[ad_1]

Basically talking, there are quite a lot of indications that 2022 earnings estimates are nonetheless overly exuberant. Nonetheless, the bullish optimism at present helps rising inventory costs. Such was a degree I touched on on this :

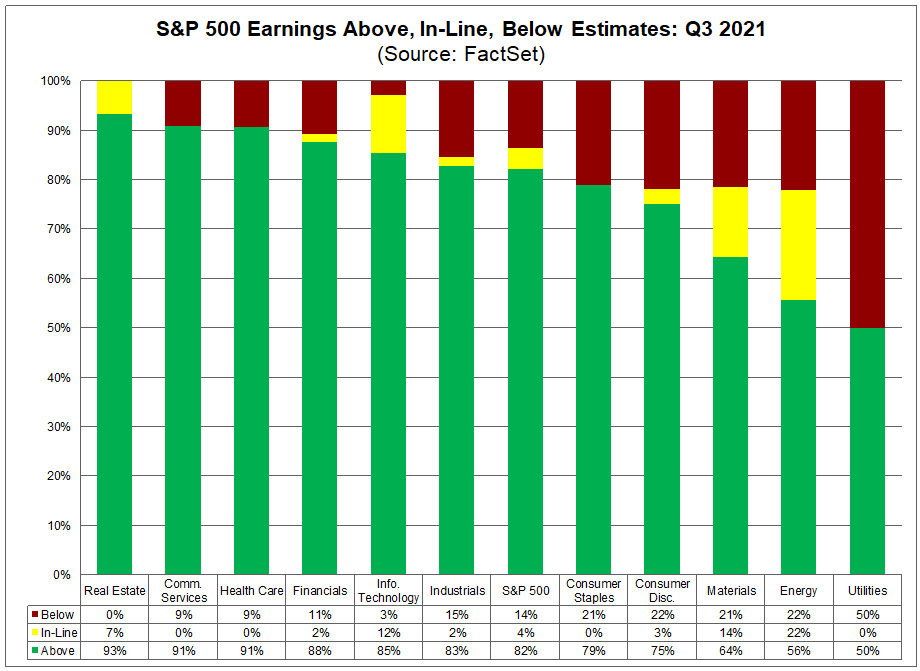

“Total, 56% of the businesses within the have reported precise outcomes for Q3 2021 up to now. Of those firms, 82% have reported precise EPS above estimates, which is above the five-year common of 76%. If 82% is the ultimate share for the quarter, it can mark with the fourth highest share of S&P 500 firms reporting a optimistic earnings shock since FactSet started monitoring this metric in 2008. In combination, firms are reporting earnings which might be 10.3% above estimates, which can also be above the five-year common of 8.4%.”

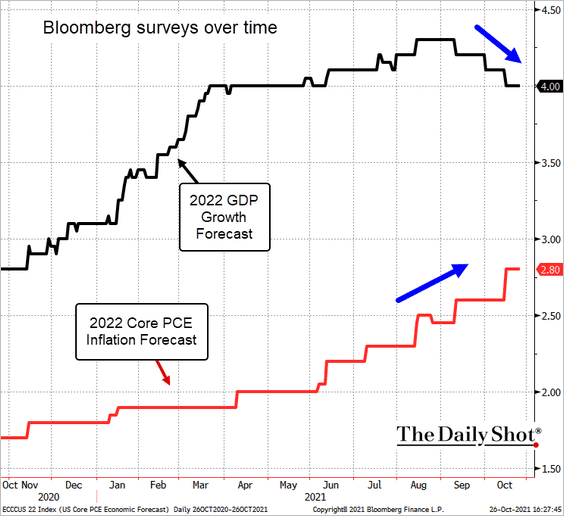

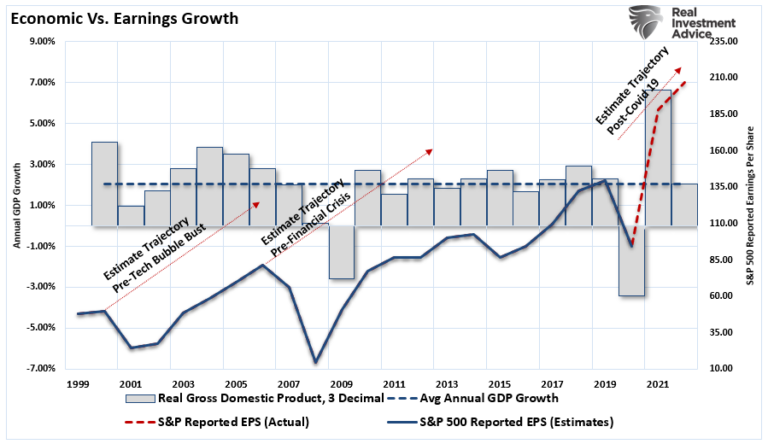

Earnings have certainly been spectacular, however as we’ll focus on in additional element, this quarter will seemingly mark the height of progress for some time. One explicit motive is that whereas the outlook for earnings stays very bullish, financial progress and inflation tendencies usually are not.

