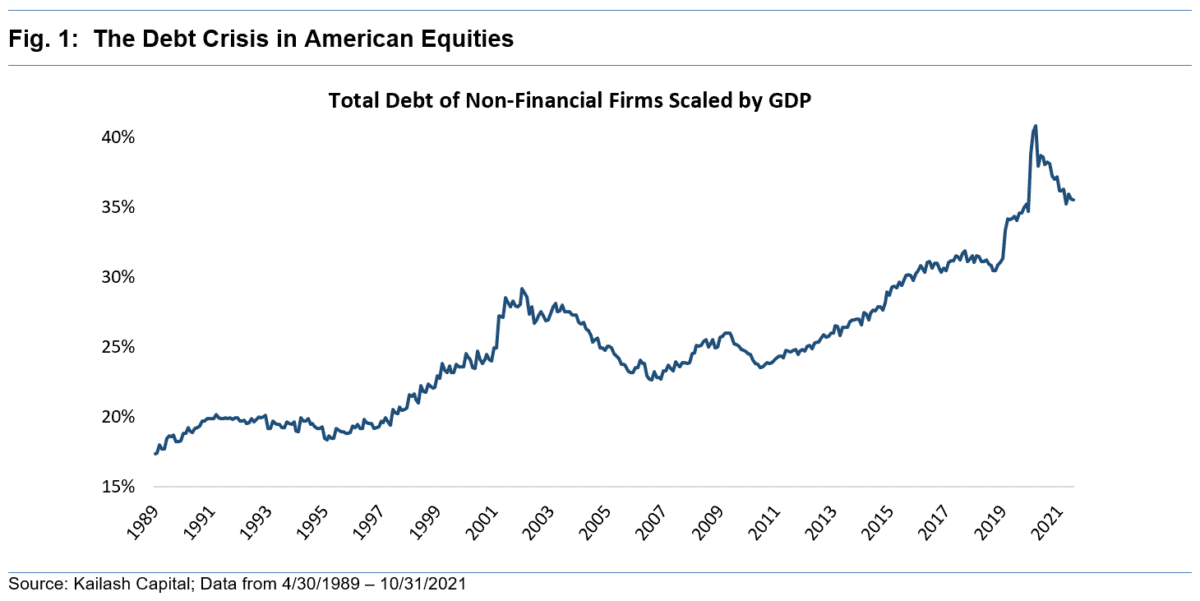

The plain downside is what occurs once they can’t refinance their debt. Sadly, as Kailash Ideas explains, debt itself is a big danger.

“At the moment, the world is awash in monetary alchemy. There may be at present a document variety of firms unable to cowl their curiosity expense from earnings.

“Since 2007, a giant a part of America’s debt disaster has moved from the monetary sector to non-financial shares with an excessive amount of debt. We consider the combo of document debt and document fairness valuations is probably going a facet impact of actual charges approaching lows final seen in 1973. Whether or not we’re proper or fallacious on the causality, the details are intimidating in our view.

“Our analysis has documented that the world has by no means been much less ready or much less outfitted to cope with a doable outbreak of inflation or pull-back in Federal largesse.”

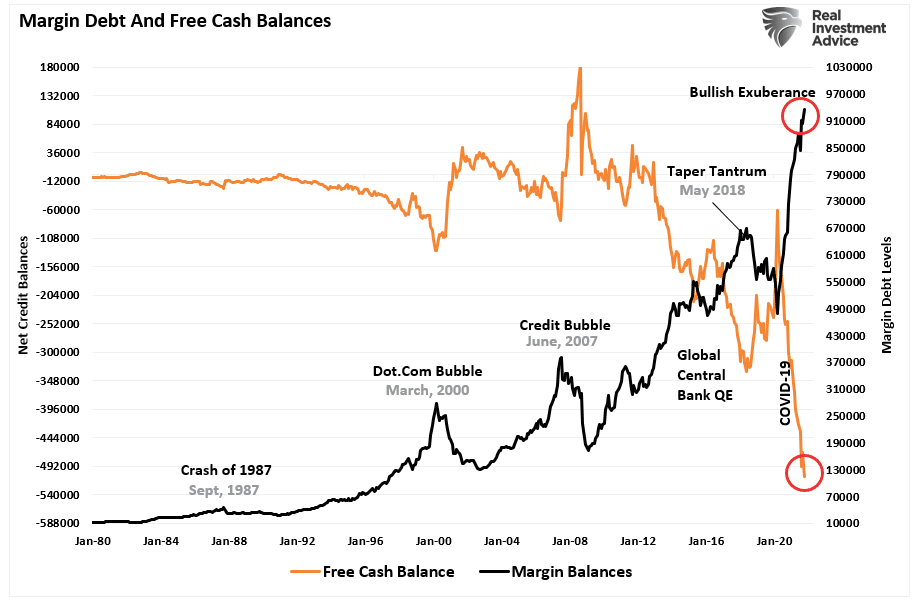

Nevertheless, it isn’t only a company leverage bubble. It’s also a bubble in investor leverage as people tackle debt to chase markets.

In fact, the vital factor about “margin debt” is that it fuels the bullish advance. However, sadly, it additionally accelerates the market’s eventual decline as leverage reverses. Such is all the time a brutal and mauling occasion, which is why Wall Road calls it a “bear market.”

The Danger Of A Coverage Mistake Is Huge

In we mentioned how if rates of interest rise, the Fed tightens financial coverage, or the financial restoration falters, a monetary disaster is feasible.

“Within the brief time period, the financial system and markets (because of present momentum) can DEFY the legal guidelines of economic gravity as rates of interest rise. Nevertheless, they act as a ‘brake’ on financial exercise as charges NEGATIVELY affect a extremely levered financial system:”

- Charges will increase debt servicing necessities lowering future productive funding

- Housing slows. Individuals purchase funds, not homes

- Greater borrowing prices result in decrease revenue margins

- The huge derivatives and credit score markets get negatively impacted

- Variable fee curiosity funds on bank cards and residential fairness traces of credit score improve

- Rising defaults on debt service will negatively affect banks

- Many company share buyback plans and dividend funds are performed by using low-cost debt

- Company capital expenditures are depending on low borrowing prices

- The deficit/GDP ratio will soar as borrowing prices rise sharply

Most significantly, during the last decade, the first rationalization for overpaying for fairness possession is that low charges justify excessive valuations. Sadly, with inflation surging, which shrinks revenue margins, and the Fed set to hike charges, valuations are seemingly an even bigger concern than most suspect.

As Mohammed El-Erian acknowledged in a latest interview:

“Traders ought to regulate the chance of an abrupt shift from a relative valuation market mindset to an absolute valuation one. If that occurs, you need to cease worrying concerning the return in your capital and begin worrying concerning the return of your capital.”

Nevertheless, for now, there is no such thing as a motive to fret concerning the subsequent “monetary disaster.”

Nicely, that’s except somebody pushes the “huge crimson button.”

[ad_2]