[ad_1]

- U.S. CPI is anticipated to point out inflation stayed close to a 40-year peak in Might.

- The Federal Reserve is all however sure to boost rates of interest by one other half a proportion level on the conclusion of its June coverage assembly.

- Buyers ought to take into account including Palo Alto Networks, Phillips 66, and Financial institution of America to their portfolio.

- For instruments, knowledge, and content material that can assist you make higher investing selections, attempt InvestingPro+.

Worries over sky-high inflation and the Federal Reserve’s aggressive plans to boost rates of interest have been the first drivers of market sentiment for many of the yr.

As such, all eyes shall be on Friday’s key U.S. report, which arrives lower than per week earlier than the Fed’s extremely anticipated June coverage assembly.

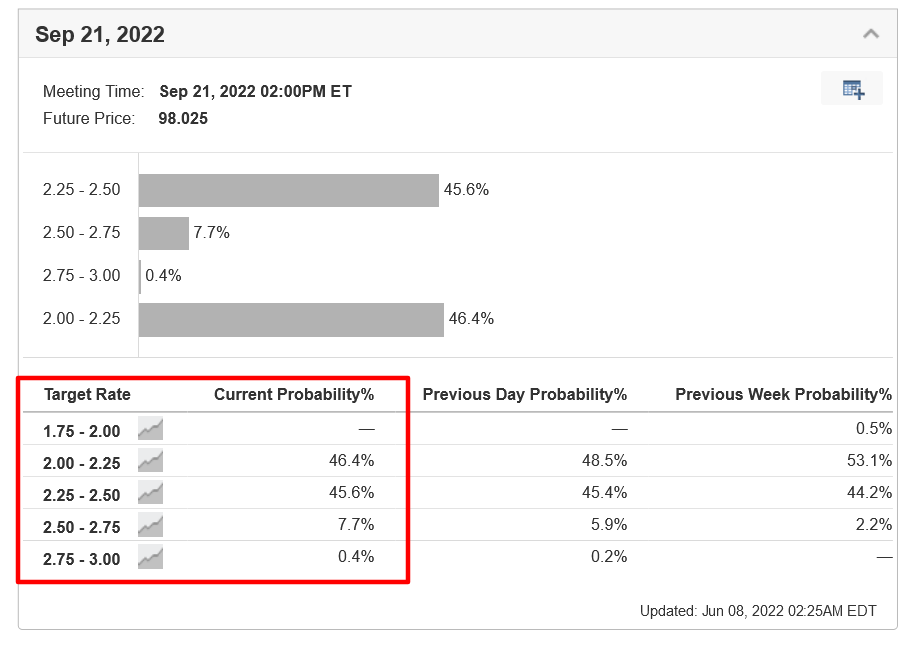

For now, the market a half-point charge hike at each the Fed’s June and July conferences. Nevertheless, a hotter-than-expected CPI print might set off recent bets towards a 75-basis-point transfer in July, and probably September.

Supply: Investing.com

The U.S. central financial institution has already raised its Fed Funds goal charge by 75 foundation factors to this point this yr.

Taking that into consideration, under, we spotlight three firms which are leaders of their respective fields which are set to outperform within the months forward because the Fed tightens financial coverage to fight hovering inflation.

1. Palo Alto Networks

- Yr-To-Date Efficiency: -5.3%

- Market Cap: $52.5 Billion

Palo Alto Networks (NASDAQ:) is extensively thought-about one of many main names within the cybersecurity software program trade. The corporate serves over 70,000 organizations in 150 international locations, together with 85 of the Fortune 100.

Its core merchandise are a platform that features superior firewalls and intrusion prevention methods that supply community safety, cloud safety, endpoint safety, and numerous cloud-delivered safety providers.

In our view, shares of the Santa Clara, California-based tech firm are effectively positioned to renew their march larger within the months forward, contemplating the continued surge in cybersecurity spending amid the present geopolitical atmosphere.