Economics vs Earnings

The issue for earnings is that weaker financial progress and rising will weigh on revenue margins.

Let’s begin with financial progress.

Financial Development Set To Weaken

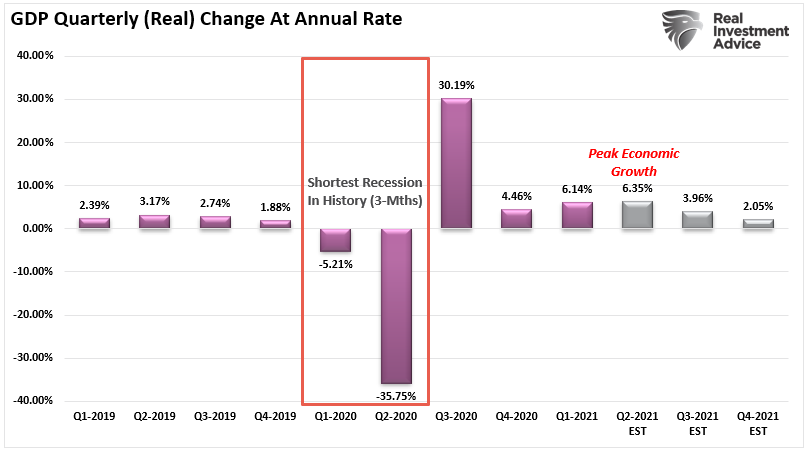

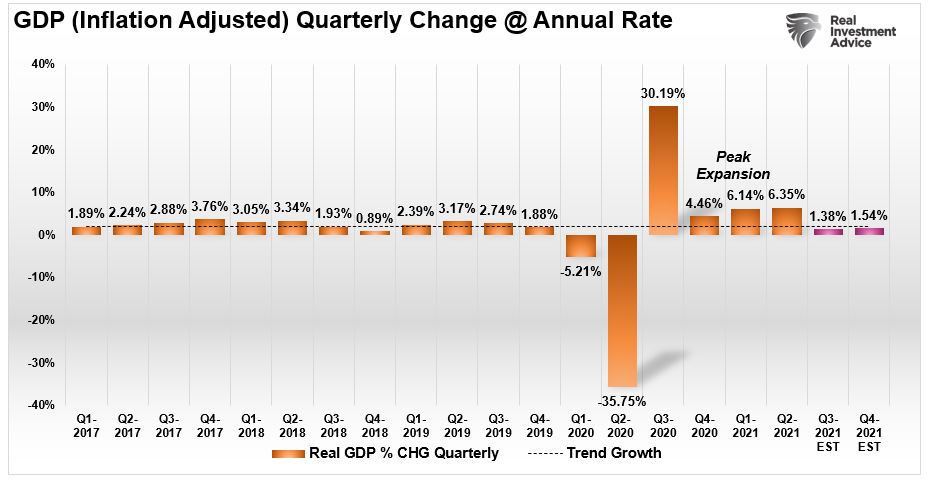

In March of this 12 months, I penned an article entitled whereby we mentioned the financial system would run “scorching” after which “crash.” On the time, I obtained quite a lot of “pushback” on my “dire predictions” of financial progress later within the 12 months. Moreover, I adopted that evaluation asking if Q2 was the “Peak Of Financial Development?” To wit:

“Was the second quarter the height of financial progress and earnings? If estimates are right and the year-over-year ‘base impact’ fades, such suggests threat to present earnings estimates. The chart from a makes use of the Atlanta Fed’s present estimates for Q2-2021 GDP. The complete-year estimates are from JP Morgan. Notably, the financial system shortly slows to 2% heading into 2022.”

At the moment, we estimated lower than a 4% progress charge for the financial system, with the Atlanta Fed nicely above 6%. Final Thursday, the preliminary launch of Q3 got here in nicely under even our “bearish” expectations at simply 2%.

