[ad_1]

Worth shares have been a few of this 12 months’s greatest performers as buyers seek for corporations that profit from the bettering financial outlook on the expense of high-growth know-how shares.

Present displays buyers making the shift from risk-on property that characterised development shares the previous 12 months, to extra risk-off shares, given the uncertainty of future market route.

Certainly, the iShares S&P 500 Worth ETF (NYSE:) has outperformed the iShares S&P 500 Development ETF (NYSE:) by a large margin because the begin of the 12 months amid bets a setting will harm sectors of the market with longer-term money movement horizons.

Given the change in investor danger appetites, we’re highlighting three main value-themed names which might be properly price contemplating as market contributors proceed to dump dangerous shares for safer bets.

1. British American Tobacco

- This autumn Earnings Launch: Thursday, Feb. 3, earlier than market open

- P/E Ratio: 12.1

- Dividend Yield: 7.89%

- Market Cap: $98.3 Billion

- 12 months-To-Date Efficiency: +15.2%

British American Tobacco (NYSE:) is a U.Ok.-based multinational cigarette and tobacco manufacturing firm. Its most acknowledged and best-selling merchandise, offered in over 180 nations world wide, are the Newport and Fortunate Strike manufacturers.

With a price-to-earnings ratio of 12.1, and an annualized dividend of $2.96 per share at a sky-high yield of seven.89%, British American seems choice for buyers seeking to hedge within the face of additional volatility within the months forward.

Good high quality blue-chip dividend shares are likely to carry out properly in a turbulent setting as market gamers search defensive-minded client staple corporations with comparatively down-to-earth valuations.

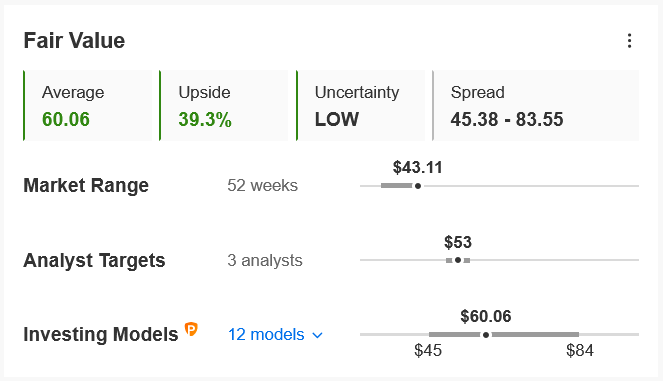

Certainly, the quantitative fashions on InvestingPro level to roughly 39% upside in BTI inventory from present ranges over the following 12 months, bringing shares nearer to their honest worth of $60.06.

Supply: InvestingPro

BTI rallied to its greatest stage since February 2020 at $43.90 on Monday. It closed Tuesday’s session at $43.11. At present valuations, British American, whose major itemizing is on the London Inventory Change, and is a constituent of the , has a market cap of $98.3 billion.

The London, England-based Large Tobacco firm, which has capitalized on its latest shift to non-combustible, reduced-risk merchandise, has seen its inventory leap almost 15% year-to-date, far outpacing the comparable returns of each the and the .

2. Chevron

- This autumn Earnings Launch: Friday, Jan. 28 earlier than market open

- P/E Ratio: 24.6

- Dividend Yield: 4.57%

- Market Cap: $255.5 Billion

- 12 months-To-Date Efficiency: +13%

Chevron (NYSE:)is likely one of the world’s largest vitality corporations. Its core enterprise operations contain exploring, producing, refining, and transporting , and associated merchandise.

Because the Fed tightens financial coverage and inflation continues to rage, we anticipate prime quality worth corporations which might be delicate to the bettering financial outlook to outperform the broader market. That makes the San Ramon, California-based oil large, which operates in roughly 180 nations, a stable choose for the weeks and months forward.

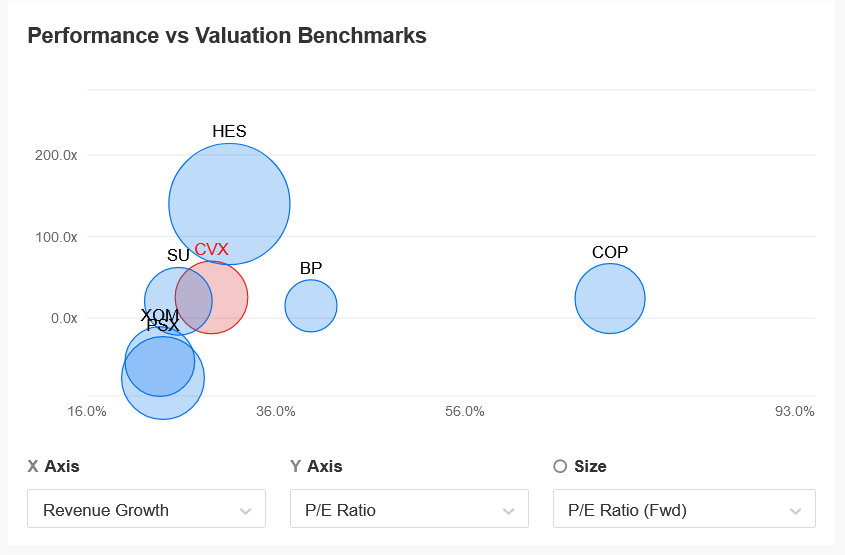

Chevron’s inventory has a relatively low P/E ratio of 24.6, making it cheaper than different notable names within the vitality sector, such ConocoPhillips (NYSE:), Schlumberger (NYSE:), Pioneer Pure Assets (NYSE:), and Devon Power (NYSE:).

