[ad_1]

- Banking sector big Goldman Sachs shares have misplaced 8.5% because the starting of 2022

- This autumn earnings missed estimates

- Lengthy-term buyers may contemplate shopping for shares at present ranges

World funding financial institution Goldman Sachs (NYSE:) shares have been weak because the launch of in mid-January. To date this 12 months, the inventory is down 8.48%. But, up to now 12 months, shares gained 9.6%.

By comparability, the —the 30-component mega cap index that features GS—is down 6.3% year-to-date, however up 10.0% within the final 12 months. In the meantime, the , which returned 16.8% over the previous 52 weeks, has misplaced 2.7% since January.

On Nov. 2, 2021, GS shares went over $426 to hit a file excessive. Now, nonetheless, they’re altering fingers for $350.12. The inventory’s 52-week vary has been $316.46-$426.16, whereas the market capitalization (cap) stands at $117.2 billion.

Regardless of the latest decline in worth, Goldman Sachs bulls may contemplate investing round present ranges. Right here’s why:

The place Current Earnings Got here From

When it comes to international revenues amongst funding banks, JPMorgan Chase (NYSE:) has the highest spot with a 9.6% market share. Subsequent come Goldman Sachs (9.0%), Morgan Stanley (NYSE:) with 6.7% and Financial institution of America (NYSE:) with 6.4%.

Once we take a look at the league desk for mergers and acquisitions (M&A), Goldman Sachs is forward of JPM, adopted by MS which is why Wall Road pays shut consideration to quarterly stories from these international giants.

Goldman Sachs launched This autumn financials Jan. 18. Income was $12.64 billion, a rise of 8% year-over-year (YoY). The financial institution stories income in 4 segments:

- World Markets (37% of income, divided between Equities and Mounted Revenue, Foreign money and Commodities, FICC);

- Asset Administration (25% of income);

- Funding Banking (25% of income); and

- Client & Wealth Administration (13%).

Buyers famous that larger web revenues in Funding Banking and Client & Wealth Administration segments partially offset the decline in Asset Administration and World Markets.

Diluted earnings per share for the interval was $10.81, in contrast with $12.08 a 12 months in the past. Analysts have been searching for a revenue of $11.76 per share. Stress on the underside line was from rising bills in addition to weaker buying and selling revenues.

Annualized return on fairness (ROE) was 15.6% for the quarter, however 23% for 2021. Lots of our readers would know that buyers regard ROE as an essential measure of a financial institution profitability. Metrics from InvestingPro counsel that Goldman Sachs has a better ROE than its friends (15.9%).

On the outcomes, CEO David M. Solomon highlighted that 2021 had been a file 12 months for the banking big. In the meantime, administration’s medium-term (roughly 3-year time horizon) firmwide ROE goal is 14-16%.

Previous to the discharge of the quarterly outcomes, the inventory was round $380. However now, it’s buying and selling barely over $350. The present worth helps a dividend yield of near 2.3%.

What To Count on From Goldman Sachs Inventory

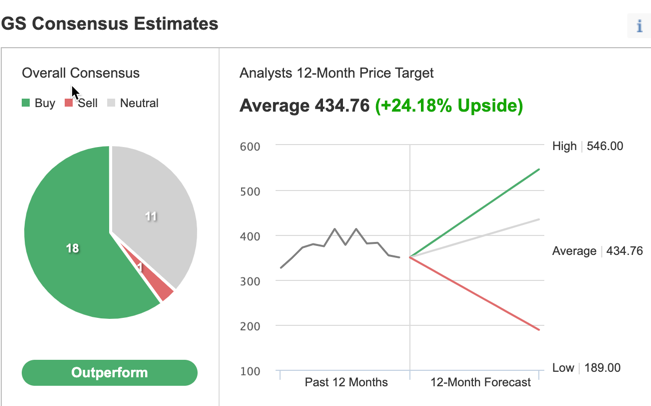

Amongst 30 analysts polled by Investing.com, GS inventory has an “outperform” ranking.