Notably, the “advance estimate” is derived from a sampling of economists’ estimates. As precise information will get factored into the GDP calculation throughout the subsequent two months, the expansion estimates will get revised. However, as mentioned in the weak point within the financial information suggests these GDP revisions can be decrease.

Financial Output Composite Index

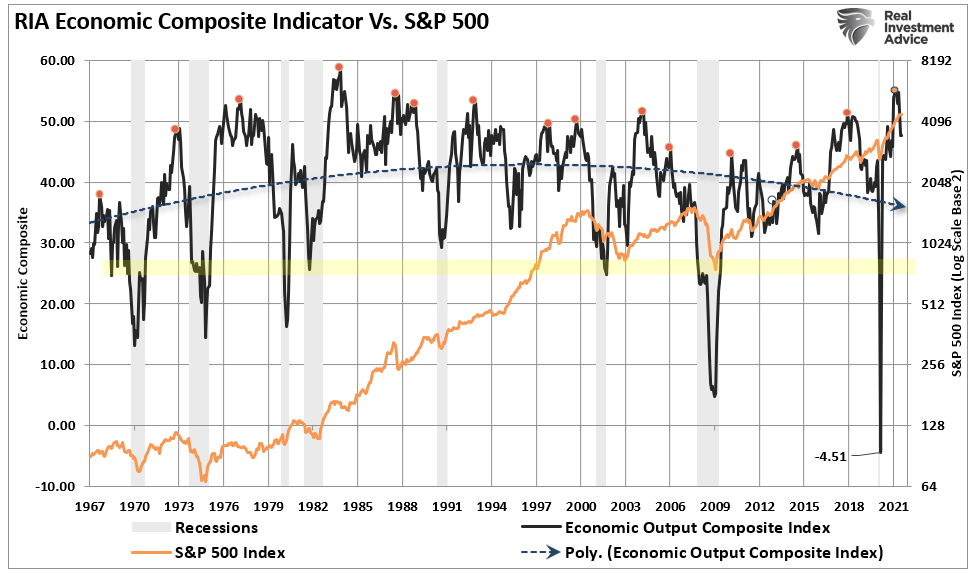

We’re assured in our evaluation of weaker financial output attributable to our Financial Output Composite Index (EOCI).

The chart under is the Financial Output Composite Index. The index contains the CFNAI, , , the Fed surveys, Markit Financial Index, Markit PMI, NFIB, TIPP Confidence, and the LEI. In different phrases, this indicator is the broadest indicator of the U.S. financial system there’s.

The final full set of knowledge is thru September. Notably, the index peaked on the second-highest degree on file. When October will get absolutely accounted for, the index will decline additional. Not surprisingly, there’s a first rate correlation between declines within the EOCI index and struggles for the monetary markets.

The implications of weak financial progress are broad. Client sentiment will stay weak as inflationary pressures undermine consumption. Moreover, the unfavourable impression on earnings continues to elude traders at present.