Supply: InvestingPro

As well as, Chevron’s comparatively excessive dividend, at the moment at $1.34 per share, which means an annualized dividend of $5.36 per share, additional enhances the enchantment of the corporate. The inventory’s dividend yield is at the moment 4.57%, greater than triple the implied yield for the S&P 500, which is 1.39%.

CVX has gained 13% up to now in 2022. It ended at $132.59 yesterday, its greatest stage since January 2018. At present valuations, the Large Oil firm has a market cap of $255.5 billion.

Chevron, which reported and income that simply topped expectations within the earlier quarter, has analyst consensus calling for EPS of $3.10 for the fourth quarter, swinging from a lack of $0.01 per share within the difficult year-ago interval.

Income is forecast to leap almost 77% year-over-year to $44.7 billion. Past the top- and bottom-line figures, buyers might be keen to listen to if the vitality large plans to return more money to shareholders within the type of increased dividend payouts and share buybacks.

3. Coca-Cola

- This autumn Earnings Launch: Thursday, Feb. 10, earlier than market open

- P/E Ratio: 29.5

- Dividend Yield: 3.08%

- Market Cap: $258.3 Billion

- 12 months-To-Date Efficiency: +1.1%

Coca-Cola (NYSE:) is a North American multinational beverage company, greatest recognized for the manufacturing, retailing, and advertising and marketing of its namesake Coca-Cola model. Its different notable delicate drink manufacturers embrace Sprite and Fanta, in addition to non-carbonated drinks Powerade, Nestea, and Dasani water.

Whereas sharp losses have walloped non-profitable high-growth know-how shares to start out the brand new 12 months, defensive areas of the are seeing robust beneficial properties as buyers pile into cyclical teams that do properly in an financial restoration.

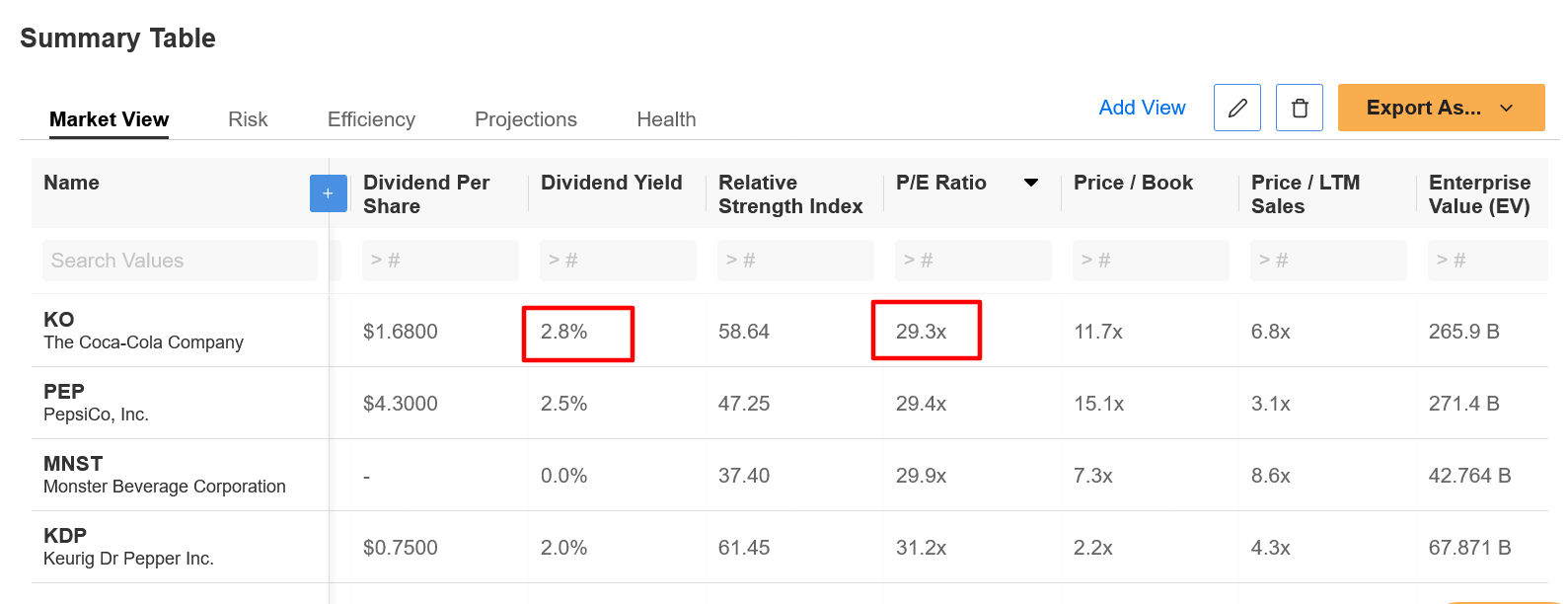

With a P/E ratio of 29.3, Coca-Cola inventory comes at a average low cost when in comparison with its notable friends, equivalent to PepsiCo (NASDAQ:), Keurig Dr. Pepper (NASDAQ:), and Monster Beverage (NASDAQ:).

The maker of the enduring Coca-Cola model can be a top quality dividend inventory. KO at the moment presents a quarterly payout of $0.42 per share, which means an annualized dividend of $1.68 at a yield of three.08%, one of many highest within the sector.

Supply: InvestingPro

Taking that into consideration, we anticipate Coca-Cola to proceed its march increased within the close to time period because the Fed begins to boost rates of interest and winds up its pandemic-era bond-buying program.

KO touched an all-time peak of $61.45 on Jan. 14, and closed at $59.82 final evening, incomes the Atlanta, Georgia-based beverage large a valuation of $258.3 billion.

Coca-Cola reported on Oct. 27 and supplied upbeat steering due to a positive demand setting. For its upcoming launch, consensus estimates are calling for EPS of $0.41 on income of $8.99 billion.

[ad_2]