Shares of PANW, that are down 5.3% year-to-date, closed Tuesday’s session at $527.00, roughly 18% under its file peak of $640.90 touched on Apr. 20. At present valuations, the worldwide cybersecurity chief has a market cap of $52.5 billion.

In an indication of how effectively its enterprise has carried out amid the present geopolitical backdrop, Palo Alto Networks reported revenue and gross sales which for its fiscal third quarter on Might 19, due to ballooning demand for its safety software program.

The earnings beat was fueled by a powerful improve in whole billings, a key gross sales development metric, which surged 40% from a yr earlier to $1.8 billion.

The cyber specialist additionally supplied an upbeat outlook, lifting its full-year steerage for income, billings, and earnings per share because of favorable cybersecurity demand developments.

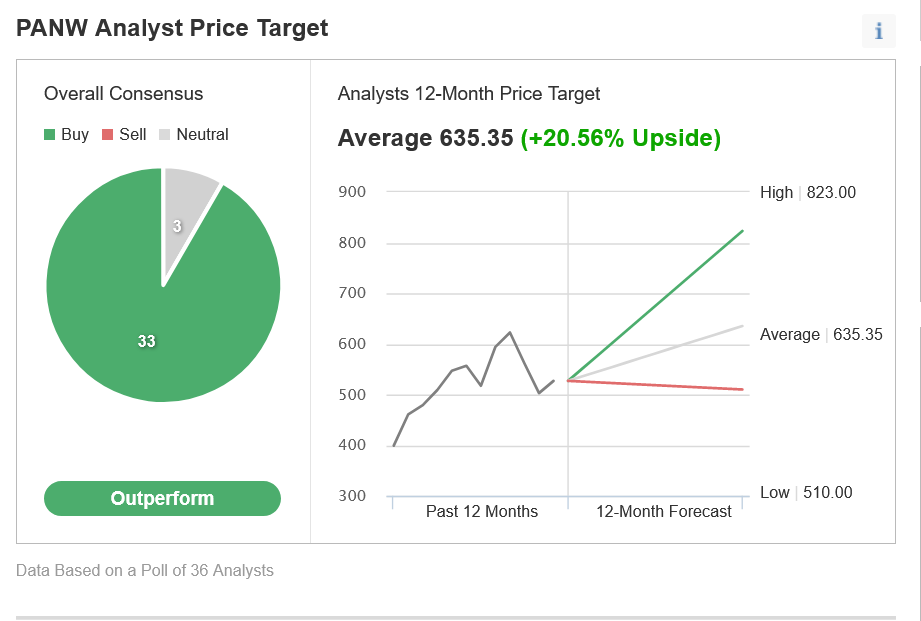

Not surprisingly, in an Investing.com survey of 36 analysts, 33 rated PANW inventory as a ‘purchase,’ three rated it as ‘impartial,’ and none thought-about it a ‘promote.’

Amongst these surveyed, the inventory had a roughly 20.5% upside potential with a median 12-month worth goal of $635.35, because it seems to be one of many important beneficiaries of the persevering with development in cybersecurity spending.

Supply: Investing.com

2. Phillips 66

- Yr-To-Date Efficiency: +51.7%

- Market Cap: $52.8 Billion

One of many main power manufacturing and logistics firms within the U.S., Phillips 66 (NYSE:), debuted as an impartial firm when ConocoPhillips (NYSE:) executed a spin-off of its downstream and midstream belongings in 2012.

Its core enterprise operations contain processing, refining, transporting, delivering, storing, and advertising crude oil, pure fuel, pure fuel liquids, and refined petroleum merchandise, corresponding to gasolines, distillates, and renewable fuels.

PSX is up round 52% in 2022, ending Tuesday’s session at $109.92—its highest degree since January 2020. At present valuations, the thriving Houston, Texas-based power agency has a market cap of $52.1 billion.