Earnings & Valuations Will Revert

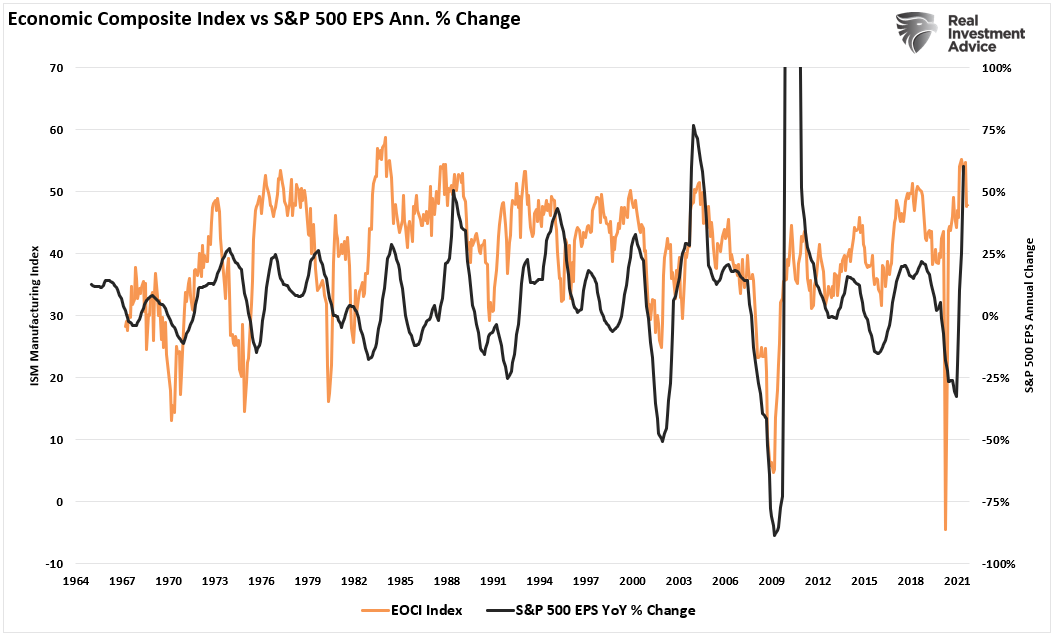

There are two crucial takeaways from the EOCI index. As famous, the inventory market tends to right, or worse, throughout reversals of the index. Secondly, there’s a excessive correlation between the index and the annual change in earnings.

Such shouldn’t be a shock on condition that “income,” which occurs on the earnings assertion’s top-line, is a perform of financial progress. As people produce and eat, such is what creates financial exercise. Revenues are a direct reflection of that exercise. As financial progress slows, so does income.

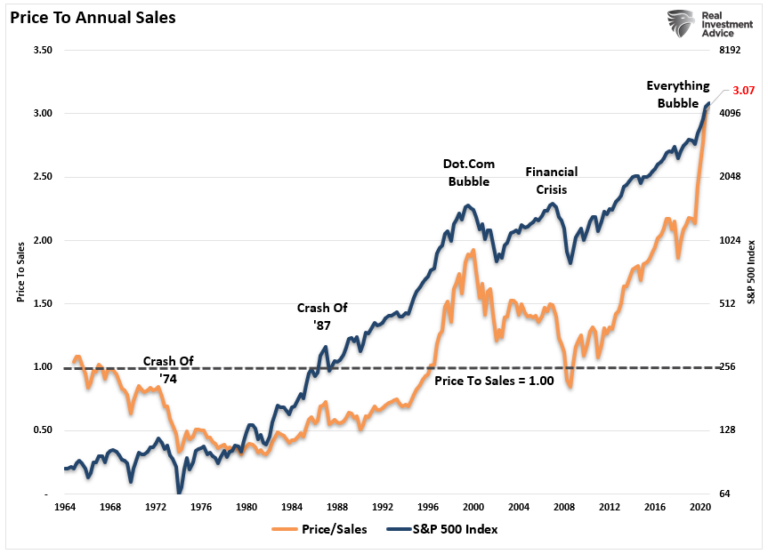

Nonetheless, it is a relationship traders have forgotten of their quest to push asset costs increased. As a result of huge liquidity infusions following the pandemic, equities have turn into more and more costly. Consequently, equities at the moment are the costliest in historical past, measured by worth to annual gross sales.

