[ad_1]

Bitcoin is buying and selling round $38,385 on Monday, 2 Might, nonetheless struggling in opposition to the bearish strain seen over the previous a number of months. The flagship cryptocurrency, which rose to costs close to $70K final November, is down 44% since its peak.

This previous week, the BTC/USD pair touched lows of $37,614 for its lowest value degree in a month.

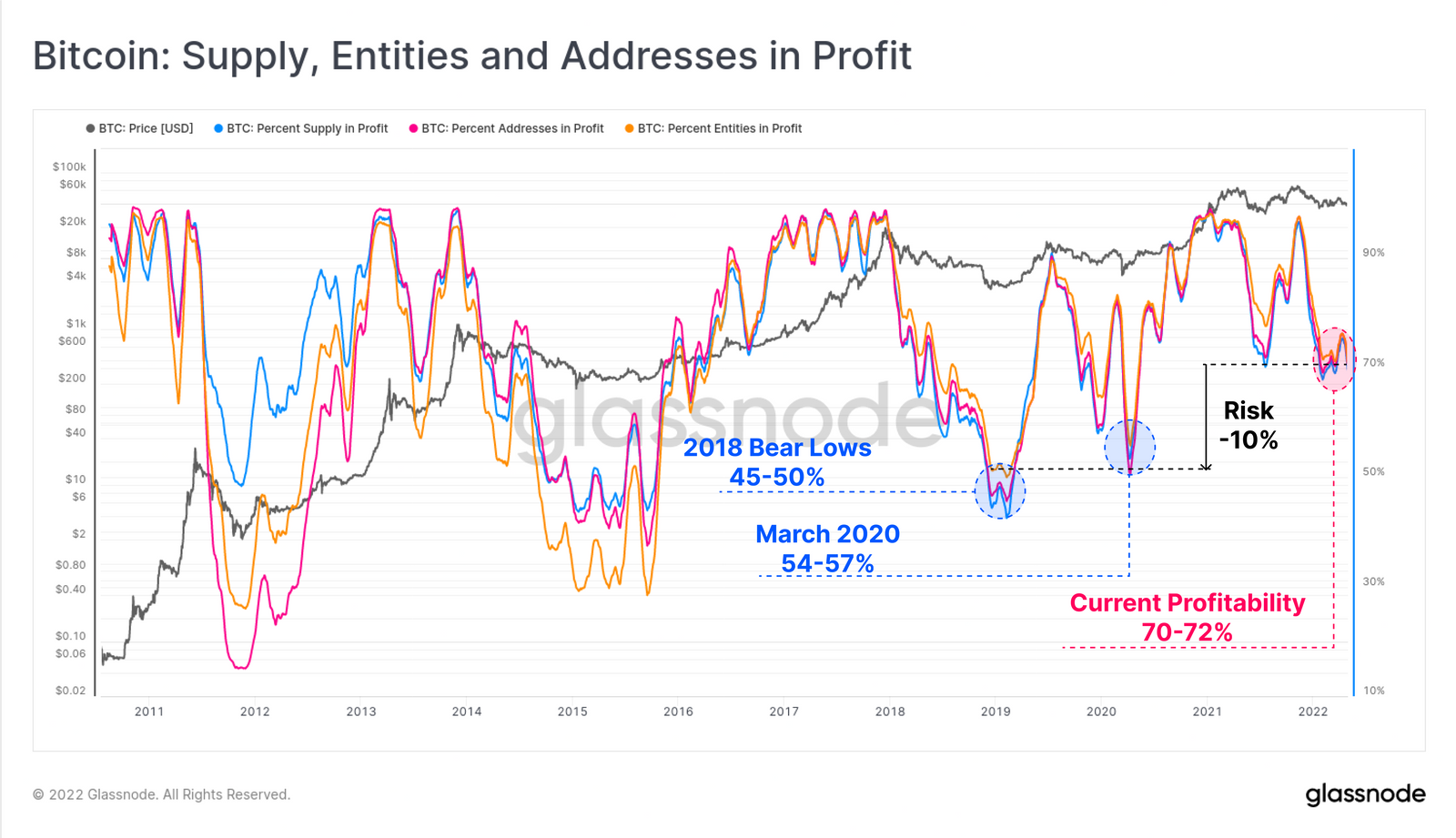

With markets largely unfavourable, the 70% of Bitcoin provide that’s worthwhile might lower considerably and see a big group of Bitcoiners see unrealized losses. That’s the outlook from an on-chain evaluation report analytics platform Glassnode revealed on Monday.

On the fringe of unprofitability

In response to the report, the hazard of a draw back stays given Bitcoin’s latest excessive correlation with the S&P 500 and Nasdaq. That is at the same time as there’s continued roiling of markets amid issues over inflation, greater rates of interest and geopolitical uncertainties.

The results of a steep draw back for equities might thus probably cascade into the crypto market and see a big group of BTC holders edge in the direction of “the abyss of holding unprofitable positions,” Glassnode mentioned within the publication.

Per on-chain information, the associated fee foundation of short-term holders (STHs) is $46,910. This implies the common coin at present held by short-term holders is at unrealized lack of -17.9%. The Market Worth Realized Worth (MVRV) metric for STHs can be pointing to important ache, with the oscillator off the imply at -0.75 commonplace deviations.

“With costs buying and selling at $38.5k on the time of writing, the market would want to fall to $33.6k so as to plunge an extra 1.9M BTC into an unrealized loss (10% of provide),” the Glassnode workforce wrote.

Chart exhibiting 10% of BTC provide might fall into loss. Supply: Glassnode

Chart exhibiting 10% of BTC provide might fall into loss. Supply: Glassnode

In 2018-2019 and in March 2020, profitability fell to between 45% and 57%, which suggests the worst might but occur for short-term holders. If 40% or extra of wallets fall into unrealized loss, it might enhance the chance of a capitulation occasion, with a cascade of panic promoting hitting the market.

[ad_2]