With strong returns, Phillips 66 stays among the best names to personal because the Fed raises charges, contemplating its newest efforts to return more money to shareholders within the type of inventory buybacks and better dividend payouts.

The oil refiner lately introduced plans to restart share repurchases after suspending this system in March 2020 as a result of coronavirus pandemic.

It additionally raised its quarterly dividend by 5% to $0.97 per share. This represents an annualized dividend of $3.88 and a yield of three.53%, making it a particularly engaging play beneath present situations.

As well as, Phillip 66’s inventory has a relatively low price-to-earnings (P/E) ratio of 18.4, making it cheaper than different notable names within the oil & fuel refining area, corresponding to Marathon Petroleum (NYSE:), and Valero Power (NYSE:).

The diversified power firm is auspiciously positioned to reap the advantages of enhancing power market fundamentals, hovering world gasoline demand, and robust oil and fuel costs, which is able to assist drive future revenue and gross sales development and permit it to take care of its give attention to shareholder returns.

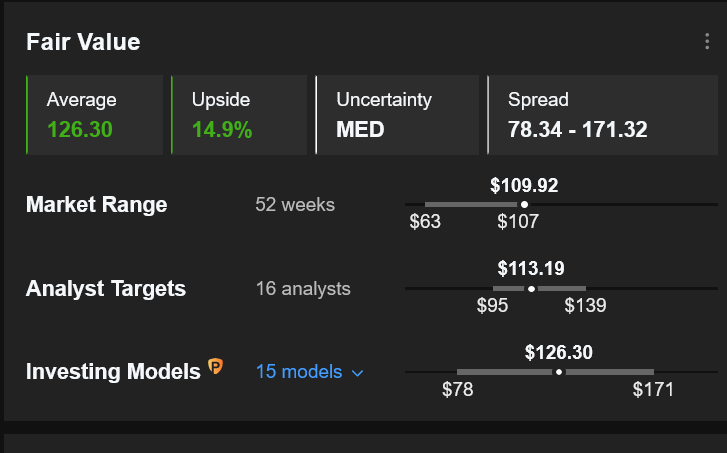

In response to a lot of valuation fashions, together with P/E or P/S multiples or terminal values, the typical truthful worth for PSX inventory on InvestingPro+ stands at $126.30, a possible 14.9% upside from the present market worth.

Supply: InvestingPro+

3. Financial institution of America

- Yr-To-Date Efficiency: -18.3%

- Market Cap: $292.7 Billion

Financial institution of America (NYSE:) is without doubt one of the nation’s ‘Massive 4’ banking establishments, together with JPMorgan Chase (NYSE:), Wells Fargo (NYSE:), and Citigroup (NYSE:).

The Charlotte, North Carolina-based firm, whose main monetary providers embrace industrial banking, wealth administration, and funding banking, serves roughly 11% of all American financial institution deposits.

BAC closed at $36.35, with the inventory being down about 18% year-to-date. At present ranges, BofA has a market cap of round $293 billion, making it the second-biggest U.S. banking establishment, behind JPM.

Regardless of rising fears that the Fed’s aggressive financial tightening might doubtlessly tip the economic system right into a recession, Financial institution of America stands to learn from the continued uptick in charges throughout the Treasury market ensuing from the present inflationary atmosphere.

Banks are amongst these most delicate to rising rates of interest as larger yields have a tendency to spice up the return on curiosity that lenders earn from their mortgage merchandise, or web curiosity margin.

In actual fact, BAC famous in its report {that a} 100-basis-point improve in rates of interest would increase its web curiosity revenue by $5.4 billion over the following 12 months.

Moreover, the banking big—whose inventory has a comparatively low-cost P/E ratio of 10.3—presents an annualized dividend of $0.84 per share at a yield of two.31%, above the implied yield for the , which is at present at 1.41%.