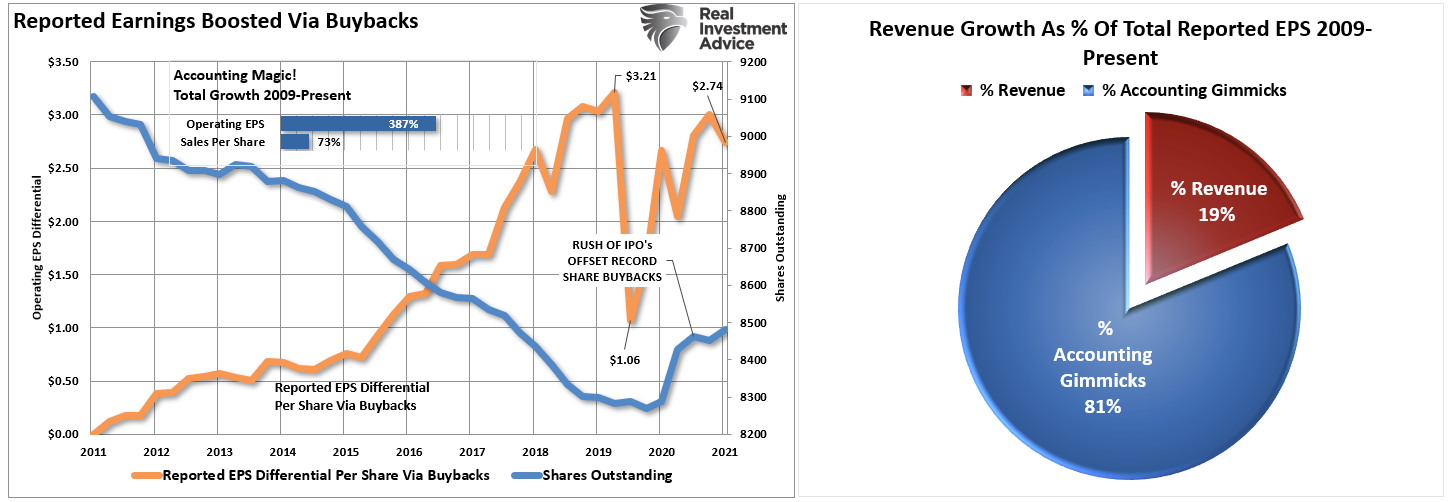

Nonetheless, earnings per share, or what occurs on the backside of the earnings assertion, are grossly manipulated by share repurchases, accounting gimmicks, and outright “fudging.” Due to this fact, top-line income offers us an correct image of the costs paid for inventory possession. At the moment, traders are paying over 3x gross sales which exceeds any level beforehand.

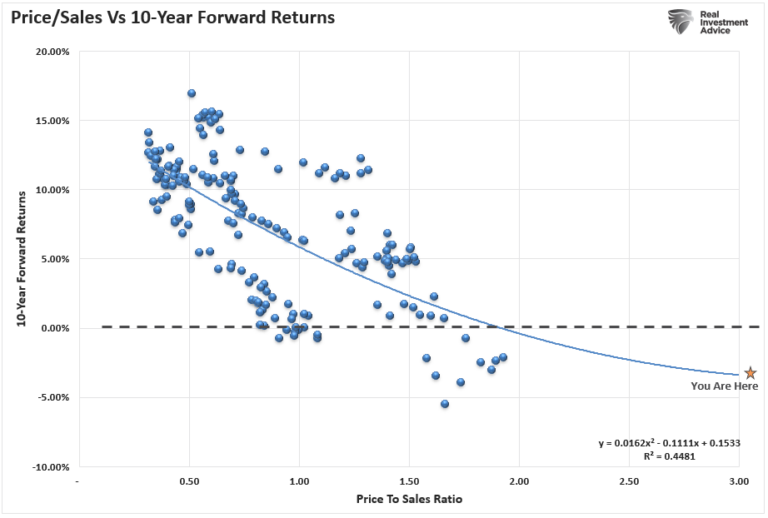

Such is a degree that ought to not get dismissed, given the lengthy historical past of valuations and ahead returns over the following decade. As proven, at 3x worth to gross sales, expectations for 8% annualized returns ought to get lowered dramatically.

Analysts Are Overly Optimistic

“The largest downside with Wall Avenue, each right this moment and up to now, is the constant disregard of the probabilities for sudden, random occasions. In a 2010 examine, by the McKinsey Group, they discovered that analysts have been persistently overly optimistic for 25 years. In the course of the 25-year timeframe, Wall Avenue analysts pegged earnings progress at 10-12% a 12 months when in actuality earnings grew at 6% which, as we have now mentioned up to now, is the expansion charge of the financial system.

That is why utilizing ahead earnings estimates as a valuation metric is so extremely flawed – because the estimates are all the time overly optimistic roughly 33% on common.” – The Drawback With Wall Avenue Forecasts

As soon as once more, analysts have turn into exceedingly optimistic of their estimates.

