[ad_1]

Thanks to our 1,405 Contrarian Revenue Report subscribers who attended our “VIP” This fall webcast a few weeks again! We chatted about bond funds paying 9%+, Federal Reserve “fueled” funds for 54% yearly returns, and extra.

Previous to the webcast, we collected over 30 questions from considerate subscribers. We addressed most of those on the decision. Nonetheless, in the course of the session, 70 extra nice earnings questions got here in!

As promised, I learn each one. Let’s chat about the commonest questions right this moment.

Q: I’m 64 years outdated and am simply involved about retiring on dividends. I personal PCI which pays a excessive dividend however trades at a excessive premium. Any purpose I shouldn’t purchase extra PCI? –Robert

Q: Do you will have any ideas on PCI (PIMCO fund)? –Michael

Q: I hear PCI, PDI and PKO are merging collectively at PIMCO. Good or unhealthy? –Allen

Q: PCI merger? Dividend change? –Rod

Legendary bond store PIMCO not too long ago introduced plans to create a “super-CEF” by merging our personal PIMCO Dynamic Credit score Revenue Fund (NYSE:) and sister fund PIMCO Revenue Alternative Fund (NYSE:) into PIMCO’s Dynamic Revenue Fund (NYSE:).

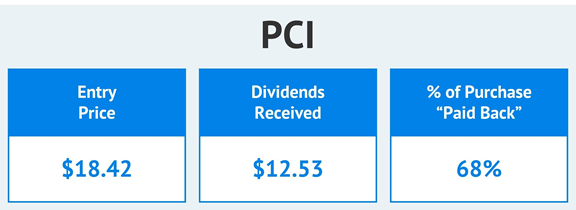

We added PCI to our CIR portfolio 5 years in the past. Should you purchased PCI then, you’ve loved $12.53 in dividends off an preliminary entry worth of simply $18.42. That’s a 68% “money return” on our funding already!

PCI

PCI is extra in style now than it was then. Again within the day, shares traded at a reduction to their internet asset worth (NAV). Right this moment, they fetch a 7% premium.

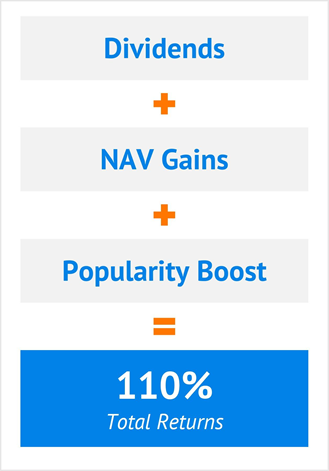

Its NAV sits larger right this moment, too. The month-to-month payouts plus the NAV positive factors plus PCI’s recognition imply 110% complete returns (and counting) for us!

Complete Returns

We received’t add cash to PCI—or the brand new “mega-fund”—until it dips to a reduction. However there’s no purpose to promote a modest premium both when PCI’s dividend (9.6%) is so significantly better than most bond alternate options. Additionally, most substitutes should not have the standard of administration supplied by PIMCO.

The longer term dividend must be superb. Sister funds PKO and PDI each pay greater than 9%, so they’re bringing loads of yield to the occasion.

Q: Why promote NRZ after they crashed their dividend from 50 cents to five cents final March? –Dale

Q: What’s (Jim) Cramer’s argument towards NRZ? –Oliver

After we purchased New Residential Funding (NYSE:), we understood the potential threat. NRZ is the most important non-bank proprietor of mortgage service rights (MSRs) on the earth. MSRs aren’t the loans themselves; they’re the rights to service these loans—a refined however necessary distinction.

MSRs sometimes earn 0.25% of the funds that they gather. My spouse and I not too long ago refinanced our home and our mortgage service firm, Truist Financial institution, is making simple cash for the precise to service our mortgage. We have already got our account on autopay!

The potential threat to MSRs is that rates of interest go down. If that’s the case, then householders like us will think about refinancing but once more and the mortgage (and repair rights) shall be “known as away” early.

It’s a longshot, nonetheless, with rates of interest already close to historic lows. Positive, they might fall by way of the basement flooring, however we’ll wager they received’t.

Since our July purchase, NRZ has already hiked its dividend by 25% (from $0.20 per quarter to $0.25). For a quick second, shares paid 10%+, however buyers have scrambled to bid the inventory’s worth up and yield “down” to eight.7%.

However that’s almost 9 p.c in a 1% world! We’ve additionally loved 10% worth pop in NRZ’s worth. There’s extra upside—plus fats payouts—to return.

I perceive the hesitancy after March 2020 and (briefly) plummeting charges, however right this moment is a distinct world with rising charges. NRZ’s portfolio is properly positioned for earnings whereas mortgage charges proceed to rise.

Now on the subject of Jim Cramer, I didn’t see the section however kindly acquired this word from considered one of our CIR CNBC correspondents:

Brett. Watching CNBC and Cramer right this moment. Anyone simply known as this second about NRZ. He mentioned keep away. NRZ is dangerous. I stick to you…however why would he say what he did?

Jim Cramer is a kick. He additionally has greater than 4,000 publicly traded shares to maintain monitor of. Tremendous sensible man. However c’mon, how many people can bear in mind what we had for breakfast, not to mention the quarterly twists and turns of 4,000 shares?

Our CIR portfolio is laser targeted by comparability. We now have solely 23 shares and funds to maintain monitor of; we all know them intimately others can solely hope to. C’mon Cramer, we’ve obtained room for you on the NRZ bandwagon!

Disclosure: Brett Owens and Michael Foster are contrarian earnings buyers who search for undervalued shares/funds throughout the U.S. markets. Click on right here to learn to revenue from their methods within the newest report, “7 Nice Dividend Development Shares for a Safe Retirement.”

[ad_2]