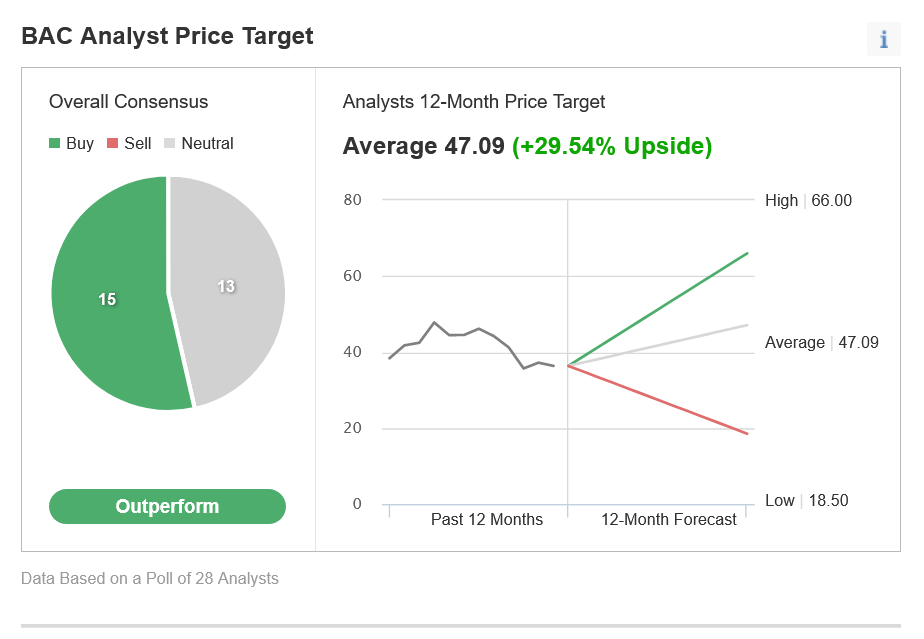

Certainly, 15 out of 28 analysts surveyed by Investing.com charge Financial institution of America’s inventory as “outperform,” whereas the remaining 13 thought-about it as a ‘maintain.’

The typical BAC inventory analyst worth goal is round $47.00, representing an upside of roughly 30% from present ranges over the following 12 months.

Supply: Investing.com

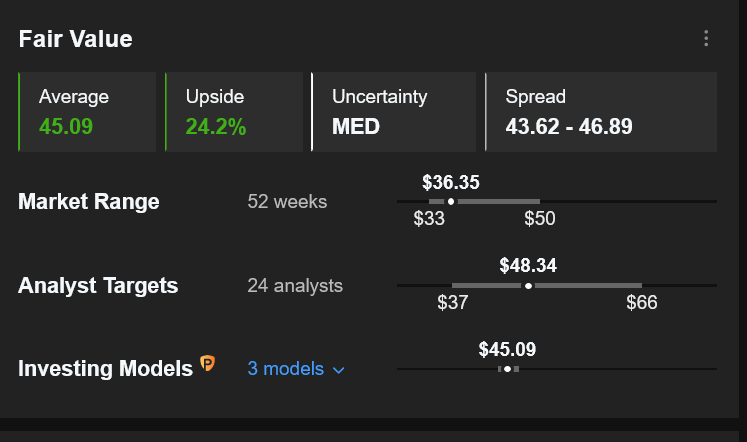

Equally, the quantitative fashions in InvestingPro+ level to a acquire of roughly 24% in BAC inventory from present ranges over the following 12 months, bringing shares nearer to their truthful worth of $45.09.

Supply: InvestingPro+

***

The present market makes it tougher than ever to make the suitable selections. Take into consideration the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive applied sciences

- Rate of interest hikes

To deal with them, you want good knowledge, efficient instruments to type by the information, and insights into what all of it means. You have to take emotion out of investing and give attention to the basics.

For that, there’s InvestingPro+, with all of the skilled knowledge and instruments you might want to make higher investing selections. Be taught Extra »

[ad_2]