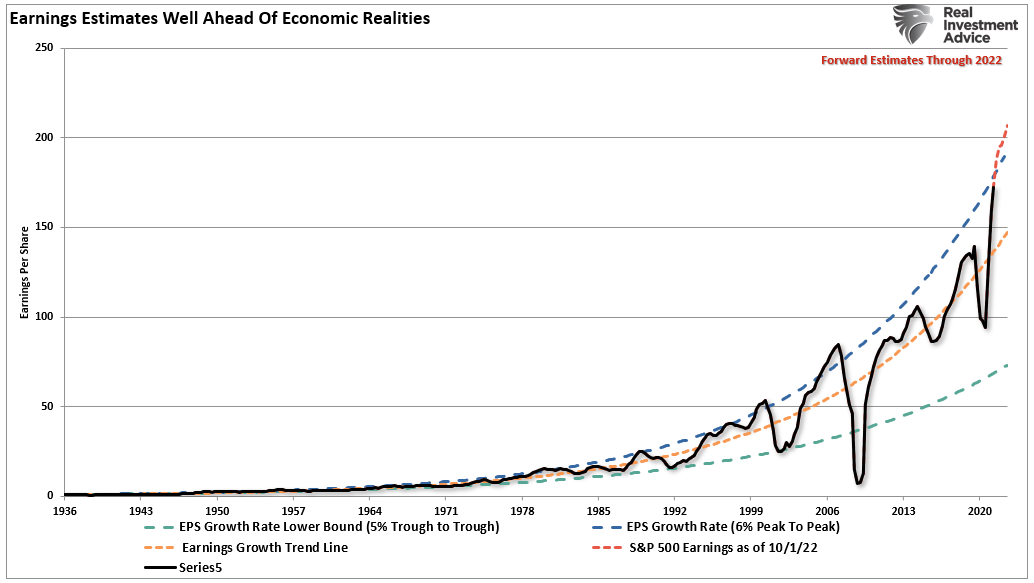

Regardless of financial progress weakening as inflation will increase, liquidity lowering, and revenue margins underneath stress, analysts proceed to extend their earnings estimates. At the moment, estimates for the This autumn-2022 are $207/share in accordance with S&P. As proven, that degree will exceed the historic 6% exponential progress pattern that contained earnings progress since 1950.

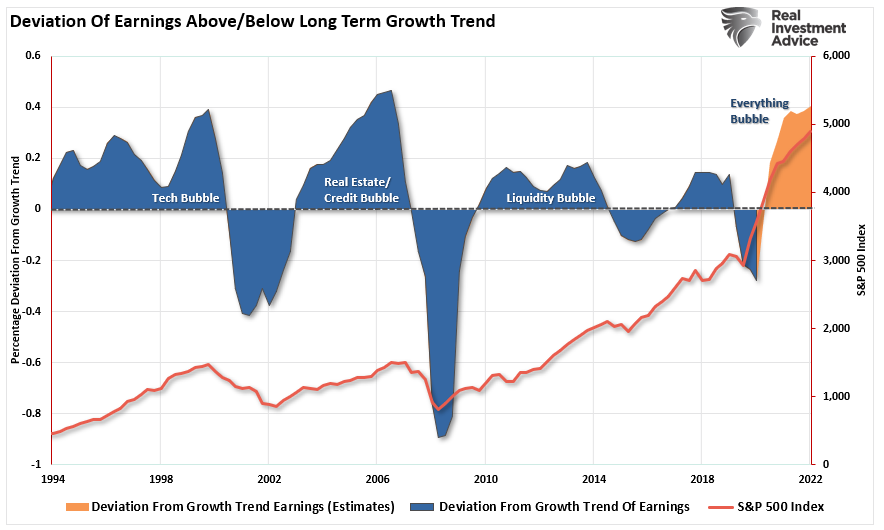

At the moment, earnings expectations exceed the annual exponential progress pattern by probably the most important deviations on file. The one two durations with related deviations are the “Monetary Disaster” and the “Dot.com” bubble.

With analysts extraordinarily exuberant, there appears to be little concern for traders. Nonetheless, I might warning in opposition to such complacency.

As famous above, probably the most important drivers to bottom-line earnings stay accounting gimmicks, share repurchases, and decrease tax charges. Nonetheless, there’s a substantial threat to modifications within the tax code, increased potential tax charges, and a discount in liquidity. Such doubtlessly threatens the crucial drivers to profitability. As proven, income progress, as a share of the entire, has shrunk to simply 19% although reported earnings per share surged by $2.74/share from repurchases.

Conclusion

The “sugar excessive” of financial progress seen within the first two quarters of 2021 resulted from an enormous deficit spending surge. Whereas these actions create the “phantasm” of progress by pulling ahead “future” consumption, it isn’t sustainable, and revenue margins will observe swimsuit shortly.

The purpose right here is easy, earlier than falling sufferer to the “purchase the market as a result of it’s low cost primarily based on forward-estimates” line, be sure you perceive the “what” you might be paying for.

Wall Avenue analysts are all the time exuberant, hoping for a continued surge in earnings within the months forward. However such has all the time been the case.

At the moment, there are few Wall Avenue analysts anticipating considerably weaker financial progress in 2022. However, sadly, there’s a excessive likelihood such can be a actuality, significantly because the Fed begins to “taper” bond purchases.

The danger to traders continues to rise as earnings peak and revenue margins contract.

Wall Avenue is infamous for lacking the main turning factors of the markets and leaving traders scrambling for the exits.

[ad_2]