Supply: Investing.com

Wall Road additionally has a 12-month median worth goal of $434.76 for the inventory, implying a rise of greater than 24% from present ranges. The 12-month worth vary at the moment stands between $189 and $546.

Equally, in keeping with various valuation fashions, like those who would possibly contemplate P/E or P/S multiples or terminal values, the common honest worth for Goldman Sachs inventory by way of InvestingPro stands at $436.58. In different phrases, the elemental valuation additionally suggests shares may enhance near 25%.

We will additionally take a look at Goldman Sachs inventory’s monetary well being as decided by rating greater than 100 elements in opposition to friends within the monetary sector. As an illustration, by way of progress, revenue, relative worth, and worth momentum, it scores 3 out of 5. Its general rating of three factors is an efficient efficiency rating.

At current, P/E, P/B, and P/S ratios for GS are 5.5x, 1.2x, and a couple of.0x. Comparable metrics for friends stand at 10.1x, 1.8x, and 1.7x. These numbers counsel that following the latest decline, Goldman Sachs shares supply higher worth than they did a number of months in the past.

Our expectation is for Goldman Sachs inventory to construct a base between $340 and $360 within the coming weeks. Afterwards, shares may doubtlessly begin a brand new leg up.

Including GS Inventory To Portfolios

Goldman bulls who aren’t involved about short-term volatility may contemplate investing now. Their goal worth can be $434.76, analysts’ forecast.

Alternatively, buyers may contemplate shopping for an exchange-traded fund (ETF) that has GS inventory as a holding. Examples embrace:

- iShares U.S. Dealer-Sellers & Securities Exchanges ETF (NYSE:)

- SPDR Dow Jones Industrial Common ETF Belief (NYSE:)

- First Belief Dow 30 Equal Weight ETF (NYSE:)

- Monetary Choose Sector SPDR® Fund (NYSE:)

- Invesco S&P 500® Momentum ETF (NYSE:)

Lastly, those that count on Goldman Sachs inventory to bounce again within the weeks forward may contemplate organising a bull name unfold.

Most possibility methods aren’t appropriate for all retail buyers. Due to this fact, the next dialogue on GS inventory is obtainable for academic functions and never as an precise technique to be adopted by the common retail investor.

Bull Name Unfold On Goldman Sachs Inventory

Worth At Time Of Writing: $350.12

In a bull name unfold, a dealer has a protracted name with a decrease strike worth and a brief name with a better strike worth. Each legs of the commerce have the identical underlying inventory (i.e.,Goldman Sachs) and the identical expiration date.

The dealer needs GS inventory to extend in worth. In a bull name unfold, each the potential revenue and the potential loss ranges are restricted. The commerce is established for a web value (or web debit), which represents the utmost loss.

Right this moment’s bull name unfold commerce entails shopping for the Might 20 expiry 360 strike name for $14.80 and promoting the 370 strike name for $10.90. Shopping for this name unfold prices the investor round $3.90 or $390 per contract, which can also be the utmost danger for this commerce.

We must always notice that the dealer may simply lose this quantity if the place is held to expiry and each legs expire nugatory, i.e., if the GS inventory worth at expiration is beneath the strike worth of the lengthy name (or $360 in our instance).

To calculate the utmost potential acquire, we are able to subtract the premium paid (or $3.90) from the unfold between the 2 strikes (or $10.00), and multiply the outcome by 100. In different phrases: ($10.00 – $3.90) x 100 = $610.

The dealer will understand this most revenue if the Goldman Sachs share worth is at or above the strike worth of the quick name (larger strike) at expiration (or $370 in our instance).

Backside Line

Since November 2021, Goldman Sachs inventory has come underneath vital stress. But, the slide has improved the margin of security for buy-and-hold buyers who may contemplate shopping for quickly.

Alternatively, skilled merchants may additionally arrange an choices commerce to learn from any potential rally within the worth of GS inventory.

[ad_2]